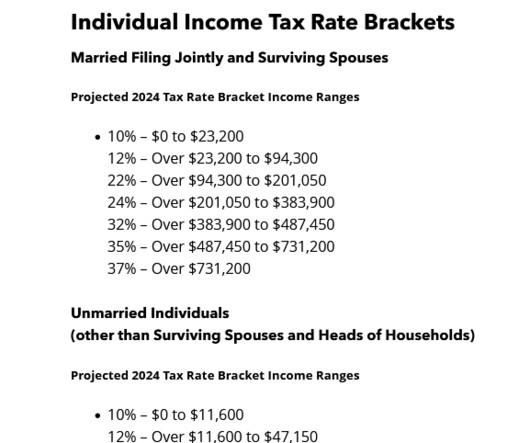

Is Your Income Tax Withholding Adequate?

RogerRossmeisl

SEPTEMBER 19, 2022

The calculator reflects tax law changes in areas such as available itemized deductions, the child credit, the dependent credit and the repeal of dependent exemptions. The post Is Your Income Tax Withholding Adequate? You can access the IRS calculator here: [link] Life changes There are. appeared first on Roger Rossmeisl, CPA.

Let's personalize your content