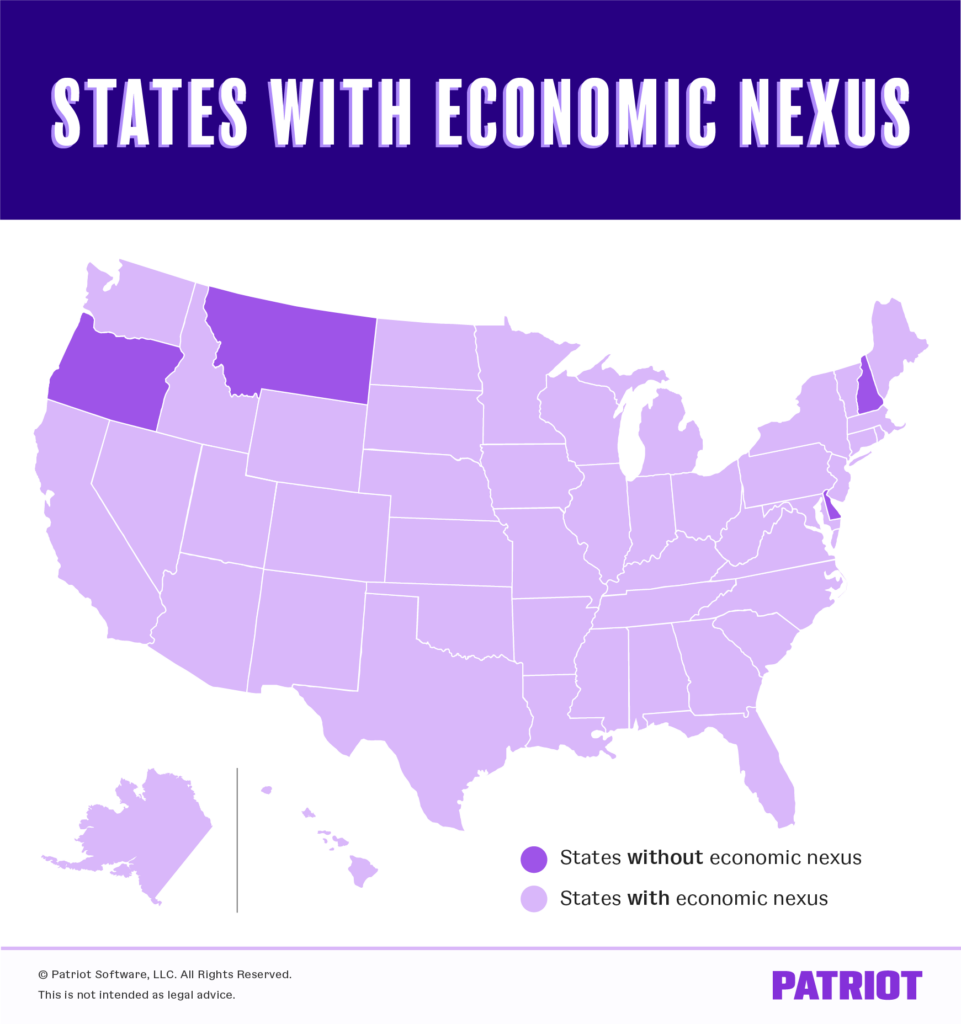

Economic nexus has taken the nation by storm. With the majority of states establishing economic nexus laws (46 states to be exact), it can be hard to keep up with all of the rules and changes.

Regardless of if you have in-person or online sales, you need to know whether the state you’re selling in has rules for economic nexus. Keep reading to learn about economic nexus laws by state and how the rules can impact your small business.

Overview of economic nexus

Before you can learn all about economic nexus, you need to know a few sales tax terms to get you on the right foot.

Sales tax terminology

Nexus is the amount of presence a business has in a certain location (e.g., state or city). You might have nexus in a state if you sell goods to a customer in that state.

Sales tax is a pass-through tax. Businesses in specific localities or states must collect sales tax from customers at the point of sale. In short, customers are responsible for paying sales tax to the business during a purchase.

Sales tax nexus determines whether or not your business has presence in a location. If you have presence in a state with sales tax, you must collect sales tax from customers. Factors like business location, employees, and amount of sales help determine if a business has sales tax nexus in an area.

Economic nexus

Now that you know a little bit more information on nexus itself, let’s jump right into economic nexus. So, what is economic nexus?

Economic nexus is essentially sales tax nexus for online sales. With economic nexus, a seller must collect sales tax in a state if they earn above a revenue or sales threshold in that specific state. In most cases, economic nexus impacts out-of-state sellers.

Because of the South Dakota v. Wayfair case ruling, both physical and economic presence in a state creates sales tax nexus. This means that you don’t have to have physical presence in a state in order to collect and remit sales tax for that state.

