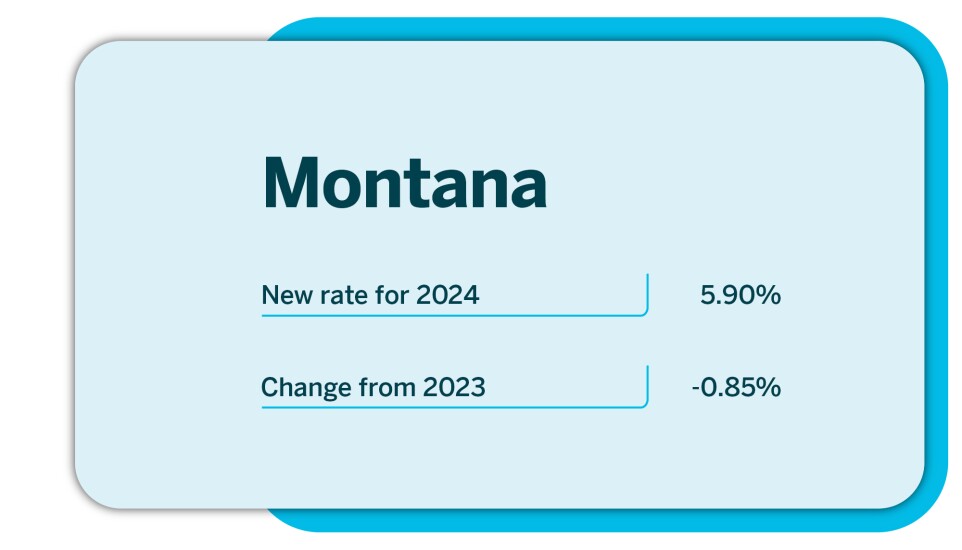

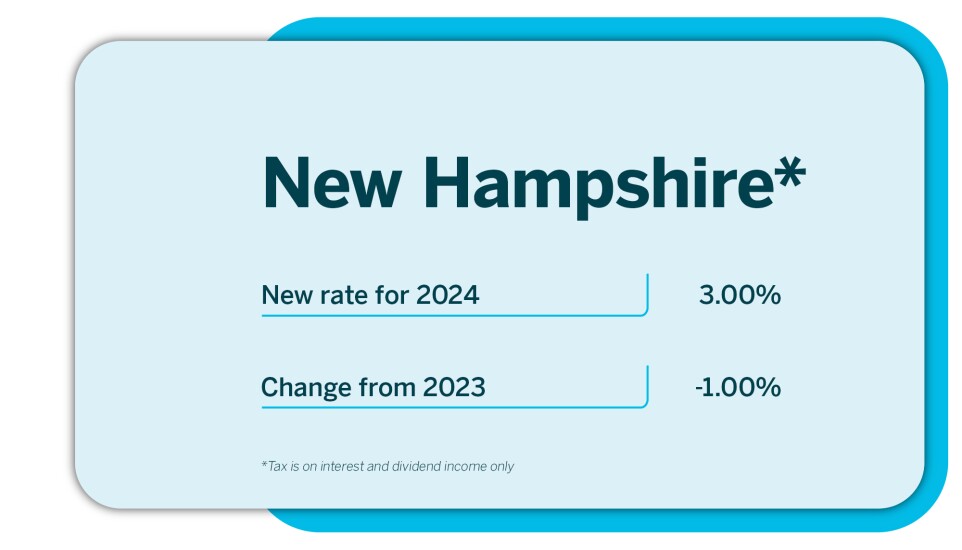

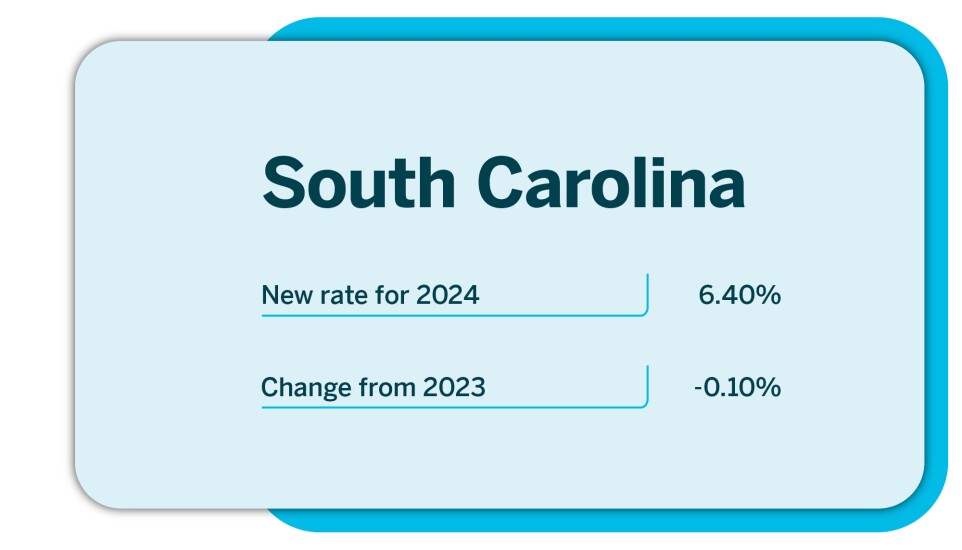

Individual states habitually target the start of a new year for making any changes to their tax codes, which usually come into effect on January 1.

