Survey: Accountants are burning out

Accounting Today

JULY 19, 2022

Canopy Accounting

JULY 27, 2022

Have you ever wondered how the rest of the world views your job? Entertainment can sometimes give us a peek through that window. Usually, when we want to plug into TV or movies, it’s to escape our daily lives. But, sometimes, it can be fun to watch shows about our lives, especially our work lives! There’s shows about doctors, lawyers, IT teams, journalists, government officials and a myriad of other professions.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

RogerRossmeisl

JULY 16, 2022

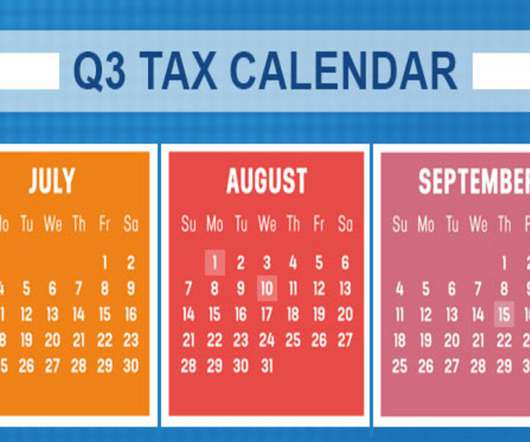

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. August 1 Report income tax withholding and FICA taxes for second quarter 2022 (Form 941), and pay any tax due.

Going Concern

JULY 13, 2022

On May 20 the Houston headquarters of R&D tax credit consulting firm Alliantgroup was raided by the IRS , in the weeks since we’ve had plenty of speculation about the whys and we’ve heard countless accounts from current and former Alliantgroup employees about the “evil, toxic, and emotionally damaging company” that employed them.

Advertiser: Paycor

HR doesn’t exist in a vacuum. This work impacts everyone: from the C-Suite to your newest hire. It also drives results. Learn how to make it all happen in Paycor’s latest guide.

Xero

JULY 11, 2022

We recently held our fourth Xero Responsible Data Use Advisory Council meeting via Zoom with seven council members across four time zones to discuss the most important emerging trends around responsible data use for small businesses. How time has flown – we’ve nearly completed our first year of a council. The council includes myself, Samuel Burmeister of Tall Books (advisor), Laura Jackson of Popcorn Shed (business owner), Maribel Lopez of Lopez Research (analyst), Wyndi and Eli Tagi of WE Accou

Withum

JULY 20, 2022

As far as the IRS is concerned, not all tax scams should be treated equally. Last month the Service announced which scams made the list comprising the IRS’s “Dirty Dozen” for tax season 2022, meriting extra scrutiny. Included on the list is a wide range of tax evasion tactics. This article highlights four of them, namely syndicated conservation easements, micro-captives, return nonfiling, and secreting assets. .

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

ThomsonReuters

JULY 21, 2022

QUESTION: Our company currently offers a general-purpose health FSA. If we switched to an HDHP/HSA, could our employees receive tax-free reimbursements for the same types of expenses from their HSAs? ANSWER: Yes, and they might acquire a few additional options. Like health FSAs, HSAs can provide tax-free reimbursement of out-of-pocket expenses for medical care as defined in Code § 213(d).

Anders CPA

JULY 19, 2022

The Employee Retention Tax Credit (ERTC) is gaining more and more attention as companies are discovering that they have through the end of 2023 (for 2020) and 2024 (for 2021) to amend their previously submitted 941s. Eligible companies impacted by the pandemic have been able to claim generous amounts, which makes the credit very appealing. But it’s important to keep in mind that there are gray areas in the IRS guidance around the credit.

Going Concern

JULY 25, 2022

We received the following from a small firm owner who is suffering under the weight of talent shortages, massive workloads, and hoards of would-be clients shopping around because their accountant (rightly) raised their fees. What’s a small firm to do? I have a small firm in [redacted]. I have been reading constantly about how the large firms are merging, paying more for top talent, taking people away from other firms, etc. due to the natures of the current accounting marketplace.

Xero

JULY 3, 2022

This is a guest post by accountant Daniel Hardy of Xero Platinum Partner firm Caveo Partners. Recently, Caveo Partners was named the best boutique firm of the year at the Australian Accounting Awards. . With a new financial year upon us, you might be thinking, what’s next for my small business? In fact, you’ll likely have all kinds of thoughts about where you’re at and where you’re headed next.

