Offering virtual CFO services is a great way to help small businesses and startups manage their finances. These services can help businesses level up with financial reporting, planning and forecasting, and more.

In this guide, I’ll discuss:

- What virtual CFO services are

- The different services offered within them

- The benefits of offering and using them

- How to offer them yourself

- And more 🙂

Ready? Let’s get started!

Table of Contents

- What Are Virtual CFO Services?

- Benefits of Virtual CFO Services

- What Services Do Virtual CFOs Offer?

- When Are Virtual CFO Services Recommended?

- How to Offer Virtual CFO Services

- Popular Virtual CFO Tools

- How Much Does an Outsourced CFO Cost?

What Are Virtual CFO Services?

Otherwise called fractional CFO services, outsourced CFO services, or part-time CFO services, virtual CFO services are professional financial management services that are delivered remotely.

They are there to support the CEO and ensure that he or she is receiving the right financial advice and is aware of any financial dangers or opportunities that may arise in their firm.

A CFO frequently serves as the CEO’s right-hand person. In general, they are fulfilling their responsibilities on a higher and more strategic level rather than getting involved in the specifics of things.

According to a survey conducted by Xero, the following were the top 3 business objectives of small business owners:

800 small business owners answered the poll and 42% want to be better prepared for financial instability.

This data is a great indicator for an experienced financial professional to support business owners in achieving these objectives by providing a range of virtual CFO and advising services.

Benefits of Virtual CFO Services

The advantages of offering virtual CFO services are as follows:

- Help Your Clients Improve and Grow: Working as a virtual Chief Financial Officer while having the option to serve multiple clients can be a rewarding career choice if you have a passion to see others thrive.

- There’s a Growing Demand: The majority of small business owners nowadays are looking for ways to hire a virtual CFO within a specific budget, hence, the demand is increasing because it’s less expensive with minimal overhead.

- Recurrent Source of Income: Because you can have several clients at once and are providing different CFO services to each of them, being a virtual CFO not only transforms your clients’ lives but yours as well.

And for small business owners, these are some of the great benefits of hiring a virtual CFO:

- Reduced Expenses: Small businesses can avoid the expenses of having a full-time CFO, such as regular incentives and other benefits. In addition, the cost of services will depend on the time and deliverables that a company requires because they are priced based on the client’s individual demands.

- Diverse Experience: They are well-equipped to face nearly any issue that a company has because they have managed different organizations from various industries.

- Flexibility: Depending on the shifting demands of the organization, their working hours may be increased or decreased. In addition, small businesses have the option to pay for the time and products needed for your company without compromising on the experience, expertise, and knowledge they need.

What Services Do Virtual CFOs Offer?

Let’s take a closer look at some of the more popular CFO services to offer. Keep in mind this is a non-exhaustive list.

- Financial Strategy: Developing a financial strategy for the client’s business. This may include creating budgets, financial risk management, and developing long-term financial goals for a more profitable business.

- Budgeting and Forecasting: Creating a budget for the business and implementing cost-saving measures. This also involves forecasting of the business’s cash flow so that the client can make informed financial decisions.

- Financial Reporting: Providing financial reports that will give insights into the business’s financial health. This may include balance sheets and financial statements.

- Board Meeting Preparation: Preparing for board meetings. This may include providing financial analysis and informing the board of the current financial performance of the company.

- Implementation of financial systems and processes: Setting up accounting software, bookkeeping, and payroll.

- Maintain relationships with external parties: This may involve communicating with auditors, banks, and investors regarding the financial status of the company.

When Are Virtual CFO Services Recommended?

As a virtual CFO service provider, it’s important to note that some level of vCFO services is beneficial to all businesses, but a deeper level should be looked at with any (or all) of these factors:

- Quickly growing business: If a business sees a rapid increase in growth, it may not have the internal resources to keep up with the demand. In this case, a virtual CFO role is recommended to manage the financial side of things so that they can continue to grow without any roadblocks.

- Business is undergoing many changes: A small business that is going through a lot of changes (e.g., new product launches, expansion into new markets, etc.) can benefit from having a virtual CFO to help manage the financial impact of these changes.

- Revenues above 1m: A business that has reached the million-dollar mark in revenue is no longer a small business. At this point, it’s important to have someone who is solely dedicated to managing the finances of the company so that it can continue to grow and scale.

- Operations becoming more complex: When firms scale, their operations will become more complex. With that said, it’s important to have someone who can manage and improve the financial processes that come with a more complex operation.

