4 Ways PBC Management Makes Busy Season Less Sucky

Going Concern

FEBRUARY 9, 2023

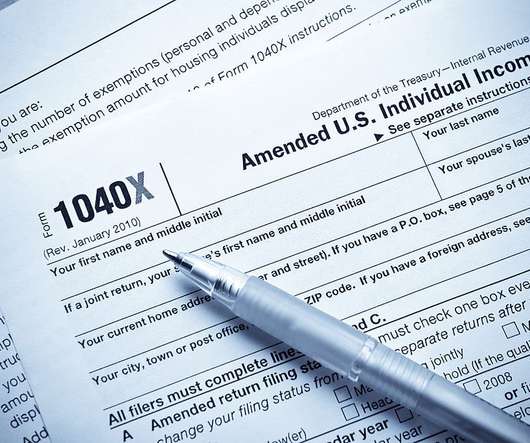

For CPAs, accountants, and auditors, busy season sucks. The stress can take a serious toll on your personal life, your relationships, and even your health. That’s because it’s hard to find time for things like diet, exercise, and those pesky “other people in your life” when you’re busy reconciling the list of outstanding client requests from: Email threads, Excel docs, Handwritten scribbles on the back of a tear-soaked cocktail napkin from last night’s happy hour that ended with you making merci

Let's personalize your content