An important metric when determining not only the health of a SaaS startup, but a target ARR prior to your next round, is the Capital Efficiency Ratio.

A question I often get asked is how much Annual Recurring Revenue (ARR) does a company need to have to be successful in the next round of fundraising. An important metric when determining not only the health of a SaaS startup, but a target ARR prior to your next round, is the Capital Efficiency Ratio.

What is the Capital Efficiency Ratio?

- Total Equity plus Total Debt minus Cash ÷ ARR

We use Total Equity plus Total Debt minus Cash as a good proxy for the amount of capital a company has used so far in its journey. The Capital Efficiency Ratio is the ratio of how much a company has spent growing revenue and how much they’re getting in return. It looks at how efficiently a startup is using its cash to operate and scale.

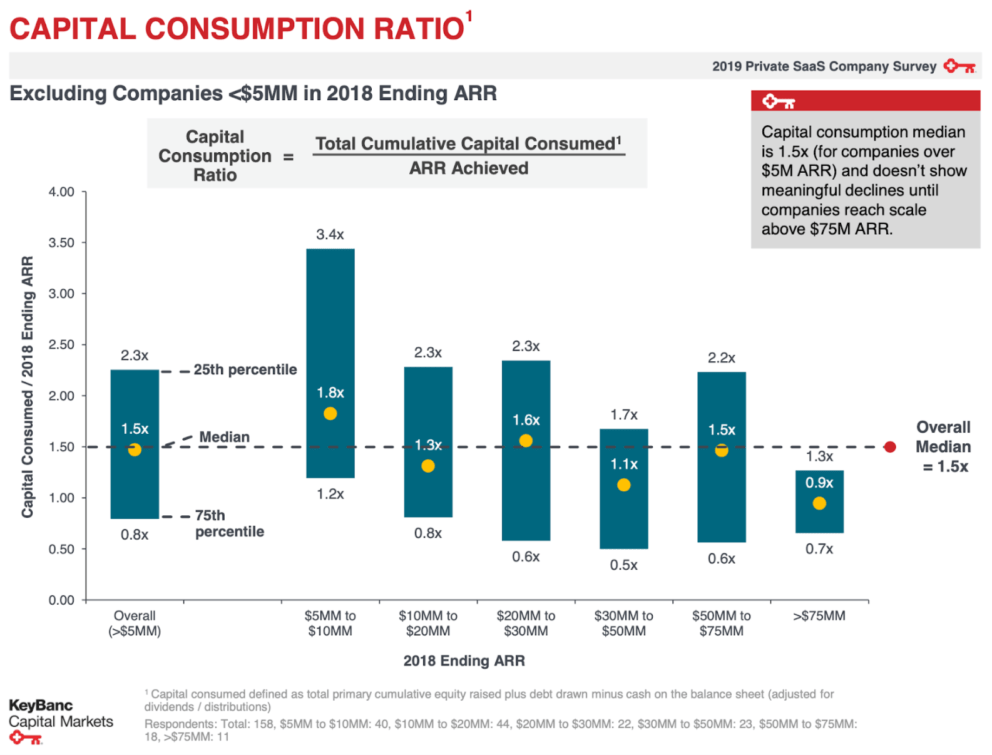

A lower Capital Efficiency Ratio is better. In a recent Key Banc Capital Markets study of SaaS companies the median is 1.5x, with a range of 1.2 – 3.4x for $5M ARR companies. Founders should take a higher ratio as a warning sign that capital is being strained, but bear in mind that this metric will not be meaningful prior to early ARR traction.

Source: 2019 SaaS Survey Results from KeyBanc Capital Markets

The Capital Efficiency Ratio & Fundraising

So how can we use this to gauge how much ARR is needed to be successful in future fundraising? Let’s say I want to fundraise 12 months from now, when my current capital raised thus far of $5M will be close to running out. Using the median 1.5x implies that my ARR needs to be around $3.3M.

If I think my ARR will be below say $1.2M a year from now, my Capital Efficiency Ratio will be 4.2x and outside the range. If this is the case, now is a good time to reimagine your sales strategy, product-market-fit, or else be prepared to tell a really good story in fundraising.

Note that the ratio tends to decrease as ARR grows, meaning companies tend to get more capital efficient. This is especially true in the earliest stages where ARR is below $1M. So for such an early stage company, it’s best to think about this as way to benchmark where a company needs to be in the future, not necessarily right now.

The Bottom Line

The Capital Efficiency Ratio is a good long term measure of SaaS success and helps startups assess where they need to be before their next round.