Staying ahead of the curve means continuously innovating and optimizing operations in an increasingly digital and interconnected business landscape. One critical element of business strategy that can significantly benefit from this relentless pursuit of innovation is budgeting.

Traditional methods of business budgeting, though meticulous, are fraught with potential for error and inefficiency, owing to their manual, time-consuming nature. Business budgeting software, and cutting-edge technological solutions, are designed to streamline budget management, enhance financial accuracy, and bolster the overall fiscal health of organizations, regardless of size or industry.

In this article, we dive deep into the world of business budgeting software, elucidating its value proposition, and exploring how it can transform your organization’s approach to financial management. By revolutionizing budget planning and execution, this advanced tool paves the way for enhanced decision-making, robust financial forecasting, and superior performance tracking. So whether you’re a seasoned financial professional or a business owner just dipping your toes into the world of automated budgeting, this piece serves as your comprehensive guide to understanding and harnessing the power of business budgeting software.

Contents:

1. Business budgeting: what is it and why do you need it?

- What is a business budget?

- Types of business budgets

- Why is business budgeting crucial for any business?

2. How to create a realistic business budget?

3. What is business budgeting software, and how does it help?

4. Best small business budgeting software: solutions review

- Synder

- QuickBooks Online

- Xero

- Sage Intacct

- FreshBooks

- Kashoo Online Accounting

- Microsoft Dynamics 365

- NetSuite

- Workday Adaptive Planning

- PlanGuru

Business budgeting: what is it and why do you need it?

Before we get to business budgeting software and compare some budgeting software tools, it’d be great to look at the overall idea of a business budget and see how it can help businesses.

What is a business budget?

So, what does a business budget stand for? By definition, it’s an estimation of future business incomes and expenses based on the evaluation of the business finances over a certain past period. Usually, a business budget gets created annually. However, short-term budgets, like quarterly or even monthly, also can be used and perfectly co-exist.

Usually, a business works out a general budget for the whole company. Also, each department might have its own budget (like marketing, sales, the IT department, if you have one, financial, etc.) to include the anticipated expenses and revenue. So, the general budget encompasses all those departmental budgets.

Types of business budgets

A business budget is a wide concept that might include various types of budgets a company might want to create, depending on their goals. The most typical types of budgets include:

- Master budget – the general company-wide budget containing projections and goals for the whole fiscal year. Usually, it takes all three major financial statements, the income statement, the balance sheet, and the cash flow statement, to create a master budget.

- Static budget – the most basic type of budget that takes into account only fixed expenses, the ones that don’t depend on production or sales volumes.

- Operating budget – the budget that focuses on operating expenses, such as the cost of goods sold (COGS), and the revenue from the day-to-day business operations.

- Cash-flow budget – the budget that zooms in on all the company’s inflows and outflows of cash (including the due cash).

Why is business budgeting crucial for any business?

Business budgeting is an integral part of running a business. A study analyzing startup failures showed running out of cash as one of the top reasons for them to crumble. In light of this, budgeting certainly looks like something not to ignore. Still, nearly half of the small businesses don’t embrace formal budgets for various reasons: from a vague idea about how to put one together to the time investment required and lack of awareness of how it can help the business.

A budget is a tool that gives business owners more control over their finances, allowing them to track and compare anticipated against actual expenses and revenue and make more informed and timely decisions on handling their cash flow balances more efficiently.

Thus, well-elaborated budgeting will help you with the following:

- Financial forecasting: Well-crafted budgets allow businesses to anticipate revenues and expenses, helping them to predict short and long-term financial performance.

- Cash flow management: Budgets aid in managing the flow of cash, ensuring there is enough liquidity for daily operations and investment opportunities.

- Performance evaluation: By comparing actual financial results with budgeted figures, businesses can identify areas of strength and weakness, guiding them in making strategic adjustments.

- Resource allocation: Budgets provide a roadmap for allocating resources efficiently, ensuring funds are utilized where they can provide the most value.

- Risk management: With robust budgeting, businesses can anticipate potential financial risks and establish contingency plans to mitigate them.

- Profit maximization: Budgets help businesses identify and focus on profitable areas, driving revenue growth and reducing unnecessary expenses.

