By Feng Gu and Baruch Lev

In April 2020, Tapestry, Inc. (TPR) (luxury goods) announced a goodwill write-off of $211 million related to its line of Stuart Weitzman (shoes). Investors’ reaction was swift and harsh, Tapestry’s stock price decreased by 12.7% on the announcement day. There was other news in Tapestry’s announcement that likely affected shareholders’ reaction, but the goodwill write-off was definitely a contributing factor. Studies examining investors’ reaction to goodwill write-offs report an average negative reaction of 3-5%. Why do I tell you this?

Because in an interview with the Wall Street Journal (January 4, 2021), the Financial Accounting Standards Board (FASB) chair stated that goodwill accounting will be a priority for the U.S. standard-setting body in 2021. Accounting goodwill, to remind you, is the difference between the total price paid in a corporate acquisition and the fair (market) value of the assets acquired minus liabilities. Goodwill, therefore, reflects the total value of the unrecognized acquired assets — mostly intangible assets which are difficult to value separately, such as brands, big data, unique organizational capabilities (e.g., Amazon’s (AMZN) and Netflix’s (NFLX) recommendation algorithms), etc. In today’s economy, the acquired assets “buried” in goodwill are among the main value-creators of enterprises.

So, goodwill is an important asset! The problem is how to value goodwill on the balance sheet after acquisition. Since the value of an asset depends on the future cash flows (or cost savings) it generates, and since in an uncertain business environment, particularly as related to intangible assets, no one knows how to reliably estimate future cash flows. The exact value of goodwill, post-acquisition, is difficult to impossible to estimate.

That’s the problem that has beset goodwill accounting for decades. Until 20 years ago, accounting rules mandated that the value of goodwill be amortized quarterly and annually on a straight-line basis, over no longer than 40 years. Since goodwill amortization is a charge to income (an expense), most companies chose the longest amortization period, generally 30 to 40 years to maximize reported earnings. This made a mockery of both the amortization expense in the income statement and the unamortized goodwill on the balance sheet, both often ignored by investors.

In 2001, the FASB replaced the straight-line amortization rule with a requirement to annually determine whether goodwill was impaired, namely whether the current value of goodwill is lower than its value on the balance sheet. If it’s lower, then goodwill has to be written off to its current value, and the write-off amount has to be recognized as an expense, like Tapestry’s $211 million goodwill write-off in 2020. The Economist (Sept. 1, 2018) reported that for the top 500 European and the top 500 American firms, cumulative goodwill write-offs over the past 10 years amounted to $690 billion.

But remember, it’s very difficult to value goodwill. So, the goodwill issue remains a thorny one. The write-off amount is highly subjective, and research, unsurprisingly, shows that goodwill write-offs are sometimes manipulated (what’s new, dealing with accounting data?) and are being delayed by managers.

However, with all the dissatisfaction with goodwill write-offs, there are two undeniable facts:

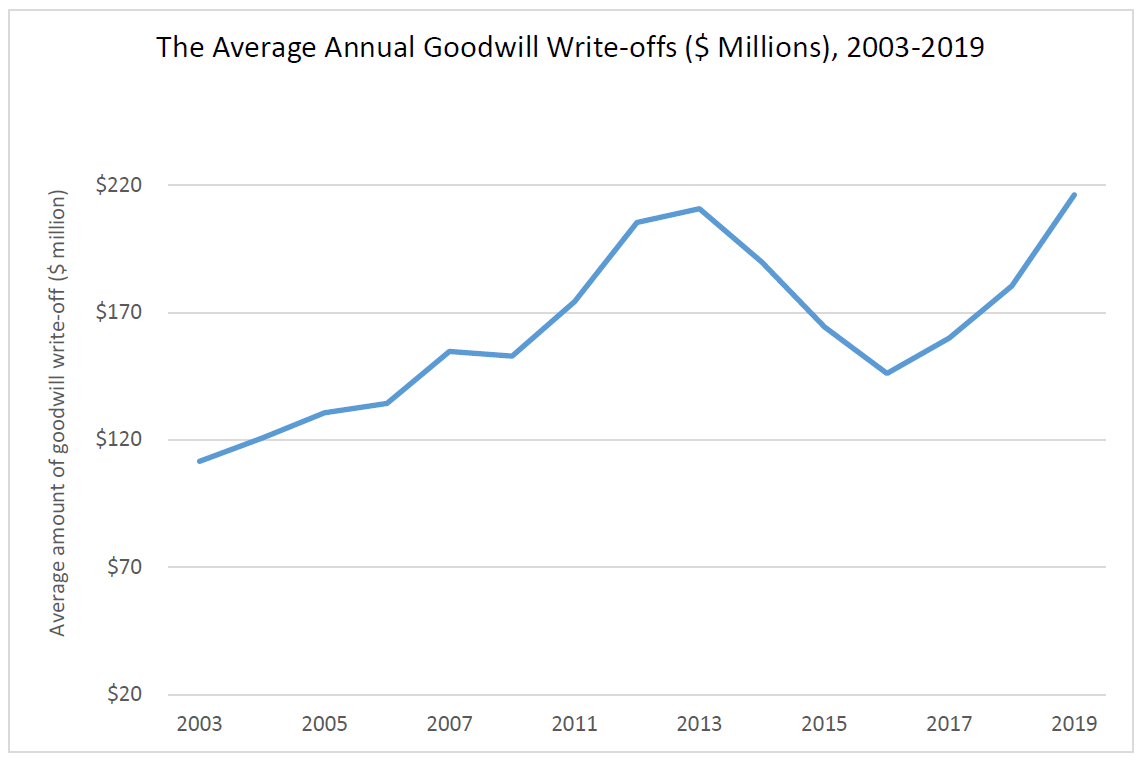

1. Managers do write-off impaired goodwill, with increasing amounts, as clearly portrayed by the following figure (an average write-off of $220 million in 2019). So, goodwill write-offs aren’t ignored.

2. Investors find goodwill write-offs as important, new information, indeed the only information, about the performance of past acquisitions. This is clearly indicated by the negative share price reaction to Tapestry’s goodwill write-off that opens this article, and by the research generally showing a negative investors’ reaction to goodwill write-offs.

Source: Feng Gu and Baruch Lev

So, despite all the shortcomings of goodwill write-offs, which by the way are shared by other fair-value rulings of the FASB in the past quarter century (e.g., physical assets write-offs), they serve an important purpose for investors. In the current financial reports, which don’t provide any meaningful information on the success or failure of corporate acquisitions ― generally, the most consequential decisions made by managers — a goodwill write-off informs investors about a failure of an acquisition. Late, perhaps, but better late than never. Corporate managers, however, dislike goodwill write-offs, and claim that they are costly and meaningless.

Back to the FASB. In the Wall Street Journal interview mentioned above, the FASB chair stated that goodwill write-off is a top issue for 2021, and that while a final decision wasn’t made yet, board members lean toward returning to the pre-2001 rule, of a straight-line amortization of goodwill, perhaps up to 10 years. Back to the future.

This is, if implemented, a cave-in to managers and accountants who often prefer uninformative, uniform accounting rules over more complex, subjective, but meaningful standards that provide important information to investors.

Rather than return to a trivial accounting rule (straight-line amortization), the FASB and its international counterpart, the IASB, should develop meaningful accounting standards for corporate acquisitions, particularly standards that allow investors to continuously track the consequences (success or failure) of acquisitions, such as separating revenues, costs, and earnings to organic (net of acquisitions), and the impact of recent acquisition on these financial statement items. Such a separation will enable investors and board members to assess the wisdom of managers’ acquisitions.

Investors agreeing with our point of view should lobby the FASB against the reversion of goodwill to meaningless accounting.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Note: This post was first published here at SeekingAlpha.com on Feb. 03, 2021.