How to Offer Virtual CFO Services

It depends on the services that are being offered. Some services can be developed into a recurring offering (ex: budgeting, cash flow) while other services are better suited for an ad hoc basis (ex: dealing with the bank to help with financing).

A recurring model is recommended as much as possible to create a smooth cadence for all parties, along with a recurring revenue stream for the accounting firm.

Let’s look at a few brief step-by-step examples of how to offer recurring virtual CFO services:

Budgeting

- Step 1: Hold a meeting to collect financial assumptions from your client

- Step 2: Prepare and present the budget

- Step 3: A monthly/quarterly/annual service to update the budget and analyze variances

Cash Flow Forecasting and Budgeting

- Step 1: Charge a once-off price to develop a 12-month forecast budget

- Step 2: Include monthly/quarterly/semi-annual/annual maintenance of the budget or cash flow forecast

- Step 3: Update the budget or forecast to take into account changes occurring in the business

Client Coaching

- Step 1: Understand where someone is now and where someone wants to end up

- Step 2: Guide your client, hold them accountable and act as a sounding board

- Step 3: Look for a simple coaching framework that you can offer on a subscription basis

- Step 4: Hold a meeting with your client and indicate what their financial goals are to define where they want to be

- Step 5: Work with your client to develop a documented action plan

- Step 6: Meet your client periodically to provide insights and help them in areas they are struggling in

Popular Virtual CFO Tools

There are many different types of software and apps that are used by virtual CFOs, but some popular ones include:

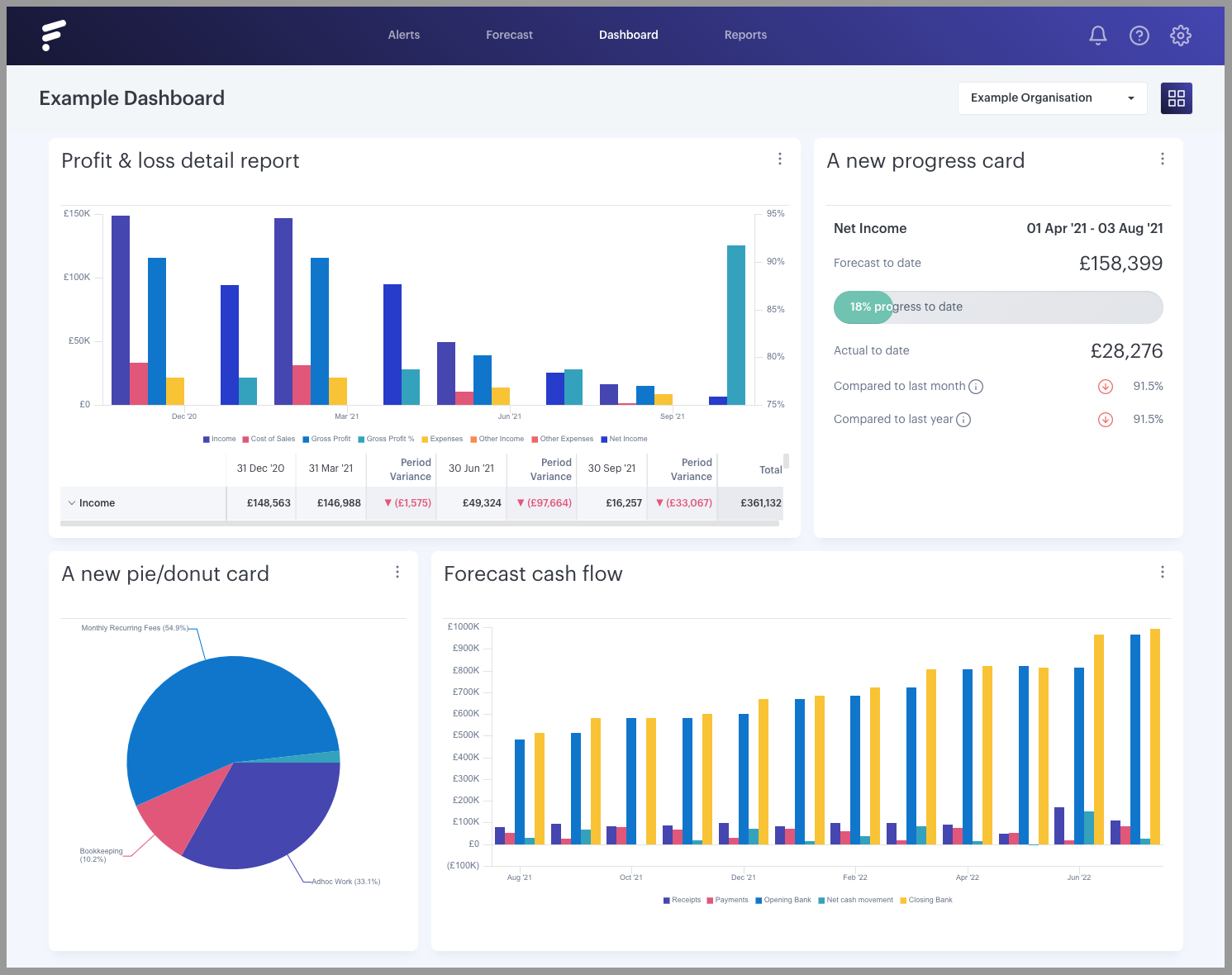

Fathom

One of my favorites, Fathom is a tool for financial analysis and management reporting, can be used to track trends, evaluate the performance of an organization, and find areas for development.

They also have a neat forecasting tool as well.

Users can simply import financial data from their accounting software thanks to its integrations with MYOB, QuickBooks, and Xero.

Futrli

Recently acquired by Sage, users can generate reports and forecasts from their non-financial and financial data that can be created either from scratch or by using templates within the app.

For small to medium-sized businesses that need thorough reporting of their cash flow and KPIs, Futrli is an ideal app for them, especially those looking for a flexible dashboarding option.

Float

With the aid of this cash flow forecasting tool, Float allows you to see your cash flow in real-time and use that information to guide your future company decisions.

You can ditch complex cash flow spreadsheets thanks to its integration with Xero, FreeAgent, and QuickBooks, which gives you more control over how you manage your cash.

Jirav

Accurate forecasting, reporting, and budgeting of financial plans are made possible with Jirav. With its all-in-one business planning software and proper tools, users can examine and visualize historical data with collaborative reports faster and better.

Jirav’s added functionality is building financial plans easier with data imports from Intacct, NetSuite, Xero, Quickbooks, or Excel in a single place.

Jirav is quite strong on the financial planning and modeling aspect of things, though can come with a bit of a learning curve.

Spotlight Reporting

Created for and by financial professionals, Spotlight Reporting offers detailed performance reports, customizable dashboards, three-way forecasting, and more.

Helm

An app used for short-term cash flow forecasting, Helm provides a straightforward, accurate, and adaptable forecast that is simple to understand so that you can assist your clients in making important company decisions.

They also have a pretty cool integration with Veem that allows you to schedule payment of bills directly from within its platform.

How Much Does an Outsourced CFO Cost?

The monthly cost of a good virtual CFO service would not be less than 1k/month but could range all the way up to 10k/month for a full-fledged service with all the bells and whistles.

To put this in perspective, the average salary of a Chief Financial Officer (CFO) is $175,000 to $480,000 per year according to salary.com. Truthfully, this is probably a bit overkill for most businesses, but it’s realistic to assume that you won’t get a highly skilled in-house CFO on the team for less than $150,000 per year.

In other words, for a fraction of the cost of hiring an in-house Chief Financial Officer, businesses can have access to all the same high-level financial expertise and services by hiring a virtual CFO.

If you’re looking for help on how to price virtual CFO services, check out my guide to pricing accounting services here.

And Now I’d Like to Hear From You?

I hope you found this guide helpful.

Now I’d love to hear your thoughts…

Which virtual CFO services would you like to offer first?

What apps might be missing from this article?

Is there anything else you’d like to learn about virtual CFO services?

Just leave a comment below and I’ll be sure to give it a look!

Very detailed and informative.

Shared CFO services is getting popular now a days.

Small businesses cant afford to have full time CFO while CFO is must to scale up new business.

Financial monitoring and control is very important for start ups.

Ryan thanks for writing this. Very helpful and gives me a lot to think about.

One thing I would like help with is getting more “skilled” at these kinds of services. What are some resources to help train an up and coming vCFO?

Hey Scott, thanks for this. I did have a podcast episode on the skills required to deliver these services: https://futurefirm.co/skills-to-deliver-effective-virtual-cfo-services/

Are you asking how/where you can learn the skills mentioned in the episode? Or something else?

Great article. I was just asking my network of financial professionals this question. Small businesses have similar but different needs vs. corporate, so this is super helpful to know where to focus.

Glad you enjoyed it!

well explained , thanks for blog.

Thank you for appreciating our content!

Thanks for the blog.