“Behind every good business is a great accountant.” As an accountant, you probably agree with this saying (as you pat yourself on the back). But, you’re more than an accountant to your clients: you’re also their trusted advisor. And as an advisor, your role extends beyond reconciling their accounts. It might extend so far as to offering payroll services.

Technology continues to automate certain manual, repetitive tasks (think data entry). As it does, accountants may need to expand their offerings into the realm of payroll services.

If you’ve steered away from offering payroll services to clients in the past, you might consider—well—reconsidering. Cloud-based payroll systems have paved the way to new opportunities for accountants wanting to offer payroll services.

Read on to learn about the advantages of offering payroll services to your clients, what to look for before partnering with a payroll provider, and how to market payroll to your clients.

Advantages of offering payroll services

Many accountants believe that payroll is too time-consuming and risky (mainly because of the changing payroll-related laws) to spend time on.

While that may have been true in the past, there are several advantages of offering payroll services thanks to cloud-based payroll. Cloud-based payroll software automatically updates when there are legislation changes. That means up-to-date, accurate, and automatic calculations (goodbye manual calculations using income tax withholding tables).

When you offer payroll services using payroll software for accountants, you or your clients run payroll using the software, and the provider handles your clients’ federal, state, and local tax obligations.

That saves you from the repetitive, time-consuming responsibility of running payroll for your clients and gives you more time to focus on the big picture: fielding your clients’ questions, analyzing their financial health, and providing strategic advice.

1. Profit

Providing payroll services to your accounting clients can be profitable with the right strategy and partnership.

Because of cloud payroll, you no longer have to pour time into keeping up with changing tax laws—the payroll automatically updates. And, you don’t have to worry about filing and remitting payroll tax forms and payments thanks to full-service payroll options.

Your firm can cover your clients’ payrolls when you offer payroll services. Then, you can charge clients a premium. And when you partner with a payroll provider, you may get special pricing, driving your profits up. Some payroll services may even throw in free payroll software for your accounting firm.

Here’s how it works: You team up with a payroll software provider. You or your clients run payroll using the payroll software. The payroll provider bills you for the software at a reduced rate. You then invoice your clients according to your practice fees.

2. Meet clients’ needs

You are your clients’ trusted advisor. As such, your clients likely turn to you to help them in all aspects of business—including payroll. They might even expect you to cover their payroll needs.

By adding payroll services to your offerings, you further solidify your role as trusted advisor by meeting a common need business owners have.

Payroll challenges are one of the biggest time sucks and frustrations small business owners have. They may come to you for advice on the best way to run payroll. You can also grow your accounting firm by meeting popular business needs through service expansion.

Think about this scenario: A potential client is comparing accounting firms. The business owner needs payroll. The other accounting firm offers it, and you don’t. Who’s the potential client going to choose?

3. Grow your client base

Adding payroll services to your offerings can also help you grow your client base. All employers need to run payroll, right? Right.

You can use payroll as a foot-in-the-door technique to start a relationship with a client. Then, you can upsell to your tax and bookkeeping services.

What to look for in a payroll provider partner

Weigh your options before investing your time and money into a payroll software provider. There are several cloud payroll programs vying for you to partner with them.

So, what are the things you should look for in your payroll provider partner? Here are three key things:

- Reliability

- Payroll software features

- Costs

1. Reliability

When you’re on the hunt for a payroll partner, you need reliability. After all, your clients will be using your payroll provider’s software because of you. And you know what that means: Any problems your clients have could reflect poorly on you.

Look at testimonials to get a feel for other users’ experiences. You might see a mix of reviews from both business owner customers and partners. Don’t go straight for the reviews from the payroll provider’s accounting partners, though. Both testimonials from accountants and business owners can paint a full picture of what it’s like to use the software.

Grab a cup of coffee (tea, hot chocolate) and peruse review channels to read what real users have to say. Has their experience been good or bad? What are their pain points? What is the payroll provider’s customer service like?

For firsthand experience on what each potential payroll partner’s customer service is like, talk with their partner department. See for yourself if you could picture partnering with the payroll company. And, find out if there are any fees to partner with the company.

