Predictive analytics will transform accounting

Accounting Today

MARCH 25, 2025

By helping accountants to predict results and make informed, proactive decisions, the rise of predictive analytics improves traditional accounting tasks.

Accounting Today

MARCH 25, 2025

By helping accountants to predict results and make informed, proactive decisions, the rise of predictive analytics improves traditional accounting tasks.

Basis 365

MARCH 23, 2025

The way businesses handle their finances is evolving. Managing accounting in-house is expensive, time-consuming, and often inefficient. Hiring full-time staff, maintaining software, and ensuring compliance take valuable resources away from growth. Outsourced accounting services offer a smarter approach. By leveraging cloud-based technology and expert financial support, businesses can reduce costs, improve accuracy, and gain real-time financial insights.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

ThomsonReuters

MARCH 26, 2025

Businesses continue to face serious cyber threats that target payroll and tax information. As scams become more common, it is important for companies to protect sensitive data and stay compliant with regulations to better secure their payroll processes and reduce risks. Cliff Steinhauer, Director of Information Security and Engagement at The National Cybersecurity Alliance (NCA), recently highlighted the importance of recognizing common payroll-related tax scams, understanding the evolution of d

Wendy Tietz

MARCH 23, 2025

AI is transforming how we workand our students need to be ready to use AI in their future careers. As educators, we have a responsibility to help them understand how to use tools like ChatGPT responsibly and effectively.

Advertisement

You wouldn’t keep using a 2009 flip phone - so why settle for outdated close processes? It’s time for an upgrade. SkyStem's Guide to Month-End Close Software walks you through what today’s best tools can do (and what your team shouldn’t have to deal with anymore). Get smart, fast, and a whole lot less stressed when it’s time to close the books.

Basis 365

MARCH 25, 2025

The month-end close process is a critical accounting procedure that ensures the accuracy of financial statements, providing a snapshot of your business's financial health. While many business owners rely on these reports to make informed decisions, few understand the extensive effort required to produce them. This blog walks you through the steps involved in the month-end close and explains why each step is vital for reliable financial reporting.

AccountingDepartment

MARCH 26, 2025

Financial reporting has long been a fundamental component of successful business management. It serves as the blueprint for decision-making, reveals opportunities, and identifies risks. Yet, in a rapidly changing economic environment, depending only on monthly or quarterly financial statements is gradually becoming outdated.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

RogerRossmeisl

MARCH 23, 2025

If an individual taxpayer has substantial business losses, unfavorable federal income tax rules can potentially come into play. Heres what you need to know as you assess your 2024 tax situation. Disallowance rule The tax rules can get complicated if your business or rental activity throws off a tax loss and many do during the early years. First, the passive activity loss (PAL) rules may apply if you arent very involved in the business or if its a rental activity.

Going Concern

MARCH 26, 2025

Saw this on the bird app yesterday and thought its message would be worth passing along what with 20 days remaining until April 15 and nerves as strained as ever around here. We need to do a better job at pushing healthy boundaries in our profession. Third time this week someone has called the office looking for an accountant because their current one has either passed away or is in critical condition in the hospital. — Albert J.

Accounting Insight

MARCH 26, 2025

The rise of cloud computing has transformed how businesses operate, offering scalability, flexibility, and innovation at an unprecedented pace. However, for finance leaders, this shift presents a challenge: how to manage unpredictable cloud costs while ensuring financial discipline and strategic investment. Enter FinOps (Financial Operations) a cloud financial management discipline that helps businesses maximise the value of their cloud investments.

Basis 365

MARCH 23, 2025

The way businesses handle their finances is evolving. Managing accounting in-house is expensive, time-consuming, and often inefficient. Hiring full-time staff, maintaining software, and ensuring compliance take valuable resources away from growth. Outsourced accounting services offer a smarter approach. By leveraging cloud-based technology and expert financial support, businesses can reduce costs, improve accuracy, and gain real-time financial insights.

Speaker: Gerald Ratigan

The accounts payable (AP) function is evolving and AI is leading the charge. As finance teams face rising invoice volumes and expectations for speed and accuracy, AI-powered automation has shifted from a futuristic concept to the most practical solution. But for finance leaders, success isn’t just about selecting the right tools, it’s about implementing the right strategy.

