Is it feasible for one person to manage Finance, Accounting, Tax, Payroll and People Operations responsibilities at a company, even if it’s small?

Maybe if all the employees reside in the same location, though today it is rare to find even small companies with a centralized employee base. Companies with employees residing in San Francisco and the San Francisco Bay area, or New York City and the surrounding boroughs, can find themselves tasked with different sets of job posting, onboarding, reporting, accounting and tax requirements.

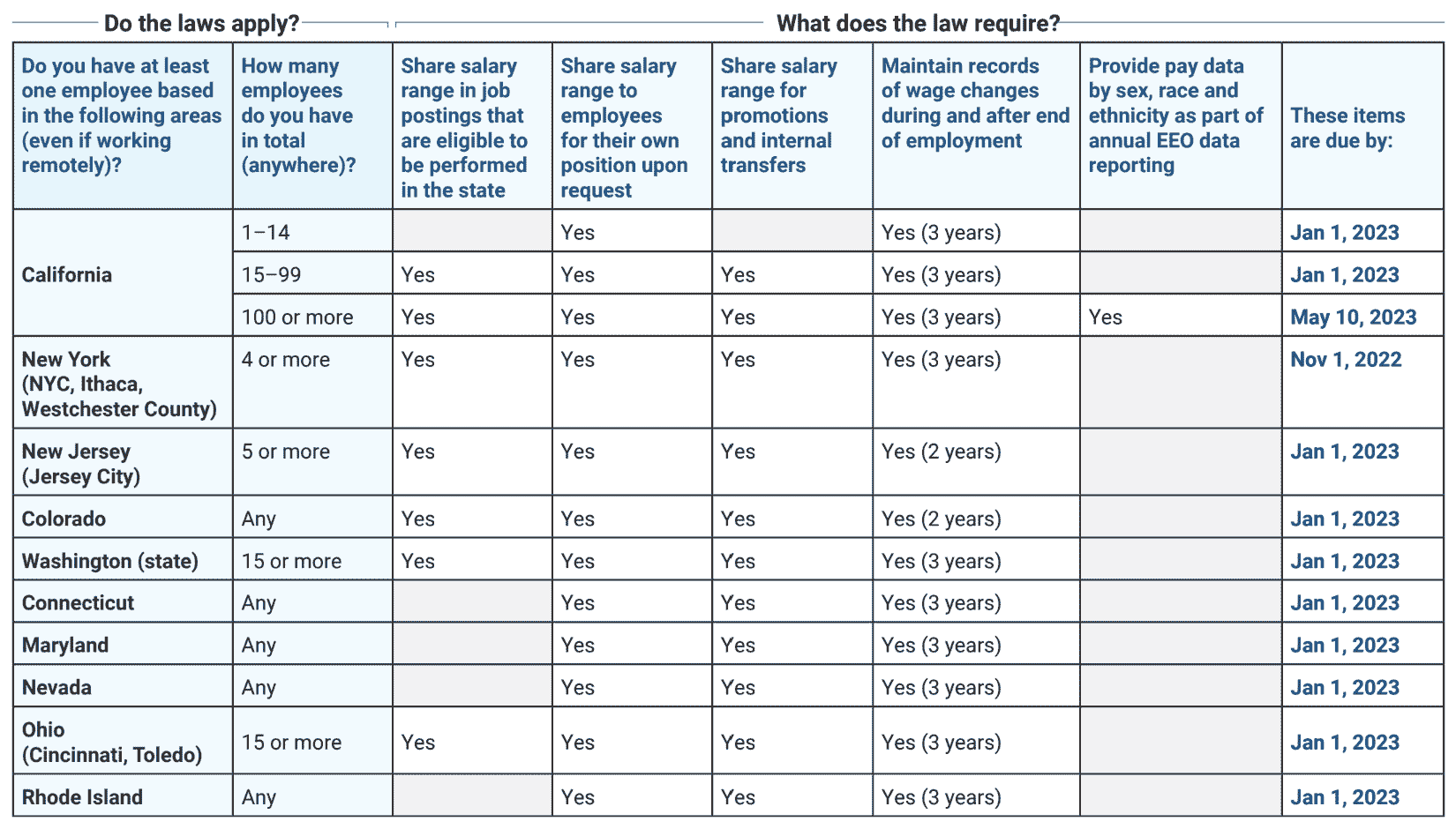

When new laws like pay transparency compliance laws are rolled out, it makes this responsibility all the more daunting with real fines as a repercussion. So why try to do it as a team of one when you have a group of trained experts at your disposal?