- Investor relations and funding: For investors and lenders, a well-structured budget is a sign of financial health and managerial competence, improving the chances of obtaining external funding.

- Strategic planning: Above all, a budget is a strategic tool, aligning financial goals with operational objectives and guiding businesses toward sustainable growth.

How to create a realistic business budget?

In oversimplified terms, budgeting includes three basic components – income, fixed costs, and variable costs. Knowing them is pretty much enough for a rough budget. However, to have a more accurate, powerful, and useful budget, you might need to consider more factors and put a bit more effort into the analysis. So, let’s take a quick look at the steps you might need to follow to create a more effective business budget.

Cost analysis

Understanding the expenses involved in your business operation is the first step to budgeting. Here, you might want to focus on fixed, variable, one-time, and unexpected costs.

Fixed costs

These costs are the recurring monthly expenses you pay regardless of how much revenue you gain. These might include rent, utilities, business loan payments, some taxes, business software subscriptions, etc.

Variable costs

Variable costs are expenses that might vary depending on business performance. They might include COGS, marketing and advertising costs, commissions, office needs, etc. Some of these costs can be less essential for the business than others, so they’ll be the first to look at when cutting your budget.

One-time costs

This type of expenses is previewed just in the current budgeting period. They won’t repeat, and this way, won’t be included in your next budget. These can be spent on company events, buying new office furniture or appliances, etc.

Unexpected costs

Unexpected costs are the expenses you factor in just in case any event you don’t anticipate occurs. Providing for unexpected costs in your budget, you create a safety pillow for your business if anything goes not as planned.

Cost negotiations

Including cost negotiations in your budgeting can be a helpful step, especially if your business deals with suppliers. If you have long-established relations with your suppliers, you can try to renegotiate some costs, which might include better pricing for in-bulk purchases, delivery costs, etc. This way, you’ll preview your renegotiated costs in the upcoming budget.

Cost negotiations work at their best for long-term budgeting, like at the end of the fiscal year, when you create a budget for the upcoming year. You can also negotiate on the cost of business software – vendors often provide custom plans upon request.

Revenue analysis

At this point, you might want to look at all your revenue channels and track how your revenue changed period over period in the past to make more accurate projections, based on the change trend. However, it’s important to not overestimate the expected revenue. Your financial planning should be based on robust data to draw the right conclusions for your upcoming business budgets.

You might also want to take into account some seasonal fluctuations in revenue. It might require thorough trend analysis based on the previous year’s data to identify those months most affected by seasonal increases and decreases in revenue to factor them into your budget.

