You don’t know what you don’t know. This phrase couldn’t be more true, especially when it comes to taking up your business’s accounting. After all, it’s a technical and complex subject. And when it comes to your responsibilities, you probably have a million accounting questions—even if you don’t know exactly what they are.

Have questions and concerns swirling around in your head? We’ll try to answer them (and more) by going over 18 common accounting questions and answers.

Accounting questions

Nobody expects you to be an accounting expert. But if you don’t stay on top of your accounting responsibilities, other entities (like the IRS or creditors) may step in and hit you with penalties.

To legally set up your business, avoid penalties, and boost profits, you must understand the basics. Get started by taking a look at these accounting questions and answers, organized by category.

- General accounting questions about business startup

- Bookkeeping questions (setting up and managing your books)

- Accounting questions about taxes

- Sales-related accounting questions and answers

- Good accounting questions to ask about profits

General accounting questions about business startup

To ease you into the business ownership process, here are some basic business startup questions.

1. How should I structure my small business?

One of the first decisions you’ll make when starting up is your business structure. The structure you choose impacts taxes, liability, control, and how to pay yourself from your business.

You can structure your business as a:

- Sole proprietorship

- Partnership

- Limited liability company (LLC)

- Corporation (C Corp or S Corp)

Some business structures are more complicated to manage than others. Depending on how you structure your company, you may have significant filing and reporting requirements.

Before selecting a business entity, lay out your business goals and consider the pros and cons of each.

2. Do I need a separate business bank account?

Not all businesses are required to open a separate business bank account. But that doesn’t mean you shouldn’t do it regardless.

Mixing personal and business funds can cause you to file taxes inaccurately, become disorganized, and overspend. You may accidentally use business funds to make personal purchases if you combine funds.

Convinced? To open a business bank account, you must:

- Choose a bank

- Gather necessary documents (e.g., articles of incorporation)

- Open the account

3. How do I finance my business?

Not every aspiring entrepreneur can afford to bootstrap their business. You may need to think about financing options if you want your small business dream to come to life.

If you’re interested in borrowing funds (which may require collateral), you can apply for a:

- Business line of credit

- Business loan

- Small Business Administration-backed loan

Instead of borrowing funds, you may want to find investors to invest in your business, like venture capitalists or angel investors. They won’t help for free, unfortunately. You likely need to offer them business equity or control in your company.

Another popular financing option is crowdfunding. Crowdfunding is a financing method where you ask for investments or donations, generally from a large group of people. Keep in mind that you probably need to offer an incentive if you want crowdfunding to be effective (think about company-branded swag, early access to products, or personal shoutouts!).

You can also ask friends and family for loans or investments. Treat funds from family and friends seriously by creating a contract and payment plan (friends and family are worth their weight in gold, but only if you pay back borrowed funds!).

4. What accounting terms should I be familiar with?

How much accounting lingo do you know? If you don’t have all the terms memorized, don’t worry about breaking out the flashcards. Instead, familiarize yourself with a few key terms to get started:

- Cost of goods sold (COGS): An expense that represents how much it costs you to produce your offerings. COGS is a crucial factor when determining your business’s profit.

- Debits and credits: Equal but opposite entries in your books (i.e., one increases an account and the other decreases the opposite account).

- Inventory: Includes the raw materials in storage, items in the production process, and finished goods available for sale.

- Assets: Your business’s physical (tangible) or non-physical (intangible) property that adds value to your business.

- Liabilities: The money that your business owes. You can have both short-term liabilities that are due within one year and long-term liabilities that are not due within one year.

- Equity: The value of your business after subtracting liabilities from assets.

- Revenue: The amount of money your business brings in from sales.

Bookkeeping questions (setting up and managing your books)

To run your business, you need to track profitability, maintain records, analyze your accounts, and make day-to-day and long-term decisions.

Here are some small business accounting questions about setting up your books.

5. How should I record transactions?

One of the first decisions you need to make when setting up your books is deciding how to record transactions. You can:

- Record transactions by hand

- Hire an accountant

- Use accounting software

Recording transactions by hand is the most inexpensive and time-consuming method. It also opens up your business to common accounting errors, such as miscalculating or failing to balance accounts, which can be costly.