Speaker: James Kahler, COO of Full Course

Ever wondered where to splurge and where to safely conserve when it comes to operating and growing your restaurant? 🤔 Join James Kahler, COO of Full Course and industry visionary, in this new webinar where he'll talk all about best practices to invest in your restaurant's success! Whether you're a new business or an established restaurant, a seasoned pro or a rookie, you'll learn the keys to sustainable success in this competitive industry.

Withum

JULY 28, 2022

We all knew this day was coming, and it has finally arrived. Multiple businesses notified us this week that their claims for the employee retention credit (ERC) are being audited by the IRS. This does not mean that these businesses did anything wrong, or that they will end up owing money to the IRS; it just means that the IRS selected their ERC claims for review.

Intuitive Accountant

JULY 19, 2022

Utilizing the Maslach Burnout Inventory for the first time in an accounting setting, FloQast's survey reveals the alarming extent of burnout on professionals and its impact on critical accounting processes.

Snyder

JULY 13, 2022

The accounting industry has undergone some serious technical changes due to technological advancements but first and foremost due to a global pandemic. Accounting firms have been forced to drastically change working environments and the way they work, as well as reconsider the services they provide. This turbulent time led to the rise in demand for client accounting services (CAS) – something that has been around for a couple of decades, but is coming into full swing only today.

Anders CPA

JULY 6, 2022

Acquiring a company can come with many twists and turns to navigate. One of those being the accounting involved in combining businesses. To help simplify purchase accounting for business combinations involving private companies, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2014-18 back in December 2014.

Speaker: Jamie Eagan

As organizations strive for agility and efficiency, it's imperative for finance leaders to embrace innovative technologies and redefine traditional processes. Join us as we explore the pivotal role of digitalization and automation in reshaping what is commonly referred to as the “last mile of reporting”. We’ll deep-dive into why digitalization is no longer a choice, but a necessity for finance departments to stay competitive in a fast-paced environment touching on: 2024 trends for the Office of

Going Concern

JULY 19, 2022

We’re learning this morning that folks at EY will not be getting lunchtime DoorDash today, their paychecks from last Friday have been unceremoniously yeeted from their bank accounts. Per a tipster: There’s a payroll snafu of some sort at EY and seems just about everyone had their payroll reversed. Mass panic and overdrafts. And a Fishbowl thread: According to our tipster and comments on Fishbowl the firm has yet to send out any communications regarding the issue and it’s too ea

Xero

JULY 17, 2022

Ringing in the new financial year may come without fireworks or champagne, but it is a great opportunity to reflect on the present and what lies ahead. It can be a moment to pause and take note of where your business currently is and how it operates – as well as where you want to be. It’s also a useful time to make changes or upgrades, especially to systems and processes, so things will be smooth-running well into the future.

Withum

JULY 18, 2022

After receiving complaints from small business owners, the Senate Finance Committee held a hearing on June 14th to review the effect of the 2018 Supreme Court decision in South Dakota v. Wayfair on small businesses and remote sellers. In 2018, the Supreme Court reviewed and upheld the lower court’s decision in South Dakota v. Wayfair eliminating the physical presence requirement for a state to impose a sales tax on sales of goods or services in that state.

Intuitive Accountant

JULY 10, 2022

Accounting firms can help their clients improve company tech stacks with integrated SaaS solutions and build a tech stack of their own for greater automation, efficiency and growth. Here's what you need to know.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

Accountant Advocate Submitted Articles

JULY 13, 2022

It’s time to get serious about operational efficiency.

SchoolofBookkeeping

JULY 29, 2022

Nothing like waking up to a fire alarm, right?? Today when opening QB desktop, we were greeted with the above screenshot. Every company we opened gave the same message, even the ones that didn't have QB Payments. Googling the phone number didn't give much confidence. I called the number and it is indeed Intuit, but they were having higher than normal call volume.

Going Concern

JULY 7, 2022

EY has had a few firsts in recent years: first Big 4 firm with unlimited PTO , first audit firm to get a $100 million fine from the SEC , first Big 4 firm to compare men and women with waffles and pancakes , and first place among the Big 4 in public company audit clients for the past seven years. Make that eight straight years now. Audit Analytics recently released its annual market share analysis of auditor engagements at public companies , and the top 10 firms by registrant counts in 2022 are

Xero

JULY 21, 2022

We’re numbers people here at Xero. And we know you – our partner community – are too. So to celebrate the return of Xerocon Sydney this September, we’ve gone and rounded up some stats to give you a taste of what to expect. Because if our calculations are correct, there are 1,161 reasons (and counting) to get excited about this unmissable event for cloud accounting leaders. . 12 keynote sessions.