Profit margin analysis

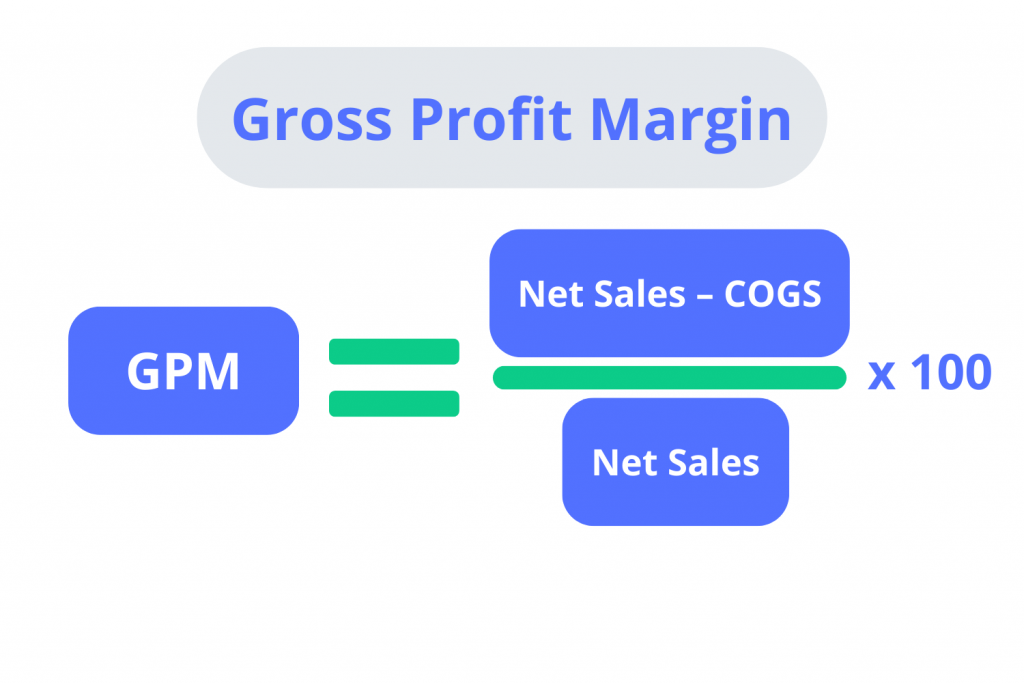

Understanding your gross profit margin is essential when creating your budget. After all, this metric gives you the most realistic picture of the cash you end up with after dealing with all expenses. It gives you insights into how well your business is doing and whether you need to reduce costs or increase revenue (and factor it into your budget).

To calculate your gross profit margin, you need to subtract the cost of goods sold (COGS) from the net sales (which is gross revenues minus returns, allowances, and discounts) and divide the result by the net sales. You might also want to multiply the final result by 100 to receive the percentage.

Gross Profit Margin = ((Net Sales – COGS) / Net Sales) * 100

What to consider a good gross profit margin mainly depends on the industry, but that’s not the only point to take into account. While some margins will be considered healthy for such businesses as retailers, restaurants, manufacturers, and other producers of goods, for many service and technology businesses, law firms, or banks, this figure can be higher. So to understand what a good profit margin is for your business, it’s best to understand in the wider context of the market, the industry, the products or services, and your chosen business model.

Cash-flow analysis

Understanding the cash flow is crucial for businesses. The two most important cash flow components you might want to consider are your customer payments (inflows) and supplier payments (outflows). Cash flow analysis can give you insights into how well those two are balanced. Moreover, you’ll get a clear picture of how timely your customers pay you, whether there are any bad debts (from customers that don’t pay), and whether your cash inflows cover the outflows. In other words, whether you have enough cash to cover your due payments, including suppliers, salaries, etc.

Basically, cash-flow analysis can help you understand whether you’ll be able to reach your budget goals and set these goals more accurately. Usually, your cash flow statement and balance sheet help you get all the necessary answers.

Creating a budget: bottom line

After analyzing all the above factors, you can start putting all the data together and creating your budget. Just to recall, you’ll sum up all your expenses (adding here the anticipated one-time spending and the provision for unexpected expenses and taking into account renegotiated costs). Then you sum up all the revenue. Extracting expenses from the revenue, you’ll get an amount to work with.

This way, you’ll be able to decide how to distribute this money to reach your company’s objectives. Again, this is a really quick look at creating a budget, just to give you a general idea.

But another conclusion that can be drawn from the above points is that budgeting is too important to get wrong and not utilize its full potential.

What is business budgeting software, and how does it help?

As you can see, the key to creating a proper budget is accurate financial data in the form of various reports, such as balance sheets, P&L, cash flow statements, etc. Putting it all together manually or with Excel spreadsheets can be inefficient and time-consuming. Moreover, there’s a high risk of losing some records or letting in errors while consolidating the reports.

And it’s where business budgeting software comes to give a helping hand in the management and optimization of the budgeting process. Most business budgeting software helps create and manage various financial statements automatically. It can also automate gathering data like sales, expenses, taxes, etc., that is needed to generate reports. The advantages are pretty obvious: apart from the time saved, there’s a clearer view of business finances based on full and accurate data.

What to consider a budgeting software solution?

Usually, when we speak about software for budgeting, we mean solutions that help create a budget in many ways: from automatically putting together your financial data (revenue, expenses, etc.) to forming a budget. In light of this, you might want to consider business accounting software as a solution for budgeting. It absolutely makes sense because many accounting software can automatically generate all the necessary financial reports that you use to create your budget. Moreover, various accounting solutions on the market come with in-built budgeting functionality, making it even easier for a business to generate a pretty accurate budget.

