The Internal Revenue Service's Criminal Investigation unit has been working with the Justice Department to uncover billions of dollars in fraud related to pandemic relief programs.

The division, also known as IRS-CI, said Thursday it has conducted 840 tax and money-laundering investigations tied to COVID-19 fraud, totaling more than $3.1 billion, through Sept. 30. The Department of Justice has also been working to investigate and prosecute pandemic relief fraud and on Tuesday announced new criminal charges, convictions and sentences related to COVID fraud and misuse of CARES Act funds.

The IRS-CI investigations include a wide array of criminal activity, including fraudulently obtained loans, credits and payments as well as tax credits.

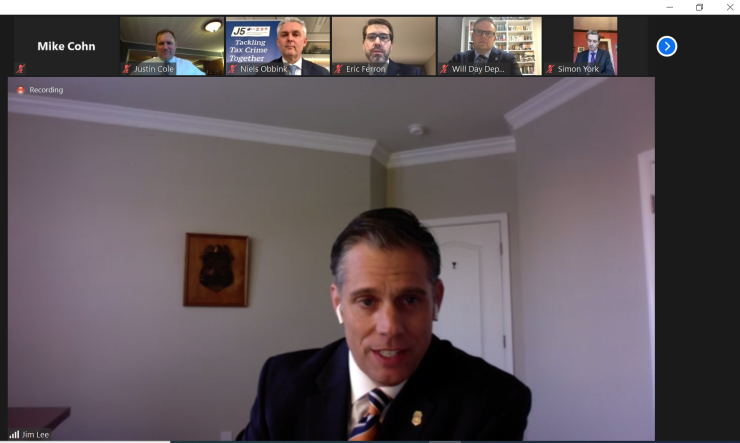

"These funds were meant for individuals and businesses whose lives were upended by an unprecedented pandemic," said IRS-CI Chief Jim Lee in a statement. "Our special agents aim to do right by the American people and ensure that those who misused these funds face justice for the crimes they committed."

The Justice Department announced a number of cases Tuesday that IRS-CI helped investigate, including two people in California who were indicted on fraud and money laundering charges in connection with a scheme to obtain $15.9 million in CARES Act funds by submitting 41 fraudulent Paycheck Protection Program loan applications and 13 fraudulent Economic Injury Disaster Loan applications on behalf of companies they owned and controlled. In another case in Florida, a man pleaded guilty last month to bank fraud and money laundering as part of a scheme to fraudulently obtain $544,900 in PPP and EIDL funds.

In another set of cases in Georgia, 13 defendants were sentenced since early 2021 and another five pleaded guilty for their roles in a scheme to fraudulently obtain over $12 million in PPP and EIDL funds. After the PPP loan proceeds were deposited in their businesses' bank accounts, the defendants distributed the funds through a series of transactions aimed at disguising the origins of the funds and how the funds were spent. They used the PPP loan proceeds to purchase luxury goods and vehicles, among other items.