Since it is so challenging to stay up to date on state and local employment and tax rules, many companies seek professional assistance and often end up with a patchwork of disparate Finance and People Operation service providers. This can create a whole new set of challenges for a company because the teams they hired to help aren’t working with one another, even though their projects often overlap and directly impact one another. Different reporting and accounting practices, duplication of efforts, or missed opportunities often result when Finance and People Operations aren’t collaborating with one another regularly.

Both Finance and People Operations are critical drivers in all businesses. Finance is focused on creating and securing assets and investments to meet financial goals, forecasting how expenses will bring a valid return on investment. People Operations is focused on the investment of people and how employees impact the company’s bottom line.

The advantages of working with Finance and People Operations teams that communicate regularly and work together are endless. When Finance and People Operation teams partner, organizational-design and budget forecasting becomes more accurate, more informed decisions are made, labor expenses decrease, and employee retention rates often increase. A company has a heightened micro and macro awareness of their business and their employees when a dedicated team of people are responsible for planning, implementing, managing, measuring and reporting results on the operations required to run and grow its business.

To better understand what these critical responsibilities are and who typically owns the responsibility, we’ve outlined them below.

Finance Teams

Finance teams help allocate resources to support an organization’s goals, maintaining a balance between costs and revenue. Teams under finance typically consist of:

- Chief Financial Officer – Responsible for financial planning and managing cash flow, analyzing the company’s financial strengths and weaknesses, and proposing strategic directions.

- Bookkeeping and Accounting – Responsible for the interpretation, analysis, classification, reporting and summarization of the financial data of a business.

- Payroll – Responsible for balancing and reconciling payroll data and reporting payroll taxes.

- Tax – Responsible for preparing and submitting tax forms on behalf of clients to pay the appropriate amount and maximize the client’s return.

People Ops Teams

People Ops teams recruit, hire, and operate people programs to advance it’s organization goals. Teams under People Ops typically consist of:

- Chief People Officer – Responsible for developing and executing a human resource strategy that helps a business achieve its goals with people.

- People Operations Partner – Responsible for onboarding, offboarding, employee compensation, and fostering a healthy and compliant workplace.

- Recruiting – Responsible for all operations related to sourcing, vetting, and hiring new staff members.

- Learning and Development – Responsible for designing programming for employees to develop and harden skills that help the business grow.

Hiring this critical team of professionals as full-time employees at a small company would be overkill because there would not be enough work to keep them busy and the costs would be prohibitive. These are two common reasons why companies use fractional service providers. When using a fractional service provider, a company can leverage as much support as needed which is particularly helpful when the company is growing quickly and the demands of the business are changing.

Right now Burkland Finance and People Ops teams are working on clients’ 2023 business strategies. Burkland CFOs are analyzing last year’s cash flows, revenue, CAC and employee costs. They are having tough conversations with CPOs about cost of living adjustments, adding to or reducing headcount, sales comp plans, performance bonuses, and rolling out new pay transparency laws. Companies want to remain competitive when it comes to hiring while ensuring they have enough cash in the bank to survive a tougher macroeconomic environment.

Regardless of whether a company decides to make cost of living adjustments, most companies will be doing a hefty analysis of the current workforce’s compensation as they prepare to comply with new pay transparency laws.

Pay Transparency Laws by Location

Companies will need to address pay transparency on two fronts:

Hiring

- Decide what is shown in job posting; full or part range, range for some or all locations

- Determine how to provide access to bands to recruiters, hiring managers and people supervisors

- Formalize process for salary negotiation; what positions in range are open to negotiation, how exceptions are handled

Employee Sharing

- Who can request; only states that require transparency, or all

- What is shared; own bands, adjacent bands, team’s bands, all bands

- When this will be shared; proactive or upon request

- Who will share the bands; People Partner or Manager

There will be a lot of heavy lifting to prepare for pay transparency and to maintain compliance. To better equip teams for this new regulation, Burkland’s People Ops team recently released a pay transparency toolkit to assist with pay transparency rollout.

Pay Transparency Tools for Startups:

- Burkland Pay Transparency Checklist for Startups 2023

- Burkland People Ops Checklist for Startups 2023

- Pay Transparency- How to define your company’s compensation philosophy

- Pay Transparency- A plan and rollout strategy blueprint

- Payscale’s Fair Pay White Paper

- Simplrr’s State of Employee Engagement 2023

- Burkland People Ops Services 1-Sheeter

Many early-stage companies are referred to Burkland by the venture capital community because of our multi-service offerings. Burkland is one of the few fractional service providers to provide all facets of Finance and People Operations, making it easy for clients to turn on and increase services as needed. Burkland quickly becomes an extension of the company, helping its clients build the right foundation and scale with confidence.