There are many budgeting software and tools on the market, from simple to the most sophisticated, so it might take you some time to explore them, identify their pros and cons, and decide on the best fit for your business. But, it’s an investment that definitely pays off.

Best small business budgeting software: solutions review

Now, let’s look at some business budgeting software tools tailored to help small business owners and finance teams prepare budgets in a more efficient manner. We’ll be reviewing both budgeting solutions that are integrated with accounting software you might already have and designated standalone budgeting software for small businesses.

This review will be split into two parts. Firstly, we’ll take a look at accounting or financial management software you might already be using to see the budgeting features that they offer. Secondly, we will look at pure budgeting software solutions and the host of functionalities they provide.

Synder – accounting and analytics for e-commerce and SaaS businesses

Synder is an accounting and business analytics software specially designed for e-commerce businesses and SaaS companies that need accurate accounting and quick access to instant business performance insights. This software allows for the consolidation of financial data from all your sales and payment channels, automatically bringing and categorizing it in accounting, and flawlessly reconciling your accounts with the bank.

The most prominent Synder’s features, functionalities, and services:

- 25+ integrations with the most popular payment (Stripe, PayPal, Afterpay, etc.) and e-commerce platforms (Amazon, Shopify, eBay, Etsy, and many more);

- Automated data integration in the background;

- Sales and expenses reports;

- Financial statements;

- Smart rules to customize your integrations;

- Invoicing and payment links;

- Instant insights into sales, products, and customers;

Budgeting features

The powerful analytical functionality – Synder Insights – allows for instantly tracking your business performance, including sales, products, and customer behavior, enabling you to make more informed decisions based on accurate numbers. The reporting within Synder gives you all the necessary information for budgeting automatically, taking a big chunk of manual work off your plate.

Synder automatically syncs transactions from sales and payment platforms (like Shopify, PayPal, and Stripe) into accounting software such as QuickBooks or Xero. This ensures that all income and expenses are accurately recorded, which is essential for effective budgeting. With accurate transaction data in your accounting software, you can generate detailed financial reports. These reports are crucial for tracking your business’s financial performance, analyzing budget variances, and making informed budgeting decisions.

If you run an e-commerce or SaaS business (or are an accounting or bookkeeping professional working with those businesses) feel free to book office hours with the Synder support team to see how it works and ask your questions. You can also sign up for a free trial to explore the full range of Synder’s features.

Synder offers 5 pricing tiers designed to meet the growing needs of businesses: the Starter plan ($11 per month), the Small plan ($22 per month), the Medium plan ($44 per month), the Scale plan ($79 per month), and the Large plan ($199 per month). This pricing reflects the yearly billing schedule that provides users with a 20% discount, but you can also choose a monthly billing plan with the adjusted pricing. In order to test all the features and tools, users can avail a free 15-day trial.

QuickBooks Online – small business accounting with in-built budgeting functionality

QuickBooks is a robust accounting software that helps small businesses cover their accounting needs. The solution helps create and send custom invoices, sales receipts, or estimations in two clicks. Besides, QuickBooks can track income and expenses, and you can even take photos of receipts and save them in the QuickBooks Online mobile app.

QuickBooks Online will be available for you any time anywhere, and the information is updated in real-time. All you need is an Internet connection and a device that you can use to log in.

Key features, functionalities, and services offered by QuickBooks Online (some features are limited to the higher-tiered plans):

- 1099 contractors management;

- Batch invoices and expenses;

- Customizable access by role;

- Project profitability tracking;

- Budget management;

- Inventory tracking;

- Employee time tracking;

- Exclusive premium app integrations.

Budgeting features

QuickBooks Online features a built-in budgeting solution. Its robust functionalities offer businesses the ability to either create an entirely new budget from scratch or construct one based on the historical data from a previous year. The latter option is particularly advantageous for businesses looking to make informed adjustments to their existing financial plans, capitalizing on past trends and patterns.

In addition to budget creation, QuickBooks Online also allows businesses to keep track of their budget progress comprehensively. This is made possible by the ability to view your budgetary information in both dollars and percentages. Seeing your budget progress in absolute terms provides a clear picture of the funds expended, while the percentage view offers a comparative perspective, facilitating an understanding of your budget utilization relative to the overall plan.

