What is Deferred Revenue?

Deferred revenue refers to a payment received by a company for goods or services that have not yet been delivered or performed. The company records this payment as a liability, rather than as income, because it is obligated to deliver the goods or services in the future. This approach to revenue recognition is based on the accrual-basis accounting method and is used to reflect the company’s financial performance and position more accurately.

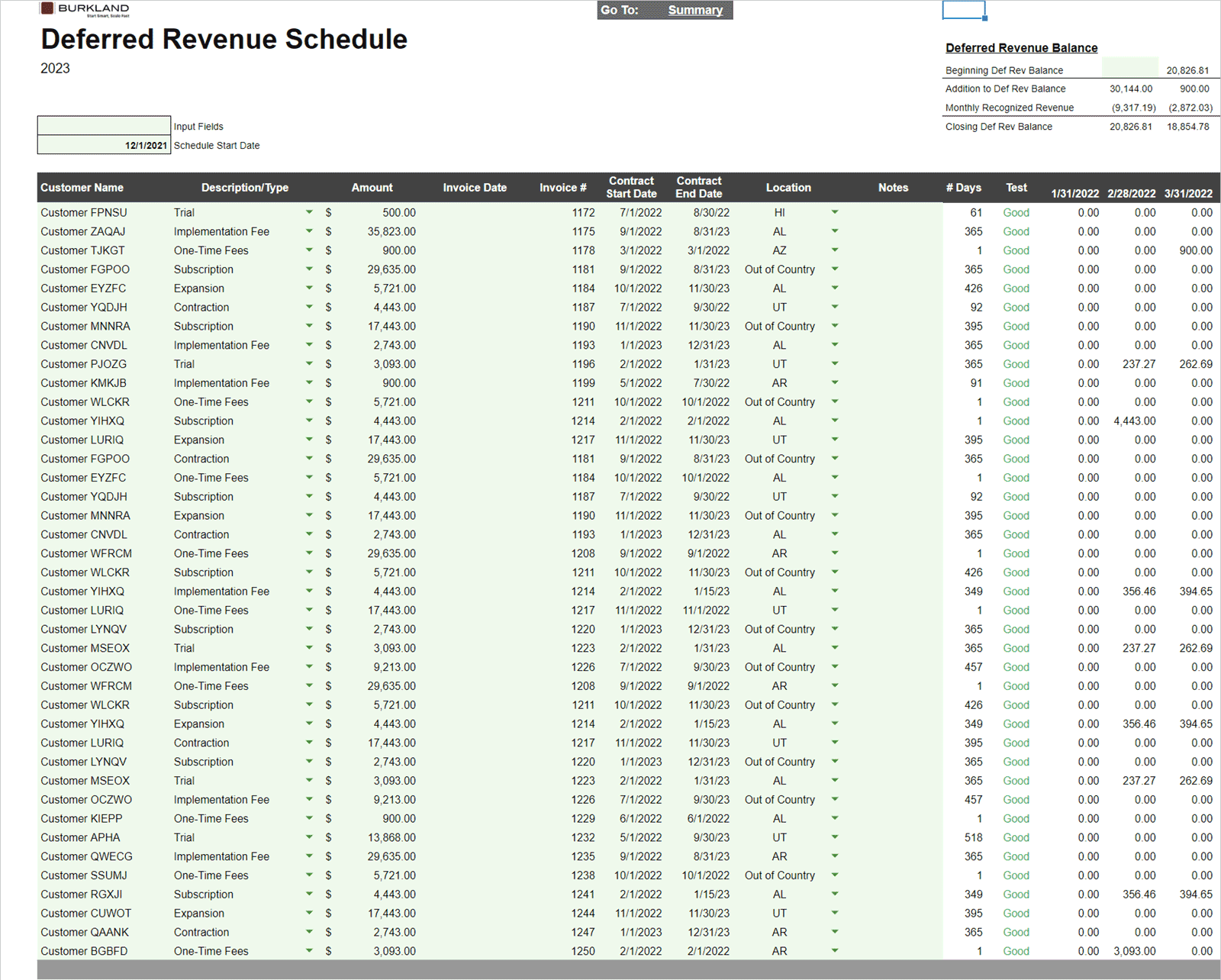

Deferred Revenue Schedule for Startups

A deferred revenue schedule is a document that outlines the amount of deferred revenue, the timing of its recognition, and the conditions under which it will be recognized.

📝 Download Burkland’s Deferred Revenue Schedule template for startups (XLS)

The deferred revenue schedule is a key tool for managing cash flow and ensuring your company’s financial statements accurately reflect its financial position. It’s important to regularly review and update your deferred revenue schedule to ensure accuracy and to identify any potential issues or risks. If goods or services are not delivered as planned, your company may owe the money back to your customer.