Hiring an accountant is the most expensive but least time-consuming method. When you hire an accountant, you don’t need to manage your books. You may hire an in-house accountant or outsource to an accounting firm.

Accounting software to manage your books is a good middle ground between recording transactions by hand and having an accountant do it all. Using software streamlines the way you track incoming and outgoing money and helps continually organize your books. With software, you can automate your recordkeeping responsibilities, then hand over your books to an accountant for the more complicated accounting requirements (e.g., tax preparation).

6. Should I use cash-basis or accrual accounting?

You can use cash-basis, accrual, or modified cash-basis accounting to manage your books.

Cash-basis accounting is the simplest way to manage your books. With cash-basis accounting, you only record transactions when you physically make or receive a payment. This is a single-entry accounting system, meaning you record each transaction once.

With accrual accounting, you record money whenever a transaction takes place, even if you don’t physically give or receive money (like when you are billed or write an invoice). This is a double-entry accounting system, which means that you must record two entries for each transaction.

Modified cash-basis accounting is a mixture of both cash-basis and accrual accounting. You can use modified cash basis if you want to use the same types of accounts as accrual but only record income and expenses when paid.

Generally, you can choose the method you want to use, but the government requires some businesses to use accrual accounting (e.g., companies that make $5 million in annual gross sales).

7. How do debits and credits work?

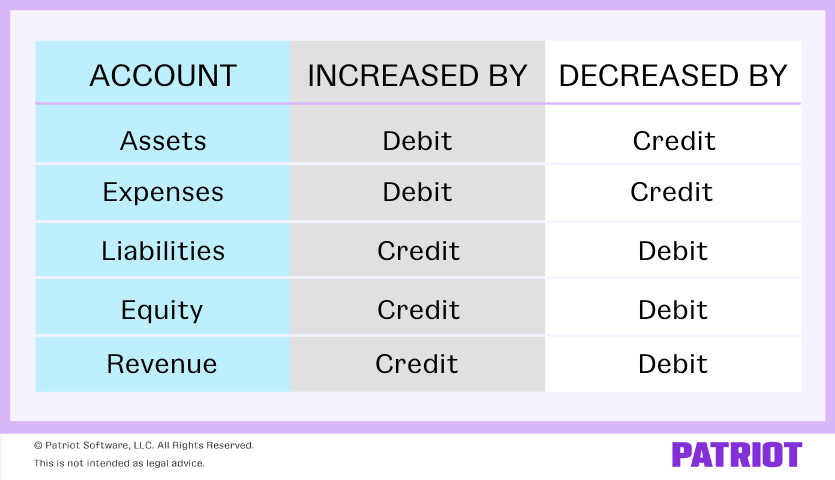

When transactions take place, you must make sure that your books properly reflect the transaction. Think of debits and credits as two sides of a scale that must balance equally—if a debit increases an account, a credit must decrease the opposite account.

Debits increase asset and expense accounts. Debits decrease liability, equity, and revenue accounts. Credits do just the opposite.

Credits increase liability, equity, and revenue accounts. And, they decrease asset and expense accounts.

Debits and credits are the basis of double-entry bookkeeping, but they can be difficult to grasp, let alone memorize. Our handy chart should help clear up any remaining confusion around debits and credits.

8. What’s the difference between accounts payable and receivable?

If you go with accrual accounting, you’ll deal with accounts payable and receivable. So, what’s the difference?

- Accounts payable: Money you owe to vendors (aka a liability). Record accounts payable when you purchase something without paying right away.

- Accounts receivable: Money owed to your business (aka an asset). Record accounts receivable in your books when customers purchase something on credit.

Accounting questions about taxes

With accurate and organized books, along with the proper guidance and knowledge, you can handle your small business’s taxes. Check out these questions about accounting and answers related to taxes.

9. How do I file my small business taxes?

To file your business tax return, you need your Taxpayer Identification Number (TIN), financial records, and the proper tax return form.

The form you file depends on how you structured your business:

- Sole proprietors attach Schedule C, Profit or Loss From Business, to Form 1040 to file their small business tax return.

- Partnerships must file Form 1065, U.S. Return of Partnership Income. The partnership must also submit a copy of Schedule K-1 (Form 1065) to the IRS and distribute Schedule K-1 to each partner.