Finally, QuickBooks Online shines in its capability to generate valuable budgeting reports. These reports are essential in gaining insights into your budget performance, spotting trends, pinpointing discrepancies, and deriving data-driven decisions. Running these reports routinely will enable you to align your budget more closely with your strategic objectives and apply any necessary corrections in a timely manner.

QuickBooks Online provides three plans to its users that can fit the needs of many businesses: Simple Start, Essentials, and Plus. As of the writing of this article, there is a special offer that gives a considerable discount for the first six months for each of the plans. The regular pricing and the discounted one look as follows: Simple Start ($18 per month, with a special offer of $1 per month for the first 6 months), Essentials ($27 per month, with a special offer of $2 per month for the first 6 months), and Plus ($38 per month, with a special offer of $3 per month for the first 6 months). You can choose a monthly billing schedule or a yearly one which offers a 10% discount. There is also a free 30-day trial for each plan.

Xero – accounting software for small businesses

Xero is an accounting software with budgeting functionalities for small businesses, bookkeepers, and accountants. Featuring pretty comprehensive accounting tools, it also connects with over 1000+ smart business apps for inventory tracking, time tracking, payments, invoicing, and CRMs. So if you don’t find a specific feature in Xero, you’ll most likely find it within their integrations.

The key features, functionalities, and services of Xero:

- Pay bills;

- Claim expenses;

- Accept payments;

- Reconcile bank transactions;

- Manage payroll;

- Capture bills and receipts with Hubdoc;

- Manage and create budgets with Budget Manager;

- Apply sales taxes automatically.

Budgeting features

Xero offers a standard set of features for each pricing plan and add-ons that you can purchase extra to customize your plan when needed.

Let’s now take a closer look at the budgeting function of Xero. Xero Budget Manager is a powerful tool that assists businesses in planning, tracking, and managing their financials.

Xero Budget Manager allows users to create comprehensive budgets from scratch. It also provides the ability to edit and update budgets as business needs change. Users can import historical financial data to assist in creating more accurate and realistic future budgets. This tool provides detailed reports that show actuals versus budgeted figures, which can help users track performance and make informed decisions.

It also allows for the creation of multiple budgets, which can be useful for businesses with different departments or projects that require separate budgets. Users can set and adjust budget figures for specific periods, allowing for more flexible and detailed budget planning.

Xero Budget Manager integrates seamlessly with the Xero accounting software, making it easier to manage all financial data in one place. Multiple team members can collaborate on the budget, making it a great tool for teams.

Xero is an accounting software that offers its users accounting essentials regardless of the chosen plan. There are three plans available: Early, Growing, and Established. The regular pricing and the discounted one (terms apply) look as follows: Early plan ($13 per month and with a 50% discount, $6.5 per month for the first 3 months), Growing plan ($37 per month and with a 50% discount, $18.5 per month for the first 3 months), and Plus plan ($70 per month and with a 50% discount, $35 per month for the first 3 months). There is also a free 30-day trial to avail if you want to try Xero before purchasing.

Sage Intacct – financial management software for mid-sized companies

Sage Intacct is a financial management software that can give a more detailed look at the scalability and flexibility of a business. Sage allows businesses to automate ordering processes, keep track of company performance, communicate between departments, and find ways to grow customer satisfaction.

Among all the features, you may be interested in the following:

- Accounts Receivable;

- Bank reconciliation;

- Billing & Invoicing;

- Expense Tracking;

- Fixed asset management;

- Fund accounting;

- Payroll management;

- Project accounting;

- Purchase order management;

- Tax management.

Budgeting features

Sage Intacct offers a host of standard budgeting features like historical import for example but it’s the selection of advanced functionalities that’s particularly interesting.

This software can create flexible budgets based on various criteria such as department, project, location, and more. With budget versioning, users can create multiple versions of a budget, allowing businesses to compare different budget scenarios and make more informed decisions.

For businesses operating in multiple locations or with various entities, Sage Intacct can automatically consolidate budgets, saving time and reducing errors. It also offers a real-time comparison of budgeted versus actual figures, enabling businesses to quickly spot variances and adjust strategies as needed.

