You Are Not Charging Enough

Going Concern

APRIL 19, 2023

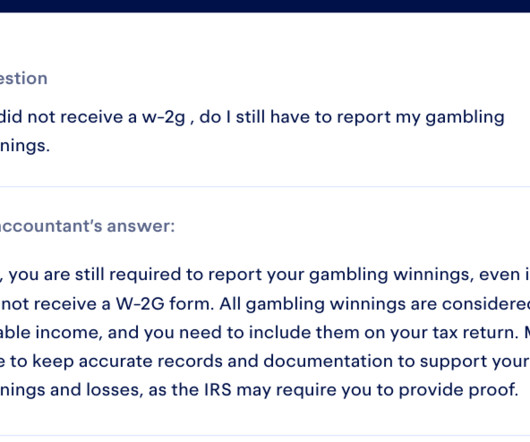

Psst. Hey, you. Yeah, you. We are speaking on behalf of the universe with a message for you: You are not charging enough. Honestly, we could just end the article here but there are minimum word counts to hit so in a moment we’re going to give you a few reasons why you need to raise your fees, though you don’t need them. Crazy concept, right? You can just raise your fees.

Let's personalize your content