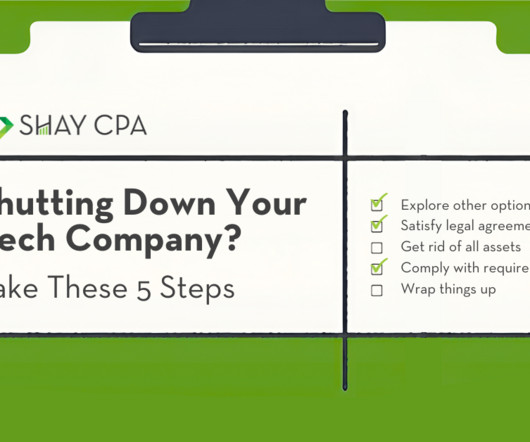

Shay CPA

MARCH 26, 2025

Deciding to close down operations at a company you founded is never easy. This venture represents a lot of time, energy, and money. Shutting it down can feel like a major loss. At the same time, though, it might come with some measure of relief. By the time youre deciding to close up shop, youve probably had some difficult months or even years. Youve felt your runway slipping away and you might be, in some ways, ready to end this chapter.

Withum

MARCH 24, 2025

If the development of a real estate property is executed without any complications, the project will begin operations and be placed in service post-production. However, what if unexpected situations delay construction? There may not be material costs, but if a project is funded with loans, interest will continue to accrue. This article takes a closer look at the tax treatment of interest expense during prolonged real estate development.

CTP

MARCH 24, 2025

When you hear about the Tax Cuts and Jobs Act (TCJA), typically people are speculating about the future of the tax laws that expire this year. What we hear less about are the tax provisions that were made permanentand that could be beneficial to your business. For instance, when you established your business, you selected a method of accounting. If you have a C corporation or a larger business, that decision may have been made for you, since most of these entities are required to use the accrual

SkagitCountyTaxServices

MARCH 26, 2025

The nations collective basketball-related madness has begun. (Thanks to tax season, my team and I have been feeling the madness for a while now. So welcome to the party). How is your bracket faring? Because I love statistics, heres one for you: So far in March Madness history, only one person has ever had an absolutely flawless bracket through the Sweet 16.

Speaker: Sean Yoder

Nonprofits are under more pressure than ever to demonstrate financial accountability while continuing to expand their impact. Traditional budgeting models often fall short, reinforcing silos, limiting flexibility, and stalling growth. Enter collaborative budgeting: a dynamic, team-driven process that enables smarter resource allocation and builds financial resilience at scale.

Going Concern

MARCH 28, 2025

Footnotes is a collection of stories from around the accounting profession curated by actual humans and published every Friday at 5pm Eastern. While you’re here, subscribe to our newsletter to get the week’s top stories in your inbox every Tuesday and Friday. Comments are closed on Friday Footnotes and the Monday Morning Accounting News Brief by default.

RogerRossmeisl

MARCH 23, 2025

If youre getting ready to file your 2024 tax return and your tax bill is higher than youd like, there may still be a chance to lower it. If youre eligible, you can make a deductible contribution to a traditional IRA until this years April 15 filing deadline and benefit from the tax savings on your 2024 return. Whos eligible? You can make a deductible contribution to a traditional IRA if: You (and your spouse) arent an active participant in an employer-sponsored retirement plan, or You (or your s

Accounting Insight

MARCH 26, 2025

BGL Corporate Solutions (BGL), a leader in company compliance solutions, has announced an enhanced integration of its company secretarial software, CAS 360, with Xero Practice Manager. This development introduces a more seamless two-way integration, enabling professional firms to manage their practice efficiently with a single firm database. The integration simplifies the management of company, trust, and individual client/contact data across both platforms, eliminating manual and duplicate data

Menzies

MARCH 26, 2025

Menzies LLP - A leading chartered accountancy firm. Overview The Government has announced a series of policy and funding reforms aimed at increasing housebuilding and strengthening skills within the construction sector, in a bid to support economic growth and meet long-term infrastructure demands. National Planning Policy Framework Reforms Reforms of the National Planning Policy Framework (NPPF) were announced in December 2024 with the aim of increasing housebuilding in England.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Withum

MARCH 25, 2025

Advertising and marketing firms operate in a fast-paced, ever-changing environment where creativity, strategy and client relationships drive success. However, behind the scenes, these firms often face challenges with financial management, resource allocation and performance analysis. Without addressing these critical areas, issues like cash flow gaps and unclear project profitability can hinder a firm’s ability to scale and succeed in a competitive market.

RogerRossmeisl

MARCH 23, 2025

Retirement is often viewed as an opportunity to travel, spend time with family or simply enjoy the fruits of a long career. Yet the transition may bring a tangle of tax considerations. Planning carefully can help you minimize tax bills. Below are four steps to take if youre approaching retirement, along with the tax implications. 1. Consider your post-career lifestyle Begin by assessing what retirement might look like for you.