Sage Intacct doesn’t share its pricing details on its website.

FreshBooks – streamlined accounting and invoicing solution for small businesses and freelancers

FreshBooks is a popular cloud-based accounting solution designed primarily for small businesses and freelancers. FreshBooks’ main focus is on time tracking, invoicing, and expense management. However, it does offer several features that can assist in budgeting and financial management.

Some of the key FreshBooks features include:

- Invoicing;

- Expense tracking;

- Time tracking;

- Project management and progress tracking;

- Estimates and proposals;

- Online payments;

- Profit & Loss, sales tax summary, and expense reports.

Budgeting features

If you’re currently using FreshBooks and aren’t looking to integrate it with a designated budgeting app, you can use some of FreshBooks’ features to create budgets.

FreshBooks provides comprehensive expense tracking, allowing you to categorize expenses and track spending. This feature can help you monitor costs and manage your budget more effectively. You can also use FreshBooks to track time and expenses for individual projects, providing a sense of how resources are being used and helping you stay within project budgets.

FreshBooks offers various reports and invoice details, which can help you manage your budget and understand your financial position better. If you bill clients based on time, FreshBooks’ time tracking feature can help you ensure that projects are staying within their allotted budgets. While not a budgeting feature per se, FreshBooks’ invoicing capabilities can improve cash flow by making it easy to bill clients promptly and accurately.

It’s important to note that while FreshBooks can certainly help with aspects of budgeting, it doesn’t offer a dedicated budgeting module for creating detailed financial plans like some other accounting or budgeting software. If your business requires more advanced budgeting capabilities, you may want to consider other software options or see if FreshBooks can be integrated with a more budget-focused tool.

FreshBooks offers four pricing plans that can be paid monthly or yearly (10% discount with the yearly pricing plans). The plans include the Lite plan ($17 per month or $132.60 per year), Plus plan ($30 per month or $234 per year), Premium plan ($55 per month or $429 per year), and Custom Pricing. With FreshBooks, you can test the tool for free using the 30-day trial.

Kashoo Online Accounting – online accounting software for small business

Kashoo makes it easier to do accounting for a small business. The app will automatically sort and categorize all the transactions of your business. They’ve implemented OCR technology to be able to scan receipts and import+categorize them in your accounting company. Whenever you have a new vendor you haven’t worked with yet, Kashoo will create a new contact in the contact list with no need for you to enter any information manually.

The advantages you receive when working with Kashoo Online Accounting:

- Categorization with Machine Learning;

- Easy reconciliation;

- Income & Expense tracking;

- OCR receipt import;

- Easy to receive financial reports.

Budgeting features

Kashoo can suit small businesses and individuals that look for a solution at an affordable price and want to use its standard features to create budgets.

Kashoo allows you to track and categorize your expenses, which is a fundamental part of managing your budget. Similarly, Kashoo makes it easy to keep track of all your sources of income. Understanding where your money is coming from is also crucial for budgeting. Similarly, the ability to create and send invoices can help ensure that you have the income you need to meet your budget targets.

Kashoo provides financial reports, such as income statements and balance sheets, that can offer insights into your financial status and help you create and manage your budget.

Just as the caveat for FreshBooks, it’s important to note that while Kashoo offers several features that can assist in managing your finances and indirectly support your budgeting process, it doesn’t have a dedicated budgeting module as part of its software.

Kashoo offers two plans: Trullysmall. Accounting Plan ($216 per year) and Kashoo plan ($324 per year). You can also sign up for a free 14-day trial.

Microsoft Dynamics 365 – a suite of business software

Microsoft Dynamics 365 is a suite of integrated business applications designed to transform and streamline how companies conduct their operations. Combining ERP (Enterprise Resource Planning) and CRM (Customer Relationship Management) capabilities with productivity applications and artificial intelligence tools, Dynamics 365 provides comprehensive solutions for Sales, Customer Service, Field Service, Human Resources, Finance, Supply Chain Management, Commerce, and more. This suite of applications enables businesses to automate processes, make data-driven decisions, and improve customer interactions, facilitating overall business growth and digital transformation.