Economic nexus can include the following:

- Physical presence (e.g., brick-and-mortar location)

- Digital presence (e.g., online sales)

Each state sets its own economic nexus laws. Thresholds for economic nexus typically vary from state to state. However, many states have a threshold of $100,000 in sales or 200 transactions in the state annually.

States with economic nexus laws

More and more states are adopting economic nexus rules. Currently, there are 46 states (plus Washington D.C.) with economic nexus laws in place.

Four states do not have sales tax at all. Thus, they do not have to follow any sales tax laws, including economic nexus.

Check out the states that don’t have economic nexus laws:

- Delaware (no sales tax)

- Montana (no sales tax)

- New Hampshire (no sales tax)

- Oregon (no sales tax)

Now onto the good stuff (and what you came here for)… the states that have economic nexus laws. Here are the states that have some type of economic nexus law:

- Alabama

- Alaska (some localities enforce economic nexus)

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Nebraska

- Nevada

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Economic nexus laws by state

Now that you know which states have economic nexus laws, let’s dive deeper into each state’s economic nexus rules. Take a look at a state-by-state breakdown of economic nexus laws below.

Alabama

Alabama’s economic nexus law applies to sellers who exceed $250,000 in sales annually. The threshold is based on the previous calendar year’s sales.

Sellers who meet the threshold must register for a sales tax permit, collect sales tax, and remit it to Alabama.

To find out more information about Alabama’s economic nexus law, visit the state’s website.

Alaska

Alaska does not have statewide sales tax. However, some localities now enforce economic nexus. In applicable localities, the economic threshold is $100,000 in statewide sales or 200 transactions.

Sellers that exceed the economic nexus threshold but don’t sell into districts with economic nexus are not required to register.

Check with your locality and review Alaska’s website for more information about economic nexus.

Arizona

The Arizona economic nexus threshold for 2021 is $100,000 in sales. The threshold applies to sales from the previous or calendar year.

Sellers who exceed Arizona’s threshold must register for a sales tax permit to collect sales tax in Arizona.

Check out Arizona’s website for additional information on economic nexus rules.

Arkansas

Arkansas’s economic threshold is $100,000 in sales or 200 transactions. The threshold includes current or previous calendar year sales or transactions.

Sellers who reach $100,000 in sales or 200 transactions must register for an Arkansas sales tax permit as well as collect and remit sales tax in the state.

Discover more information about Arkansas’s economic nexus laws by checking out their website.

California

California’s threshold for economic nexus is $500,000 in sales based on the previous or current calendar year’s sales.

Sellers who reach this threshold must collect and remit sales tax in California and register with the state.

For more information about California’s economic nexus rules, check out California’s website.

Colorado

The economic nexus threshold for Colorado is $100,000 in sales. If you exceed the threshold, you must register for a Colorado sales tax permit, and collect and remit sales tax to the state.

Out-of-state sellers that must collect sales tax might also need to collect and remit applicable local and special district sales taxes.

Read up on more information about Colorado’s economic nexus rules by visiting the state’s website.

Connecticut

As of July 2019, Connecticut’s economic nexus threshold is $100,000 in sales and 200 transactions. This means sellers have to hit both thresholds to have to collect and remit Connecticut sales tax.

If you reach the threshold, you need to register for a Connecticut sales tax permit.

Check out more details on Connecticut’s economic nexus law by going to the state website.

Delaware

Delaware does not have sales tax.

Florida

As of July 1, 2021, Florida’s economic nexus threshold is $100,000 in sales. To collect and remit Florida sales tax, sellers must hit the threshold.

For more information regarding Florida’s econominc nexus laws, visit the state’s website.

Georgia

As of January 1, 2020, Georgia’s economic nexus threshold is $100,000 in sales or 200 separate transactions. Sellers have to hit either threshold to collect and remit sales tax.

To find out more information on Georgia’s economic nexus rules, visit the state website.

Hawaii

Following the economic nexus trend, Hawaii’s threshold is also $100,000 in sales or 200 transactions in the previous or current calendar year.

To get the scoop on Hawaii’s economic nexus laws, check out the state’s website.

Idaho

The economic threshold for Idaho is $100,000 in sales made in the previous or current calendar year.

If you’re a seller and meet the threshold in Idaho, you must register with the state for a sales tax permit and begin collecting and remitting sales tax to Idaho.

Visit Idaho’s website for more information on economic nexus laws.

Illinois

Illinois’s economic nexus threshold is $100,000 in sales or 200 transactions from the current or preceding calendar year.

Sellers that meet the sales or transaction threshold must register with the state of Illinois and start collecting and remitting sales tax to the state.

Learn more information about economic nexus laws on Illinois’s website.

Indiana

Like many other states, Indiana’s economic nexus threshold is $100,000 in sales or 200 transactions.

Sellers who reach one of the thresholds must register with the state of Indiana.