2. Payroll software features

Payroll software features are huge. Think about what your firm needs to run payroll accurately and effortlessly. Some of the features you should keep your eyes peeled for in a full-service payroll software include:

Calculations

- Guaranteed wage and overtime calculations

- Bonus, commission, and tip management

- Time-off accruals

- Multiple pay rates

Functionality

- Ability to pay 1099 workers in payroll

- Access to expert support

- Ability to run unlimited payrolls

- Multiple payment options (e.g., direct deposit or paper checks)

- Employee portal

- Cobranding with your accounting firm (if you want to give clients the option to run payroll themselves)

- Payroll optimized for mobile

- Payroll reports

Integrations

- Accounting integration

- Workers’ comp integration

- Time and attendance integration

Tax filing and reporting

- Payroll tax filing and deposits

- Year-end tax filings

- Printable W-2s for employees

- Printable 1099s for contract workers

- Printable forms

3. Costs

And now we get to the bottom line: your bottom line. When partnering with a payroll provider, you likely want to compare costs.

Again, some payroll providers offer special, discounted pricing to accountants who want to sign their clients up with the software. Additionally, there might be bonuses, rewards, and perks to think about.

Generally, the more clients you add, the bigger your discount.

| Ready to partner with a reliable payroll provider? Not only has Patriot been rated the #1 payroll software for accountants, but our Partner Program gives you special pricing, free co-branding, and so much more. |

How to market payroll to your clients

From showing your clients how fast they can run payroll to showing how easy it is to add payroll data to their general ledger, there are several marketing for accountants tips to follow.

1. Brand yourself as an advisor

If you want to market payroll to your clients, you must brand yourself as a trusted advisor … (which should be pretty easy for clients who already work with you).

To brand yourself as an advisor to current and potential clients, be sure to:

Keep communication channels open. Set aside time to meet with your clients to address their questions and concerns. Add scheduled check-ins with your clients so they don’t have to be left wondering when the next time you’ll talk will be. By keeping communication channels open, you can get a deeper understanding of your clients’ pain points—including payroll—and use the opportunity to help streamline the responsibility for them.

Prioritize honesty. Transparency is so important in your practice. When you are fully transparent with your clients, you build trust. And when a client trusts you, you become much more than an accountant—you brand yourself as an advisor.

Give guidance. What separates an advisor from a listener is that you … give advice. As a constant presence throughout the year (not just at year-end), your clients know that they can trust you with their business. And, that means they can trust your suggestions and services. For example, if you see a client making too many payroll errors or soaking too much time into manually handling payroll, offer your payroll services.

Market yourself as an advisor. Marketing yourself as an advisor is a pretty obvious way to brand yourself as an advisor. But hey, you might be branding yourself as an advisor everywhere but in your marketing materials. So the next time you take out a social media ad or update your accounting firm’s website, promote your role as an advisor.

2. Ask the right questions

Before you start offering your clients your new payroll services, get a feel for their unique needs as business owners. To do that, find out what they’re currently doing to run payroll. Then, show them how your payroll services can help.

Ask clients (or potential clients) questions like:

- Have you ever used payroll software to run payroll?

- How do you currently run payroll?

- How much do you spend on payroll?

- What’s lacking in your current payroll process?

- What’s the number one thing you want out of a payroll process?

- Would you be interested in our payroll services?

3. Market payroll services

Last but not least, remember to add payroll services to your list of offerings everywhere you market your accounting practice.

Here are some ways you can market payroll services to clients:

- Take out an advertisement (e.g., Facebook ad) announcing your new service

- Add payroll services to the list of accounting services you offer on your website and social media pages

- Email your clients to let them know

- Email contacts who had inquired about your services but ultimately didn’t hire you because you didn’t offer payroll