Among the features of Microsoft Dynamics 365 Fiance, you can find:

- Cash management;

- Forecasting;

- Income & Balance sheets;

- Multi-department project management;

- Budgeting;

- Asset management;

- General ledger;

- Profit & Loss statements.

Budgeting features

Microsoft Dynamics 365 Finance offers a comprehensive set of budgeting and financial planning tools to help businesses manage their finances more effectively.

Dynamics 365 Finance allows businesses to create detailed budget plans based on historical data and predictive modeling. It also provides analysis tools to compare budgeted figures against actuals to track performance. It supports the creation of multiple budgets to accommodate different scenarios or departments. This makes it possible to allocate resources more effectively across the organization.

The system can automatically check transactions against the budget, preventing overspending. This provides real-time visibility into budget utilization.

The budget planning process integrates seamlessly with Dynamics 365’s built-in workflow capabilities. This allows for budget approvals and reviews to be managed within the system, enhancing control and compliance.

Microsoft Dynamics 365 Finance integrates deeply with Excel, enabling users to perform budgeting tasks within a familiar interface. You can import and export data to Excel for additional manipulation and analysis.

Last but not least, the software provides advanced forecasting tools that use AI and machine learning to help predict future financial scenarios. This can aid in making more informed budgeting decisions. It presents a unified view of financial and budget data, providing greater transparency and control over an organization’s finances.

Microsoft Dynamics 365 offers many plans designated to different departments or businesses. The budgeting tools are a part of Microsoft Dynamics 365 Finance software that comes with a single plan of $180 per month per user. You can also avail of a 30-day free trial.

NetSuite – financial planning and budgeting software for mid-sized and enterprise businesses

NetSuite is a comprehensive cloud-based business management software developed by Oracle. It provides a suite of applications to help businesses streamline their processes across multiple departments. This includes Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), Professional Services Automation (PSA), and e-commerce solutions. By integrating these functions into a unified platform, NetSuite enables businesses to have real-time access to key business data, enhancing decision-making, efficiency, and overall business performance.

Among many of NetSuite’s features, users can find:

- What-If scenarios;

- Asset management;

- Cash management;

- Consolidation;

- Forecasting;

- General Ledger;

- Income & Balance sheet;

- Multi-company management;

- Multi-department management;

- Multi-project management;

- P&L reports.

Budgeting features

There are many more features useful for accounting, accounts payable, accounts receivable, resource planning, manufacturing, e-commerce, and more. NetSuite will fit a mid-sized business or a large enterprise.

NetSuite offers a robust set of budgeting features designed to help businesses manage their financial planning effectively. With this software, you can create comprehensive budgets, modify them as necessary, and track performance over time as well as create multiple budgets, allowing for departmental or project-specific budgeting.

A very interesting feature of NetSuite’s budgeting tools allows for scenario-based budgeting and forecasting, enabling businesses to plan for various potential future circumstances. Moreover, NetSuite provides real-time reporting capabilities, so you can compare actual results against budgeted figures at any time. This can help identify discrepancies and areas for improvement. Another great feature is a rolling forecast which allows for ongoing budget adjustments and updates as business conditions change.

From the management point of view, the software supports a budget approval workflow that ensures proposed budgets are reviewed and approved by relevant stakeholders. And since NetSuite integrates seamlessly with the other NetSuite modules, this creates a unified platform for all your business management needs.

NetSuite offers a different pricing system that includes an annual licensing fee and a one-time implementation fee. To find out the pricing, NetSuite requires prospective users to submit a quotation request. While there is no free trial available NetSuite offers a product tour.

Workday Adaptive Planning – business financial planning software

Workday Adaptive Planning is a cloud-based business planning and financial modeling tool. It provides comprehensive solutions for budgeting, forecasting, reporting, and analytics, empowering businesses to achieve a more collaborative and efficient planning process. It prides itself on the use of AI and machine learning to power its functionalities.

As for the integration, Workday Adaptive Planning integrates seamlessly with the other Workday applications, as well as other ERP and CRM systems, ensuring a unified view of financial data.

