Payroll

Social Security Tax Wage Base is Going Up 5.2% for 2024

Wealthier taxpayers will have more Social Security tax taken from their paychecks next year due to a wage base increase.

Oct. 13, 2023

By Kelley R. Taylor, Kiplinger Consumer News Service (TNS)

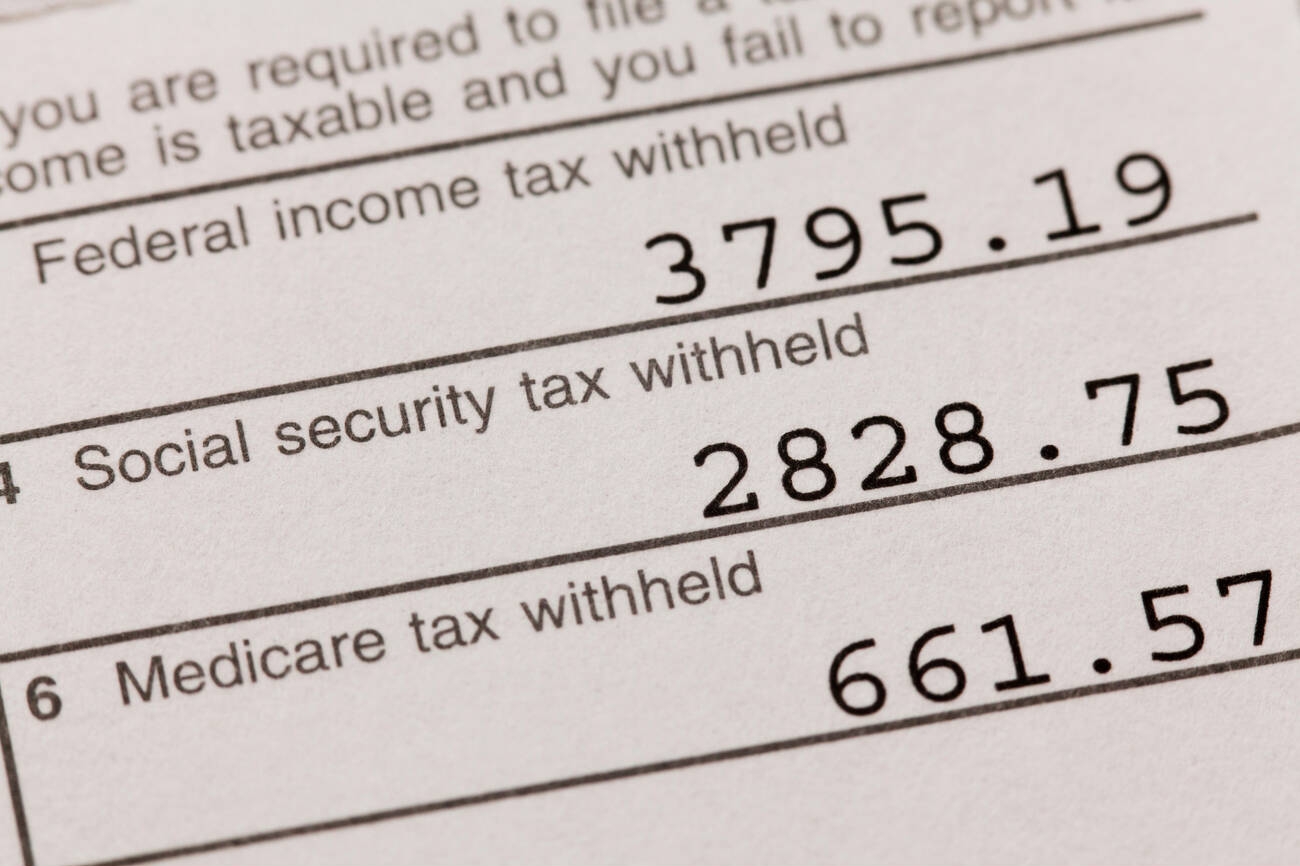

The Social Security tax, withheld from each paycheck, stops once your income reaches a certain amount. That is due to the “Social Security wage base,” which is the maximum amount of earnings subject to Social Security tax. These taxes fund the Social Security program, which provides retirement, disability, and survivor benefits to eligible recipients.

Thursday, along with a 3.2% cost-of-living (COLA) increase, the Social Security Administration (SSA) announced a 5.2% increase in the wage base for 2024, leading to higher taxes for some wealthy taxpayers in the coming year.

Social Security wage base increases

In 2024, the Social Security wage base limit is set to rise to $168,600. For 2023, the wage base is $160,200. If you earn more than $160,200 this year, you won’t have to pay the Social Security payroll tax on the amount that exceeds that limit. That can result in considerable tax savings for those who earn more than the wage base.

Take, for example, an employee with an annual salary that exceeds the wage base by $10,000. In this case, they would save $620 on Social Security taxes. On the other hand, someone who earns wages exceeding the base by $30,000 would receive a $1,860 tax break. (The more you make over the wage base, the more your Social Security tax savings.)

However, the Social Security wage base increases each year the national average wage index increases. When that happens, which is almost every year, more income is subject to the Social Security tax.

How much are Social Security taxes?

The tax rate for an employee’s portion of the Social Security tax is 6.2%.

- Your employer also pays 6.2% on any taxable wages.

- Self-employed individuals pay the full 12.4%. However, it’s worth noting if you’re self-employed, you can deduct the employer-equivalent portion of that amount.

Over the past five years or so, the Social Security wage base has increased by an average of about $3,960 a year. However, in 2024, the wage base will go from $160,200 to $168,600, an increase of $8,400 from the previous year. That is significantly less than the $13,200 increase from 2022 to 2023, which was the largest recorded increase.

As a result, the maximum Social Security tax jumps from $9,932 to $10,453. So, people making over $168,600 in 2024 will be paying about $521 more in Social Security taxes next year than they would have paid if the wage base remained at $160,200.

Social Security benefits COLA 2024

On Oct. 12, along with the wage tax base rate, the SSA announced the 2024 Social Security COLA increase. As Kiplinger reported, more than 66 million retirees receiving Social Security checks will see their monthly government payments rise 3.2% next year.

On average, according to the SSA, Social Security retirement monthly benefits are expected to grow by more than $50 beginning in January 2024.

Who is exempt from Social Security tax?

Some people don’t have to pay Social Security taxes. (Exemptions from Social Security taxes may be available if certain requirements are met.) Some examples are listed below, although other exemptions may be available.

- Certain members of religious groups or organizations

- Students and certain young (minor) workers

- Employees of foreign governments

- People the IRS considers to be “Non-resident aliens”

______

All contents copyright 2023 The Kiplinger Washington Editors Inc. Distributed by Tribune Content Agency LLC.