Four Important Financial Statements for Your Business

You spend a lot of time analyzing financial statements as a manager or owner of a business. Of course, each statement is essential, but not all statements are equally important. While some financial statements are vital to understanding a company's financial health, others are less important.

Let's look at four of the most important financial statements for every business.

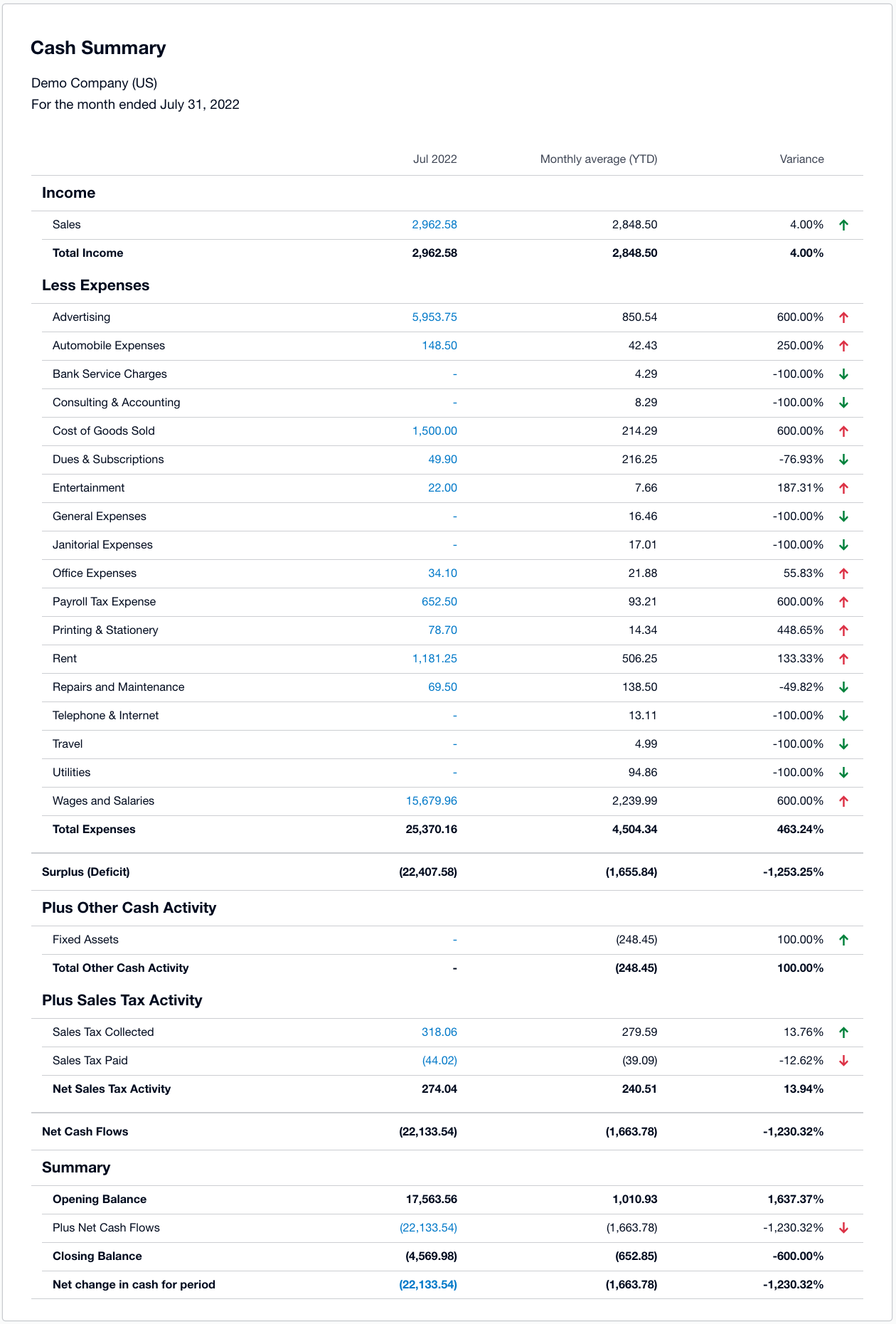

Statement of Cash Flow

* Source: Xero Demo Company

A statement of cash flow, a financial statement for businesses that shows where cash is going in relation to business operations, is what you call a statement of cash flow. The categories in the statement are pretty complex for those not working in accounting. The company's size also affects the number of categories in the cash flow statement.

Large companies typically have categories for financing activities, investing activities, and additional information on the statement. Smaller businesses have two types of cash flow statements: cash inflows and cash outflows. The cash flow statement's primary purpose is to determine where and where cash is going. This information is essential for a business to know if it is spending less money than it generates.

A similar report provided by Xero to the right is a Cash Summary. This report is formatted differently but accomplishes the same thing: What is causing the change in Cash?

The Income Statement

The income statement shows the net income or loss of the company. This statement shows the amount of money coming into the company and the amount that is being spent. The money that is spent is expenses. The income statement will show a net loss if expenses exceed revenue. The income statement lists the following categories: sales, operating expenses, and nonoperating. Operating expenses can be described as money spent on advertising such as billboards and magazines, radio ads, television commercials, and the internet. A single purchase used by the business is an example of a nonoperating expense. Sales are goods sold.

The income statement (also known as the profit-and-loss statement or P&L) is a way to see how revenue and earnings are compared. The income statement is crucial for monitoring changes in the company's finances. It's similar to how a doctor monitors changes in a patient's condition over time through ongoing assessments.

The Statement of Owner's Equity

Between accounting periods, there is the possibility of changes to the equity of a business owner. These changes can be seen on the financial statement, also known as the statement owner's equity. The financial statement contains information about the equity balance at the beginning, ending balance, as well as additions and subtractions. Additions or subtractions can be applied for a specific period. This includes financial transactions such as withdrawals, dividend payments, and income.

The Balance Sheet

Although the balance sheet is not as well-known as it should be, it is still a significant financial statement. The company's assets, liabilities, shareholder equity, owner equity, and shareholder equity are all included in the balance sheet. Accounts payable and payment types on long-term loans are included in the liabilities. When the assets are subtracted from the liabilities, the owner's or shareholder's equity is determined. The balance sheet is called such because the liabilities added to the shareholder equity equals the number of assets.

The balance sheet is essential because it gives a snapshot of the financial situation at a particular moment. This allows a manager or business owner to determine the most critical ratios, such as solvency and liquidity. These are crucial for debt management. It is also easier to see if the company can pay its bills, distribute dividends or obtain additional capital.

If you take the time to understand your company's balance sheets, you will feel more confident in budgeting. You will also be able to set the stage for financial management by knowing that your numbers are as accurate as possible. This will result in more efficient operations management, better communication with managers, and improved collaboration.