|

Getting your Trinity Audio player ready...

|

Tracking down corporate credit card transactions and reconciling at month-end in an Excel spreadsheet is a thing of the past. When it comes to credit card use and your organization, Sage Intacct has you covered.

|

Getting your Trinity Audio player ready...

|

Sage Intacct defines credit card accounts and includes credit and debit cards. In Accounts Payable, there is a distinct difference between the two. A credit card transaction is tied to a credit card vendor and a liability account. A debit card transaction is associated with a checking account. When you record a debit card transaction, the bank account is debited, and the transaction is final.

|

Getting your Trinity Audio player ready...

|

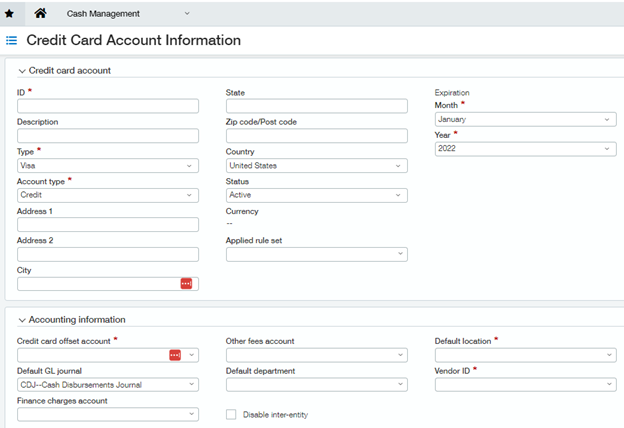

To properly set up a credit card within Sage Intacct, you must create a Credit Card ID you can quickly identify in a list view. We recommend against using leading zeros as part of an ID. IDs with leading zeros can cause errors when you import information into your company from Excel because Excel removes the leading zero. Adding the Bank name and the last four of the account number as part of the naming convention will allow you to identify the credit card account throughout the application quickly.

|

Getting your Trinity Audio player ready...

|

You must tag a unique GL (General Ledger) liability account, a unique Vendor, and a default location.

|

Getting your Trinity Audio player ready...

|

Once the credit card is created, you can use the Credit Card transaction page to record charges against your credit and debit cards. This method is helpful when you have small charges to enter quickly or when you do not have a vendor invoice entered into the system. You are not required to select a vendor when you create a transaction using this method.

|

Getting your Trinity Audio player ready...

|

You can also create a credit card transaction in the system when you pay a bill or create a manual payment using the Credit Card as the payment method. This transaction goes through the typical Accounts Payable cycle. There is a vendor invoice that you have paid with a credit card. If you are using payment approvals, the payment is reviewed.

|

Getting your Trinity Audio player ready...

|

Avoid creating credit card charges as a journal entry. Although it is quick and easy, it will create problems when creating the Charge Payoff. It will make the credit card reconciliation page entry and post it to the general ledger. Still, it will not display the transaction in the Charge Payoff screen because it was not created in the Credit Card application.

|

Getting your Trinity Audio player ready...

|

One of the most common misunderstandings about credit cards is the reconciliation process. Reconciling your credit card and paying the bill are two separate tasks. Negotiating your credit card statement does not create a Charge Payoff or an Accounts Payable invoice; it simply reconciles your credit card statement. You can also create a Charge Payoff for your credit card charges to appear as a payable bill in Accounts Payable. You are not making the payment on the Charge Payoffs Information page; you are just pushing the transactions to AP to be paid as a bill. Then, you can pay the account as you usually would. Negative amounts from credit card line items or transactions are passed along as credits to Accounts Payable, where you can apply them as you see fit. If you need to reverse a credit card transaction and have the proper permissions, ensure the associated bill from the charge payoff has been voided, reverse the Charge Payoff, then reverse the transaction.

|

Getting your Trinity Audio player ready...

|

If you make mid-month payments towards your credit cards, do not use the Advance Payment functionality found in Accounts Payable, as it will not show in your reconciliation or Charge Payoff. Instead, create a negative credit card transaction crediting a clearing account. Then create a journal entry to debit the clearing account and credit the bank account. The payment will appear in the credit card reconciliation and the Charge Payoff.

|

Getting your Trinity Audio player ready...

|

Sage Intacct sets itself apart from other Enterprise Resource Planning (ERP) systems with its enhanced functionality and ease of use, as well as providing a solution for the tasks that are often the most tedious for the accounting department.

|

Getting your Trinity Audio player ready...

|

Author: Kim Gordon, MAcc, CSM | [email protected]

|

Getting your Trinity Audio player ready...

|

Contact Us

|

Getting your Trinity Audio player ready...

|

If you are interested in a native cloud offering, our ERP and CRM Consulting Services Team can work closely with your organization to understand your specific needs and identify if Sage Intacct is the best fit.