6 min read

Nearly every nonprofit (at least those registered as nonprofit corporations) is required to file certain documents and maintain their contact/agent information with the state in which their nonprofit is incorporated.

|

Key Takeaways

|

The exact filing requirements and schedule of required updates and renewals differ between states, as the laws which govern nonprofits are different in different states.

If you are operating a nonprofit organization, you must be aware of the rules and regulations that govern your nonprofit based on the state in which you are incorporated and the governing bodies to which you must report.

While the specific filing and reporting requirements vary, there are some general guidelines that can help nonprofit leaders understand what they should know, which questions to ask, and where to find the statutes that govern their state's nonprofit corporation rules and regulations.

What Executive Leaders Should Know About Reporting for Nonprofits

The specific requirements, rules, regulations, and guidelines for official nonprofit report filing vary from state to state. We’ll take a deeper look at this in a little.

Since the legislation is slightly different in each state, nonprofits operating in different states have slightly different requirements that they must follow in order to remain compliant and in good standing. Although the requirements differ between states, the following reports and filings should generally be on your radar, if you are running a nonprofit organization.

Read More: The Nonprofit Annual Report: Do Your Numbers Tell a Story?

Nonprofit Corporation Registration, Renewals, and Annual Corporate Reports

Although not all nonprofits are required to be registered officially as a nonprofit corporation, the majority of nonprofit leaders choose to incorporate. In addition to many other benefits, incorporating a nonprofit organization enables the organization to apply for tax-exempt status, have the ability to grow, be able to increase fundraising efforts, apply for government grants and funding, and also benefit from the legal protection of personal assets for those involved in running the organization.

To incorporate an organization, you'll need to register with your state. This typically requires the nonprofit to pay a registration fee in addition to submitting information such as the type of organization, the registered agents, and contact information such as the organization's address and phone number.

Depending on the state, this registration and information will need to be renewed and updated periodically in an annual or biannual corporate report. The name of this report and the specific information to be included varies between states. A filing fee is usually required at the time the report is submitted.

Failure to maintain these filings can result in an organization losing its good standing with the state which can make it difficult to make changes to the nonprofit entities, address, and contact information. It can also affect eligibility for applications for grants and government funding.

Department of Labor

If your nonprofit organization has employees, then, initially and periodically, you will likely need to file paperwork with your state's Department of Labor.

Annual Tax Filing

In addition to a corporate report, most states also require special financial reporting from nonprofit corporations. While several states accept the IRS Form 990, some have their own documents and filing requirements separate from the federal annual information return.

Read More: When and How Do You Know Your Nonprofit Needs To Be Audited?

Filing for Tax-Exempt Status

In some states, tax-exempt status is granted indefinitely to nonprofit organizations, other states require organizations to periodically renew their tax-exempt status. To learn more about filing and updating your nonprofit's tax-exempt status in your state, contact your state's Department of Revenue and Taxation. You can also learn more about tax-exempt filing requirements from your state's association of nonprofits (if your state has one).

Additionally, the states have separate rules and requirements for receiving tax-exempt status on property tax and sales/use tax. If these taxes are applicable to your organization, you will need to inquire about the necessary documents for filing for tax exemption in these cases as well.

Charitable Solicitation Regulations

In most states, nonprofits that actively solicit or fundraise for donations and contributions are also required to report the types of fundraising activities the nonprofit participates in. Initial registration and periodic renewal are usually both required in any state where your organization plans to fundraise – not just the state in which you operate.

Additionally, in most states, it is important that the registration occurs before the organization begins soliciting (in any manner written, oral, or electronic) residents of their state for donations. Charitable solicitation laws vary, but many states also require that the professionals working on these fundraising campaigns are also registered.

Of course, there are fees associated with initial registration and renewal filings for charitable solicitation registration. Late fees are sometimes charged to organizations that are late to renew. Additionally, depending on the circumstances, failure to comply with these registration requirements can result in civil and/or criminal penalties.

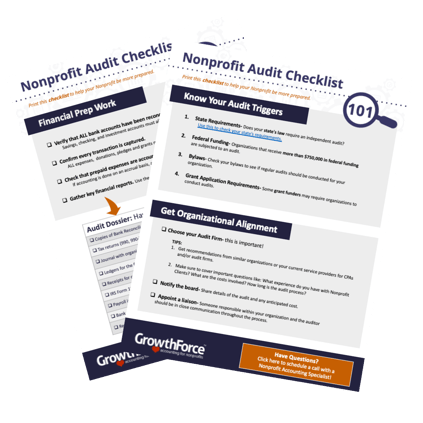

Is Your Nonprofit Prepared For Your Next Financial Audit?

The Complete Checklist To Make Sure Your Organization Is Meeting All Audit Requirements.

State-by-State Nonprofit Reporting Statutes

Reporting rules for nonprofits are different in each state. These rules and regulations can change periodically as your state's statutes and legal code are revised. We recommend checking your state's statutes directly at the time you are required to file for specific information on your reporting rules and regulations.

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

For guidance with getting started or for assistance with interpreting ever-changing legislation, you can also seek out resources provided by organizations that are established to assist and support nonprofit corporations (such as The National Council of Nonprofits) or take advantage of the expertise of an attorney who is familiar with the nonprofit statutes in your state.

Avoid Penalties and Reputational Damage: Seek Out Nonprofit Legal Counsel

Whenever you're forming a nonprofit organization or making changes to an existing organization, it is best to seek legal counsel from a professional with experience in your state's nonprofit statutes and code. This will ensure you make the right choices, understand what is legally required of your nonprofit, and that you always file your reports thoroughly, accurately, and on time.

Always Be Ready for Nonprofit Audits and Reporting With Sound Back-Office Procedures

In addition to having sound bookkeeping and accounting procedures that are designed to be streamlined, automated, and accurate, establishing internal nonprofit auditing procedures will ensure you catch any potential errors and omissions before an official state auditor does. Set up dual control procedures with plenty of internal checks and balances and/or work with an outsourced nonprofit accounting professional to help ensure your reports are always in order. When your nonprofit is audit-ready, it is also end-of-year ready which will save you time, stress, and penalties for compliance exceptions whenever an audit comes up or you need to file your annual report.