- Corporations use Form 1120, U.S. Corporation Income Tax Return, to file taxes.

- S corporations file taxes using Form 1120S, U.S. Income Tax Return for an S Corporation.

- LLCs file taxes using a form that corresponds with how you’re taxed (i.e., sole proprietorships, partnerships, or corporations).

10. Can I lower my tax liability?

Yes! You can claim a tax credit or deduction to lower your tax liability.

Both deductions and credits help you offset the cost of qualifying business expenses. Deductions reduce your total taxable income. On the other hand, a business tax credit is a dollar-for-dollar tax liability reduction.

| Tax Deductions (Example) | Tax Credits (Examples) |

|---|---|

| Home office tax deduction | 401(k) tax credits |

| Self-employment tax deduction | Employee retention credit |

| Business interest expense deduction | Work opportunity credit |

| Bad debt tax deduction | Small employer health insurance tax credit |

11. What triggers an IRS audit?

An audit is an examination of your business’s financial records. During an IRS audit, the IRS reviews your records and checks for inconsistencies in your books.

Receiving an audit doesn’t necessarily mean that you’ve done anything illegal. The IRS occasionally chooses a business at random to audit. And sometimes, the IRS audits a business if its small business tax returns look suspicious.

Some actions can trigger an IRS audit, such as:

- Running a cash-only business

- Making errors on IRS forms

- Missing tax deadlines

- Claiming too many business expenses

Sales-related accounting questions and answers

Here are some general accounting questions related to selling your goods or services.

12. Do I need to create invoices?

Invoices are bills that businesses send customers to request payment. Create invoices if you provide goods or services to a customer without demanding immediate payment.

To create an invoice, include information such as:

- The date of the transaction

- Customer information

- Seller information

- Product or service information

- Amount due

- Invoice payment terms

- Invoice number for reference

13. How much should I charge for my products or services?

To price your products or services, you need to know your target market and competitor prices. And, make sure to price your offerings high enough above your expenses—all your expenses—so you can make a profit.

You can also use strategic pricing methods, such as:

- Market penetration (initially setting a low price and raising it once you have enough customers)

- Price skimming (setting high initial prices and reducing them over time)

- Discount (regularly marking down goods or services)

14. How can I get customers to pay me on time?

If you extend credit to customers, your business success may depend on when customers finally pay you. And sometimes, it can be like pulling teeth to get customers to pay you on time.

Take a look at a few ways you can encourage early or on-time payments:

- Set clear payment terms

- Send reminders

- Offer an early payment discount

- Offer to set up a payment plan

15. What are my sales tax responsibilities?

If your business has a physical presence in a state that enforces sales tax, you must collect it from customers at the point of sale. Sales tax is a percentage of the customer’s purchase. Your state, county, or city determines the sales tax rate you must collect.

After collecting sales tax from customers, remit it to your state or local government and record it in your books.

Good accounting questions to ask about profits

Have money on the mind? You’re not alone—every business owner does. Without money, you can’t continue to pursue your entrepreneurial dream! Naturally, you may want to ask some profit-related questions.

16. How do I calculate my business’s profit?

To determine your business’s financial health, you need to know how to calculate profit. Use the following net profit formula:

Net Profit = Revenue – Cost of Goods Sold – Expenses

17. What can I do to increase profits?

If you want to increase net profit, you must decrease expenses and increase revenue. Easier said than done, right?

There are a few ways you can decrease expenses. You can shop around for different vendors to find better deals on supplies, inventory, and equipment. Or, you could look for expenses that you can reduce or cut out altogether.

You can increase sales by:

- Revisiting your market analysis

- Offering discounts

- Decreasing your prices

- Participating in events (e.g., Small Business Saturday®)

- Improving your marketing strategy

18. Where do I report profit?

You can report your business’s profit by creating an income statement. Your small business income, or profit and loss, statement summarizes your business’s profits and losses during an accounting period.

The income statement is divided into three main sections:

- Revenue

- Expenses

- Net profit or loss

An income statement is one of three main financial statements you can create to observe your business’s financial health, obtain outside financing, and make financial decisions. The other two financial statements include the small business balance sheet and cash flow statement.

This article has been updated from its original publication date of November 1, 2018.

This is not intended as legal advice; for more information, please click here.