Offering payroll services to your clients: Checklist

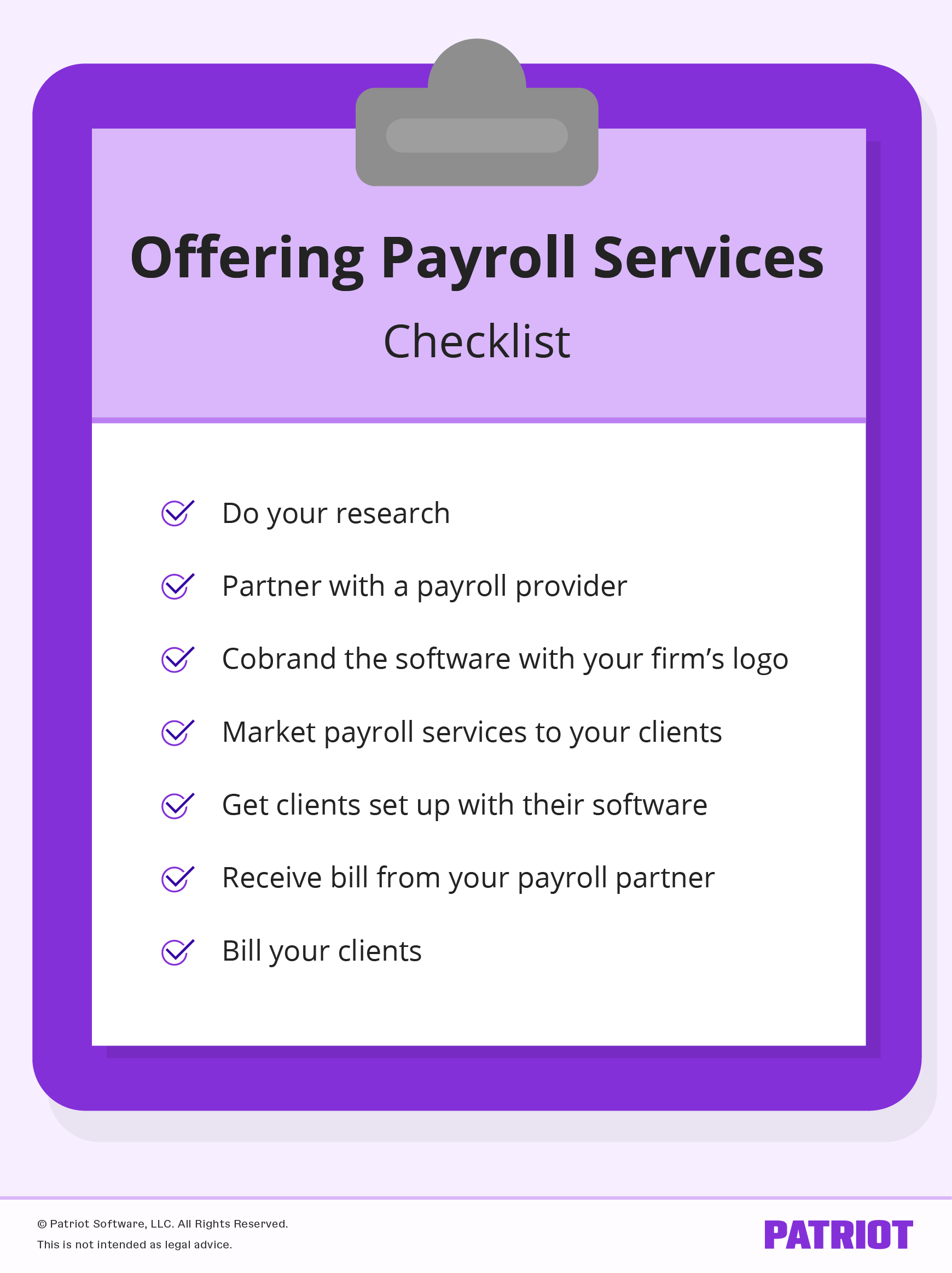

Ready to expand your accounting practice by offering payroll services to your clients? Use our checklist and start crossing things off your list today.

If you offer payroll services, you need a reputable payroll provider. Join the tens of thousands of accounting professionals who trust Patriot with their clients’ payroll (and accounting, too!). Patriot Software’s Partner Program offers discounted pricing, free USA-based support, free co-branding, and free 2-day expedited direct deposit.

This is not intended as legal advice; for more information, please click here.