7 min read

.jpeg?width=682&height=400&name=AdobeStock_537425752%20(1).jpeg)

Unless you are a bookkeeping and accounting professional, you likely didn't go into business with your heart set on financial reporting.

|

Key Takeaways

|

Financial reporting, however, is an integral part of operating any kind of business in any industry. Without sound financial reporting practices that produce accurate, reliable, and timely reports, no person could possibly hope to lead a successful business.

What Is Financial Reporting?

Financial reporting is the process of collecting data and generating reports (financial statements) for the purpose of communicating financial information to internal and external stakeholders.

The reports used and required in different businesses can vary somewhat. However, the most common financial reports for for-profit businesses include the balance sheet, income statement (profit and loss statement), and statement of cash flows. The most common financial reports for nonprofit businesses include the statement of financial position, statement of activities, statement of cash flow, and statement of functional expenses.

The Two Primary Reasons Why Your Business Needs On-Time and Trustworthy Financial Accounting

Meeting Basic Financial Accounting Standards

On-time and trustworthy financial reports are essential to meeting the basic accounting standards that provide a variety of benefits to your business. Complying with and meeting these standards by generating accurate and on-time financial reports provides the following benefits to your company:

- Ensure you're operating in compliance with regulations and laws. This saves you financial loss, reputational damage, and stress that can occur due to regulatory non-compliance in your accounting standards, reporting, operations, tax filing, and more.

- Help your business access loans and other assistance from creditors. Whether you need a business credit card, a line of credit to carry you through your down season, or a loan to purchase a new office, you'll need to provide your creditor with both current and historical financial reports that are accurate and consistently generated.

- Enable potential investors to clearly and objectively evaluate your business. Investors use standard financial reports to compare and contrast the performance of companies in which they will potentially invest. Without reliable financial reports, you won't be able to attract investors and, as a result, you might struggle to grow your business.

- Build a history of your company's finances that can be evaluated in the future. If or when you become ready to exit your business, you will need a reliable, data-based way to place a valuation on your business and attract potential buyers. Your long history of neatly kept financial reports will be your primary method of demonstrating your company's growth and profits performance history.

Business accounting and reporting standards can vary somewhat from industry to industry, state to state, and country to country, depending on differing regulatory requirements. However, most companies follow a set of accounting standards known as the Generally Accepted Accounting Principles (GAAP).

Moving Beyond Compliance With Management Reports (KPIs)

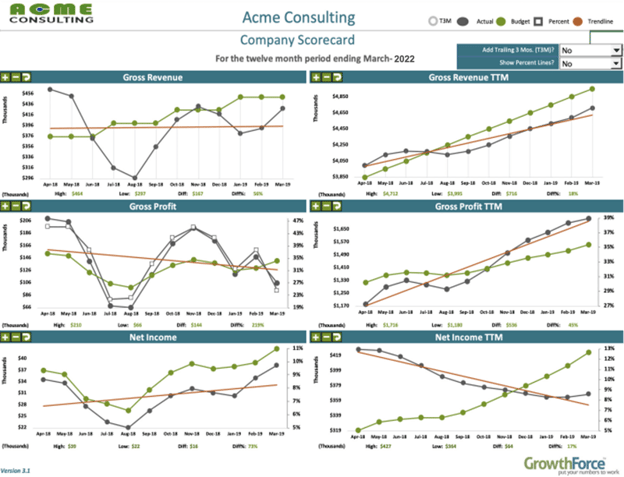

Beyond the myriad benefits that financial reports offer your business in terms of compliance, timely and accurate financial reports are also essential to business management. While standard financial reports can be useful in terms of business management, you will likely also use a set of additional reports to help you oversee and improve your company's financial health and performance.

The #1 difference between businesses that fail, and businesses that thrive? The ones that succeed are laser-focused on their numbers.

Management reports and the key performance indicators (KPIs) calculated from the information contained in them are essential to business management, budgeting, strategy, survival, and growth. Business leaders need management reports to make data-driven decisions to efficiently and effectively cut costs while spending money on and putting the greatest effort into the areas that generate the highest return on investment. Management reports allow you to spend and save smartly, while also forecasting cash flow to anticipate future challenges and opportunities.

Additionally, management reports can help you evaluate your profit margins by class in addition to assessing your hiring processes, timing, and procedures; evaluating management strategies; improving productivity; and maximizing ROI on labor costs.

Management reports are necessary for keeping a close eye on your company. If your financial reports are inaccurate or take too much time to generate, then they can be rendered useless, in terms of using them to make data-driven decisions in your business. Today's economic climate is changing rapidly, and your business's numbers might be, too. This means you can't be using last month's data to make management decisions this month. You need up-to-date information so that you can keep a close eye on your business's costs, revenue, profits, and projections.

5 Financial Reports Best Practices for Your Business

1. Standardize Bookkeeping and Accounting Policies and Procedures

In order for financial reports to be reliable and useable, they must be comparable across time. If your policies and procedures for collecting data and reporting data have not been standardized, then your financial reports are not reliable. Reports that are generated without standardized processes cannot be accurately understood, evaluated, or compared to identify financial trends.

To generate usable reports, it is necessary to use a standardized process of collecting, categorizing, and reporting data. Additionally, these standardized processes must be implemented company-wide, across departments.

Read More: 6 KPI Charts to Drive Performance & Profitability in Small Businesses

2. Minimize Manual Processes

Making mistakes is only human, and that's why (when it comes to bookkeeping and accounting systems) it's best to minimize human involvement whenever possible. If your bookkeeping and accounting system consists of mostly manual processes, then it is time to start finding ways to automate as much of these processes as possible - especially, tasks like data collection which is a high-volume, repetitive task, rife with opportunities for errors.

3. Ensure Seamlessly Integrated Accounting Systems

If you are using several different systems, tools, and apps in your back office, then there is the possibility for data to become lost or mistranslated between these tools. Automation is key to a powerful back office, but, if your system is not properly integrated, then it can present a variety of new problems.

Be sure you're starting with a powerful back-office system like QuickBooks that offers a plethora of useful, easily integrated bookkeeping, accounting, and data collection tools that can be easily implemented to streamline your company's bookkeeping and accounting processes.

4. Institute Proper Checks, Balances, and Separation of Duties

No business's back office should be fully operated by only one or two individuals. To ensure true separation of duties, checks and balances, and fraud protections, you need, at the bare minimum, to have at least three back-office professionals working at all times.

5. Outsource to a Reputable Business Accounting Services Provider

Businesses stand to save a lot of money while also improving their back-back office capabilities by outsourcing. Although they are not core functions of your business (unless you are an accounting firm), bookkeeping and accounting are essential to compliant and successful business management and operation. Investing in a reputable third-party provider can help you easily solve your back-office problems with access to industry experts while saving money on hiring a full-time, in-house department.

Read More: Outsourcing vs. In-House Accounting Cost Comparison

Take Your Business Leadership to the Next Level With Better Back Office

If you are running a small or medium-sized business, then hiring a full-time team of bookkeeping and accounting professionals while also paying a controller and CFO is likely an unrealistic budget item. Just because you can't afford a high-powered back-office team, it doesn't mean you can't access one for your business. The simple solution, in this case, is outsourced accounting services.

By outsourcing your back office to a reputable provider, you can take a break from focusing on your back office and leave it to a team of experienced professionals. With outsourcing, you can relax knowing that your back-office system is efficient, reliable, accurate, and secure. Plus, you can gain essential insights into your company's finances to boost profit drivers and make other data-driven decisions to maximize profitability and grow your business.