To keep business operations running smoothly, you need incoming money. When you make a sale or earn money from another activity, you need to record it. Learn how to record the types of revenue in different accounts. That way, you can keep your accounting books updated, organized, and legal.

What is revenue?

Revenue, or sales, is the income your business receives from business-related activities. For most businesses, the majority of its revenue is derived from sales.

You can find your revenue on the first line of your business’s income statement. To calculate sales, multiply the price of goods or services by the amount you sold. For example, you sell 100 pies at $5.99 each. Your pie sales would be $599 (100 X 5.99).

When you record revenue in your accounting books will depend on the method of accounting you use. If you use accrual accounting, you will record revenue when you make a sale, not when you receive the money. If you use cash-basis accounting, only record sales as revenue when you physically receive payment.

Revenue does not show you how much your business actually has during a period. Profit shows you the amount your business gains or loses after you deduct expenses. To calculate your profit, or net income/loss, you must use your business’s revenue as a starting point. To find your profit, subtract your total expenses from your total revenue.

Types of revenue in accounting

What are the types of revenue in business? There are two types of revenue your business might receive:

- Operating

- Non-operating

Operating revenue is revenue you receive from your business’s main activities, like sales. If you own a landscaping company, your business’s operating revenue is derived from your services. Or, if you own a pie shop, your business’s operating revenue comes from selling the pies.

Non-operating revenue is money earned from a side activity that is unrelated to your business’s day-to-day activities, like dividend income or profits from investments. Non-operating revenue is more inconsistent than operating revenue. You make sales frequently, but you might not consistently earn money from side activities. Non-operating revenue is listed after operating revenue on the income statement.

If you want to compare your business’s revenue from period to period, look at your operating revenue. This gives you more of an idea of whether your company is growing or declining since non-operating revenue is irregular.

Types of revenue accounts

When you earn revenue, you need to properly record it in your accounting books. There are a few different types of income in accounting.

You can have both operating and non-operating revenue accounts:

- Sales

- Rent revenue

- Dividend revenue

- Interest revenue

- Contra revenue (sales return and sales discount)

For accrual accounting, you need to credit one account and debit another. If an account is increased by one account, it is decreased by the other.

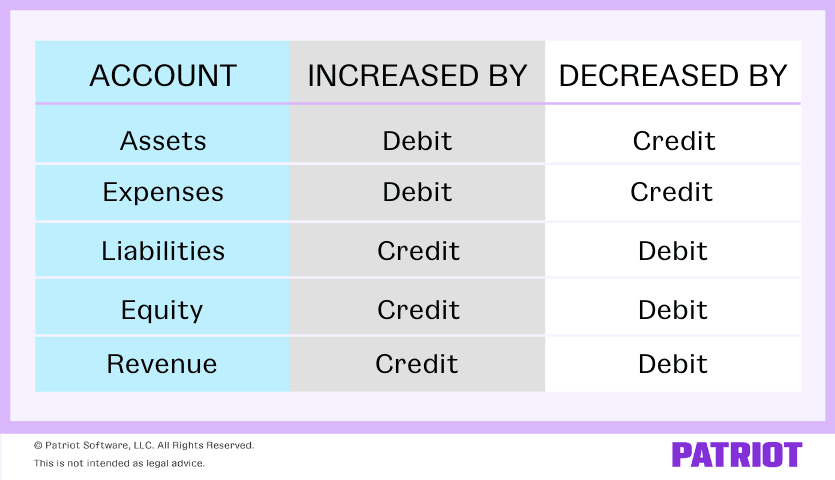

Before you can make entries for your revenue accounts, you need to know how accounts are affected by debits and credits:

Revenues are increased by credits and decreased by debits. That means you need to credit revenue when you receive it. However, you will need to debit contra revenue accounts because they are the opposite of revenue accounts.

Sales

Record incoming money from main business operations in your Revenues/Sales account. This is an account that lists your operating revenue. Some businesses might be more specific when naming sales accounts. For example, Service Revenue is a type of account that records sales from services you perform.

Here is an example of a journal entry you would create when you make a sale (using accrual accounting). The customer does not pay right away.

| Date | Account | Notes | Debit | Credit |

| 11/6 | Accounts Receivable | Sale to customer | 100 | |

| Revenue | 100 |

Rent revenue

As a business owner, you might also receive rent payments. If you have buildings or equipment that you rent out on the side, you need to make a Rent Revenue account. This is a non-operating revenue.

Many times, rent payments are made in advance. Because of this, your journal entries require an additional step. Let’s say your tenant made a rent payment in advance. You would record it as an unearned rent revenue account since they are paying before they used the building, as seen here:

| Date | Account | Notes | Debit | Credit |

| 11/17 | Cash | Building XYZ | 1,000 | |

| Unearned Rent Revenue | 1,000 |

Once you earn the revenue, you can reduce your Unearned Rent Revenue account and increase your Rent Revenue account.

| Date | Account | Notes | Debit | Credit |

| 1/1 | Unearned Rent Revenue | Building XYZ | 1,000 | |

| Rent Revenue | 1,000 |

Dividend revenue

If your business owns stocks in other companies, you will receive dividend payments. This is another non-operating revenue because it is not a day-to-day activity and is not the main operation of your business.

Here is how you would make an entry in your books for a Dividend Revenue account.

| Date | Account | Notes | Debit | Credit |

| 1/5 | Cash | Stock in ABC Company | 2,000 | |

| Dividend Revenue | 2,000 |

Interest revenue

Another non-operating revenue is interest revenue. If you have investments that earn interest, you will need to create an Interest Revenue account.

For example, you invested money into a business and earn interest on it. You need to record the interest revenue as its own journal entry.

| Date | Account | Notes | Debit | Credit |

| 1/5 | Interest Receivable | ABC investment | 200 | |

| Interest Revenue | 200 |

Contra revenue accounts

Typically, your revenue accounts add money to your business. But, you can also have contra revenue accounts.

Contra revenue accounts deduct money from your business’s sales revenue. So, you need to debit these accounts and credit the corresponding account, like Accounts Receivables.

You might have a sales return contra account or a sales discounts account. The Sales Returns account shows refunded money to customers. The Sales Discounts account shows the discounts you gave to a customer.

Let’s say a customer returns a winter coat. You will need to debit the contra revenue account and credit the Accounts Receivable account.

| Date | Account | Notes | Debit | Credit |

| 2/6 | Sales Returns | Return | 150 | |

| Accounts Receivable | 150 |

Want to simplify the process of updating your books? Patriot’s online accounting software lets you track your income and record payments within the system. Our software is made for the non-accountant, and we offer free support if you have questions. Get your free trial today!

This article is updated from its original publication date of January 9, 2018.

This is not intended as legal advice; for more information, please click here.