Check out Indiana’s website for more details on economic nexus rules.

Iowa

Iowa’s economic nexus threshold is $100,000 in sales in the previous or current calendar year.

If you meet the threshold of $100,000 in sales, you need to register with the state for a sales tax permit.

Check out Iowa’s website for more information on the state’s economic nexus rules.

Kansas

Kansas’s economic nexus rules are a little different than other states. In Kansas, all remote sellers with sales in the state have economic nexus.

As of now, the Department of Revenue is requiring out-of-state sellers to collect and remit sales tax. Keep in mind that Kansas’s economic nexus rules might change in the future.

Stay up-to-date with Kansas’s economic nexus laws by checking out the state’s website.

Kentucky

Kentucky’s economic nexus threshold is $100,000 in sales or 200 transactions in the previous or current calendar year.

Sellers who reach either threshold must register with Kentucky and collect and remit sales tax for the state.

Check out Kentucky’s website to read more about its economic nexus laws.

Louisiana

The economic nexus threshold for Louisiana is $100,000 in sales or 200 separate transactions in the previous or current year.

If you reach Louisiana’s threshold, be sure to register with the state so you can collect and remit sales tax.

Check out more information about economic nexus laws by visiting Louisiana’s website.

Maine

Maine’s economic nexus threshold is $100,000 in sales or 200 separate transactions in the previous or calendar year.

Register with the state if you meet Maine’s threshold. And, begin collecting and remitting sales tax for Maine.

Review Maine’s website for additional information on economic nexus rules.

Maryland

The economic nexus threshold for Maryland is $100,000 in sales or 200 transactions. If you’re a seller and meet this threshold, be sure to register with the state or Maryland for a sales tax permit.

Check out more information about Maryland’s economic nexus rules by visiting the state’s website.

Massachusetts

In Massachusetts, the economic nexus threshold is $100,000 in sales based on the prior or current tax year.

If you’re a seller and meet the $100,000 threshold, you must collect and remit sales tax in Massachusetts.

Discover more information about Massachusetts’s economic nexus laws on the state website.

Michigan

Michigan’s economic nexus threshold is $100,000 in sales or 200 transactions for sellers.

If you meet one of the thresholds, register with the state of Michigan and collect and remit sales tax to the state.

Find out more information about Michigan’s economic nexus rules on the state website.

Minnesota

The economic nexus threshold for Minnesota is $100,000 in sales or 200 or more retail transactions.

If you reach either threshold, you must register with Minnesota for a sales tax permit.

Check out additional details about Minnesota’s economic nexus laws here.

Mississippi

When it comes to economic nexus, Mississippi does not stick with the status quo. Mississippi’s economic nexus threshold is $250,000 in sales. The threshold applies to all transactions for the last 12 months.

If you reach this higher threshold, be sure to get a sales tax permit for Mississippi.

You can learn more about Mississippi’s economic nexus rules by reviewing the state website.

Missouri

The economic threshold for Missouri is $100,000 in sales for the previous 12-month period.

If you exceed this threshold, you must register with Missouri for a sales tax permit.

For more information, visit Missouri’s state website.

Montana

Montana does not have sales tax.

Nebraska

Nebraska’s economic nexus threshold is $100,000 in sales or 200 or more transactions.

If you reach either threshold, register with the state for a Nebraska sales tax permit.

Check out Nebraska’s website for more information about economic nexus.

Nevada

Like many other states, Nevada has an economic nexus threshold of $100,000 in sales or 200 transactions.

Register with Nevada if you meet one of the above thresholds. And, check out Nevada’s website for more details on economic nexus rules.

New Hampshire

New Hampshire does not have sales tax.

New Jersey

New Jersey’s economic threshold is $100,000 in sales or 200 or more transactions in the current or last calendar year.

If you meet the New Jersey threshold, you must collect and remit sales tax for the state.

Check out more information about New Jersey’s economic nexus rules by visiting the state website.

New Mexico

The economic nexus threshold for New Mexico is $100,000 in sales. The threshold applies to the previous calendar year.

If you meet the sales threshold, register with the state of New Mexico for a sales tax permit and begin collecting and remitting sales tax for the state.

If you want to learn more information about New Mexico’s economic nexus rules, visit the state website.

New York

New York has a higher economic nexus threshold than most states. The threshold in New York is $500,000 in sales and 100 transactions.

If you meet both thresholds in New York, register with the state and collect and remit sales tax.

Learn more about New York’s economic nexus laws by checking out the state website.

North Carolina

North Carolina’s economic nexus threshold is $100,000 in sales or 200 transactions. The threshold applies to the previous or current calendar year. If you’re a seller and meet either threshold, register with North Carolina.

Contact North Carolina for more information about its economic nexus laws.

North Dakota

The economic nexus threshold for North Dakota is $100,000 in sales based on the current or last calendar year. If you meet this threshold, register with the state for a sales tax permit.