Advertisement

Technology evolves at lightning speed, and as finance keeps changing, instant payments emerge as a game-changer for small businesses. By 2030, instant payments are projected to surge by 289% and will become the new norm in financial transactions. Our whitepaper reveals seven must-know facts about instant payments, offering to help you navigate this financial revolution effectively.

Withum

JULY 14, 2022

This week’s Barron’s July 11, 2022 cover story is about the top two dozen CEOs. A criterion that has usually been used to identify the top CEOs was their company’s stock performance. With the stock market down this year, they needed to reach for other measures, and I think the following applies to most successful leaders. The article’s purpose was not to suggest stocks to invest in, but to identify key features of winning leaders.

IgniteSpot

JULY 26, 2022

1. Separate business and personal. Small businesses often mix business with pleasure. That means that as many as 27 percent keep it “simple” and use the same credit cards and bank accounts for business and personal use, according to one survey. While that may be convenient in the short term, the long-term outlook isn’t as good. In fact, it’s a bookkeeping nightmare for you or your virtual bookkeeping partner to separate where and how you spent your money at the end of the year—and you have to be

Ryan Lazanis

JULY 21, 2022

In this post, I’ll be outlining strategies your firm can take today for how to get accounting clients and land new business in a rapidly changing world. I’ll be backing these strategies up with statistics gathered from a recent study titled “ The Next Chapter for Small Business: How to Thrive in a Changed World ” conducted by Forrester Consulting on behalf of Xero, which surveyed 1,000+ small businesses and 1,000+ consumers around the world in June 2020 to tap into today&

Snyder

JULY 22, 2022

What makes Shopify accounting special for thousands of e-commerce businesses? Firstly, it’s the option to connect several payment gateways to your online store. Secondly, the ability to accept Shopify POS and manual payments in addition to online orders. For customers, these features make paying for goods extremely convenient. But for merchants, using multiple Shopify payment methods at once becomes challenging in terms of bookkeeping. .

Advertisement

"Offer payroll and do it yourself,” they said. “It’ll be fun!” Spoiler alert: It was not fun. Most CPA firms know that they need to offer payroll services to their clients or risk losing them to another firm that will. However, many don’t really want to. It is often time-consuming and complex due to changing tax laws and regulations, and with the growing staffing shortages, most just don’t have the resources.

Going Concern

JULY 13, 2022

We all have that one friend whose door is always open to us. This person has been with you through all the ups and downs, and uneventful middle parts between. You trust this person because they’ve never let you down, their advice is always solid. What if clients thought of you as that friend? What if when something happens with your client’s business you are the first one they think of to call?

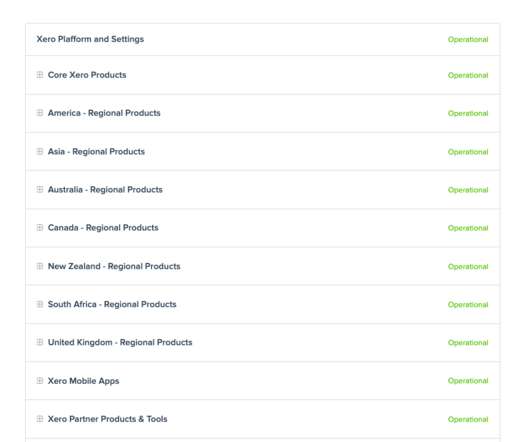

Xero

JULY 15, 2022

When the products and features you use aren’t working as they should, we know it’s really important to be able to access information about what’s happening and why quickly. We’ve recently made some changes to the way Xero’s status page works for that reason, to ensure the information you receive is more consistent, accurate and valuable. Now, when you access Xero’s status page, things will look a little different in both how the information is grouped, as well as the content of the update itself

Withum

JULY 29, 2022

I just attended a meeting at my local public library and coincidentally just finished reading a book about a library. Neither is what you might think it would be about. The Personal Librarian by Marie Benedict and Victoria Cristopher Murray was about the establishment of The Morgan Library, which is a major museum in the heart of Manhattan. It started out as the private library of J.P.

Anders CPA

JULY 21, 2022

With new reporting guidelines issued for in-kind donation reporting, is your organization prepared to implement these changes? The Financial Accounting Standards Board (FASB) issued new reporting guidelines to help increase transparency around the measurement of contributed nonfinancial assets recognized by not-for-profits, including how much was used to support programs and activities.

Advertiser: Paycor

Blue-collar jobs have a branding problem. One company, GEON, partnered with Paycor to find the solution. Learn how to attract, engage, and retain blue-collar employees, helping them build meaningful careers – and support your company’s goals.

Let's personalize your content