Powerful features of Workday Adaptive Planning software include:

- Competitive analysis;

- Correlation analysis;

- Dynamic modeling;

- Exception reporting;

- Graphical data presentation;

- Modeling & simulation;

- Performance metrics;

- Sales trend analysis;

- Statistical analysis;

- Donation tracking;

- Payroll management.

Budgeting features and tools

As the software is designed to deal with business planning and financial modeling, it offers a range of tools that help with budgeting including both basic features and advanced ones enhanced by AI and machine learning.

The platform enables businesses to create flexible and comprehensive budgets and forecasts that can be adjusted in real-time as business conditions change. Workday Adaptive Planning allows users to run what-if scenarios to understand the potential impact of different business decisions on their budget, helping to inform strategy and planning. The software supports detailed financial modeling and offers version control for budgets, allowing for comparisons between different budget versions or scenarios.

Moreover, the platform facilitates collaborative planning, enabling different team members to contribute to the budgeting process, and enhancing accuracy and ownership. Users can create their own reports and dashboards without needing to rely on IT, offering real-time insights into budgetary performance.

Workday Adaptive Planning products require a license that is issued on a subscription basis depending on the specific needs of the user(s). However, Workday Adaptive Planning doesn’t share its pricing details on the website.

PlanGuru – Budget planning software

PlanGuru has over twenty methods for analyzing and forecasting budgets with balance sheets, income, and cash flow statements. With this app, you can set goals for your company and see if you’re progressing or not. The forecasting feature helps with decision-making and seeing what’s achievable. You’ll also have access to strategic planning that will correct you and present to your employees what the company will focus on in the nearest future. It’s proven that a team with a clear goal that everyone understands will be the most productive.

Among the abilities that the app has, you’ll find:

- QuickBooks, QuickBooks Online, Xero integrations and Excel import;

- Budget forecast for up to 10 years;

- Built-in templates for financial statements;

- 20+ Standard forecasting methods;

- Forecasting with non-financial data;

- Payroll;

- Custom report builder for Excel.

Budgeting features and tools

PlanGuru as a business budgeting and forecasting software provides a wide array of tools to help businesses effectively plan their financial future.

PlanGuru supports flexible budgeting and forecasting up to 10 years ahead, allowing businesses to plan both short-term and long-term financial goals. Some great features include multiple budget scenarios and customizable financial statements. The software lets users create multiple budget scenarios, enabling businesses to plan for various possible outcomes and make more informed decisions. Users can also build customized financial statements, including income statements, balance sheets, and cash flow statements, to align with their specific business needs.

With PlanGuru, you get robust reporting features, including budget-to-actual analysis and financial ratios. Reports can be customized and exported to Excel for further analysis. What’s more, the software includes PlanGuru Analytics, a business intelligence tool that provides advanced reporting and dashboard capabilities, enhancing the visualization and interpretation of budgetary data.

PlanGuru will be a match for a small business, accountant, business advisor, or nonprofit organization. Besides all the integrations and functions, there are also some resources to learn more about the app. You can sign up for a live demo, watch video tutorials or visit the knowledge base.

PlanGuru for its cloud-based version offers 2 plans: Single Entity ($99 per month per user) and Multi-Departemant Consolidation ($299 per month per user). Additional user access can be purchased for $29 per month. You can avail of PlanGuru’s free 14-day trial to test the software.

Business budgeting software: Closing thoughts

The landscape of budgeting software is diverse and dynamic, offering a myriad of solutions tailored to various needs. From robust, comprehensive tools like QuickBooks Online and Xero, to more specialized ones like PlanGuru or Workday Adaptive Planning, and streamlined applications like FreshBooks and Kashoo, there’s a platform to suit every business type and size.

The value of these budgeting tools can’t be overstated. They offer critical features such as expense and income tracking, financial reporting, and project budgeting, among others. These capabilities simplify financial management, save time, improve accuracy, and ultimately contribute to the business’s bottom line.

However, choosing the right budgeting software requires careful consideration of your business’s specific needs, the software’s features, pricing, ease of use, and integration capabilities. By leveraging free trials or demos, you can gain firsthand experience and ensure that the selected software fits your requirements before making a commitment.