Visit North Dakota’s website for more information about economic nexus laws.

Ohio

Ohio’s economic nexus threshold is $100,000 in sales or 200 or more separate transactions. The threshold applies to sales from the current or last calendar year.

If you meet Ohio’s threshold, be sure to register with the state for a sales tax permit and collect sales tax from customers.

Read more about Ohio’s economic nexus laws here.

Oklahoma

The economic threshold for Oklahoma is $100,000 in sales from the last 12 months.

Sellers who reach the threshold must do one of the following on or before June 1 each year:

- Register for an Oklahoma sales tax permit and collect sales tax

- Comply with Oklahoma’s notice and reporting requirements

Find out more information about Oklahoma’s economic nexus laws by checking out Oklahoma’s website.

Oregon

Oregon does not have sales tax.

Pennsylvania

For economic nexus, Pennsylvania’s threshold is $100,000 in sales from the last 12-month period.

If you meet the economic threshold, register for a Pennsylvania sales tax permit. Contact the state for more details on the economic nexus rules.

Rhode Island

In Rhode Island, the economic nexus threshold is $100,000 in sales or 200 separate transactions. The threshold applies to sales from the last 12 months.

If you reach the threshold, apply for a sales tax permit with the state. Go to Rhode Island’s website to find out more information about the economic nexus law.

South Carolina

South Carolina’s threshold is $100,000 in sales from the previous or current calendar year. If you hit the threshold, apply for a South Carolina sales tax permit.

Look at South Carolina’s website to find out more information about the economic nexus rule for sellers.

South Dakota

The economic threshold for South Dakota is $100,000 in sales or 200 transactions from the current or last calendar year. If you meet this threshold, be sure to apply for a South Dakota sales tax permit.

Check out South Dakota’s website for more details about economic nexus.

Tennessee

Tennessee’s economic nexus threshold is $100,000 in sales from the previous 12-month period.

Sellers with sales exceeding the $100,000 threshold must register with the state and collect and remit sales tax.

Read more about the economic nexus law by going to Tennessee’s website.

Texas

Like Tennessee, Texas also has a $500,000 in sales threshold for economic nexus. The threshold applies to the previous 12 months.

Remote sellers must register for a Texas sales tax permit if they reach the $500,000 threshold.

Check out Texas’s website for more information about economic nexus rules.

Utah

Utah’s economic nexus threshold is $100,000 in sales or 200 transactions from the current or last calendar year.

If you reach either threshold, you need to register with Utah for a sales tax permit. Check out Utah’s website for more information about economic nexus and sales tax rules.

Vermont

In Vermont, the economic nexus threshold is $100,000 in sales or 200 transactions. The threshold applies to the preceding 12-month period.

If you hit Vermont’s threshold, register for a sales tax permit with the state. You can read more about Vermont’s economic nexus rules here.

Virginia

Virginia’s economic nexus threshold is $100,000 in sales or 200 transactions from the current or previous calendar year.

If you exceed the threshold, register with Virginia for a sales tax permit. You can either register online or fill out Form R-1.

Take a look at Virginia’s website for more information about economic nexus.

Washington

Washington state’s threshold for economic nexus is $100,000 in sales from the previous or current calendar year.

If your sales meet or exceed the threshold, register with Washington state for a sales tax permit.

Visit Washington’s website to learn more information about its economic nexus laws.

Washington D.C.

Even though it’s not technically a state, Washington D.C. also has its own economic nexus laws. Washington D.C.’s threshold is $100,000 in sales or 200 transactions.

If you sell to customers in Washington D.C. and exceed the threshold, register with D.C. for a sales tax permit.

Check out D.C.’s website for more details on economic nexus and sales tax nexus laws.

West Virginia

The economic nexus threshold for West Virginia is $100,000 in sales or 200 transactions from the preceding or current calendar year.

If you meet one of the above thresholds, be sure to apply for a West Virginia sales tax permit. Contact West Virginia for more information about economic nexus laws.

Wisconsin

Wisconsin’s economic nexus threshold is $100,000 in sales.

Register for a Wisconsin sales tax permit if you meet the above threshold. Go to Wisconsin’s website to learn more information about economic nexus.

Wyoming

The economic nexus threshold for Wyoming is $100,000 in sales or 200 transactions in the current or last calendar year.

If you reach the threshold, register with Wyoming for a sales tax permit and begin collecting and remitting sales tax.

If you have questions pertaining to economic nexus, contact Wyoming for more information.

On the hunt for a simple way to track sales tax and business transactions? Patriot’s accounting software has you covered and lets you streamline the way you record your business’s income and expenses. Start your free trial today!

Interested in learning more? Head on over to our Facebook and give us a like. We always enjoy making new friends!

This is not intended as legal advice; for more information, please click here.