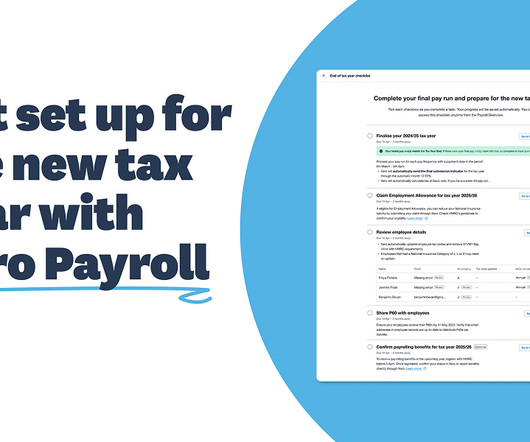

Xero

MARCH 25, 2025

With another tax year almost wrapped up, are you ready to tackle year-end payroll? We know it can be a bit painful, so weve prepared some tips to make the process as smooth as possible. Finalising your 2024/2025 tax year Wrap up outstanding items Before processing your last pay run for the 2024/25 tax year, approve any outstanding leave requests, timesheets and overtime to ensure your employees’ final pay is accurate.

Menzies

MARCH 26, 2025

Menzies LLP - A leading chartered accountancy firm. Overview The Government has announced a series of policy and funding reforms aimed at increasing housebuilding and strengthening skills within the construction sector, in a bid to support economic growth and meet long-term infrastructure demands. National Planning Policy Framework Reforms Reforms of the National Planning Policy Framework (NPPF) were announced in December 2024 with the aim of increasing housebuilding in England.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

AccountingDepartment

MARCH 27, 2025

Accounting is the backbone of any business, from managing cash flow to ensuring compliance and long-term scalability. Many business owners turn to proprietary accounting software for streamlined financial management, captivated by promises of simplicity and powerful functionality.

RogerRossmeisl

MARCH 23, 2025

The Child Tax Credit (CTC) has long been a valuable tax break for families with qualifying children. Whether youre new to claiming the credit or youve benefited from it for years, its crucial to stay current on its rules and potential changes. As we approach the expiration of certain provisions within the Tax Cuts and Jobs Act (TCJA) at the end of 2025, heres what you need to know about the CTC for 2024, 2025 and beyond.

Randal DeHart

MARCH 28, 2025

Being a construction manager and a business owner requires a unique blend of skills and attributes essential for effectively leading a crew. Leadership is at the forefront of this role, as a construction manager must inspire and motivate their team to achieve project goals while maintaining safety and quality standards. This involves clear communication, conflict resolution, and a collaborative team environment.

Menzies

MARCH 26, 2025

Menzies LLP - A leading chartered accountancy firm. Overview As we expected, todays Spring Statement brought few surprises Hospitality & Leisure sector. Hopes for cuts to announcements in the Autumn Statement, such as rise in employers national insurance, were dashed. Instead, the main focus was on public spending cuts and injections of funding into other sectors.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

BurklandAssociates

MARCH 25, 2025

Scaling a startup is exciting, but the wrong tools will slow you down. An ERP system automates tasks, centralizes data, and boosts efficiency for smarter growth. The post 5 Reasons Growing Startups Need an ERP System appeared first on Burkland.

RogerRossmeisl

MARCH 23, 2025

A business interests value is more than just a number to its owner. It represents years of hard work, sacrifice and investment. Owners often believe they have a clear understanding of their companys worth. But emotions and optimism about future earnings can cloud their perception. Lets look at psychological factors that may affect owners value perceptions and why the numbers might tell a different story.

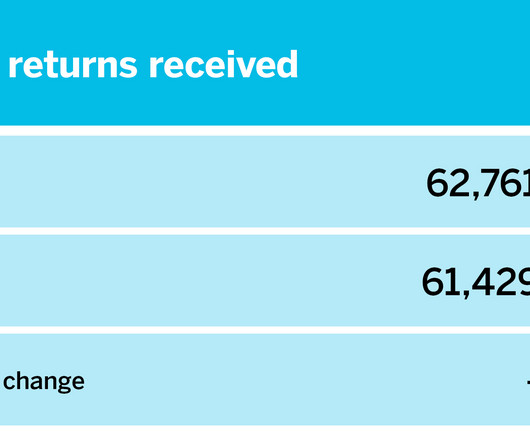

Accounting Today

MARCH 24, 2025

With tax season underway, here are the filing statistics, updated weekly.

CPA Practice

MARCH 28, 2025

Top 30 firm Aprio and top five firm RSM US have reached an agreement for Aprio to acquire RSM's Professional Services+ practice operating in the U.S. andCanada.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Let's personalize your content