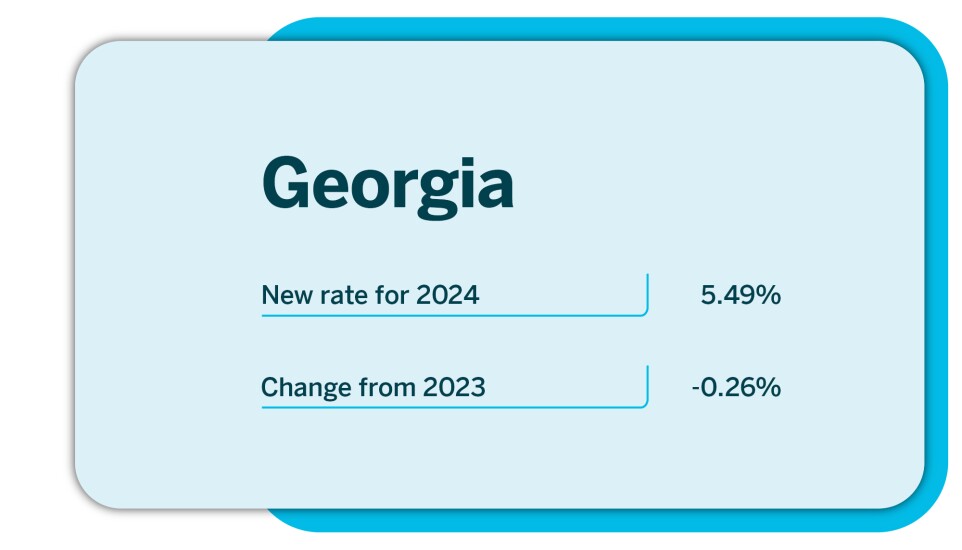

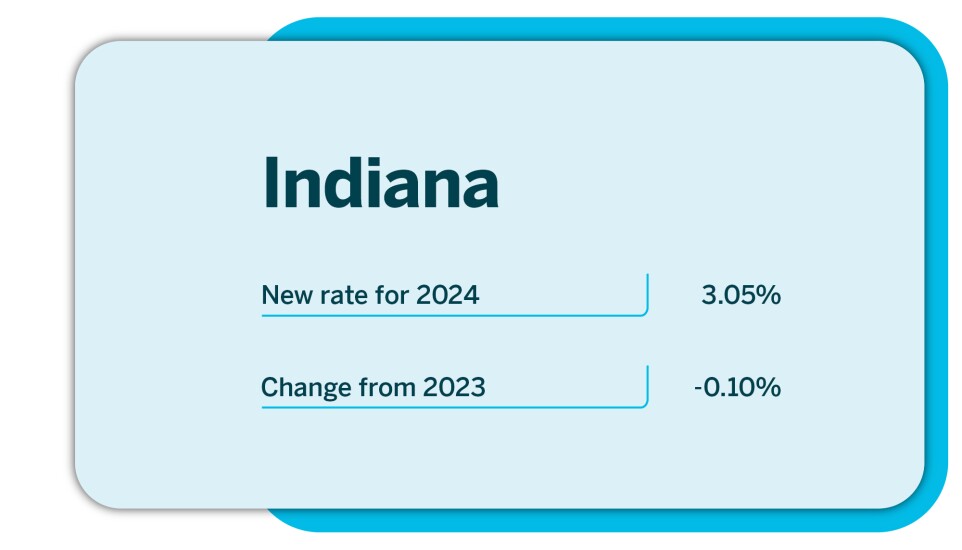

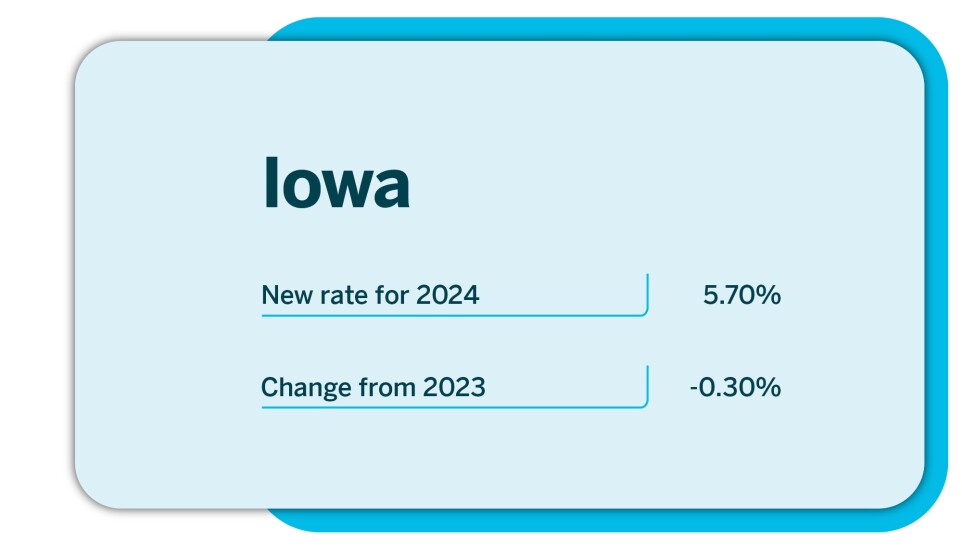

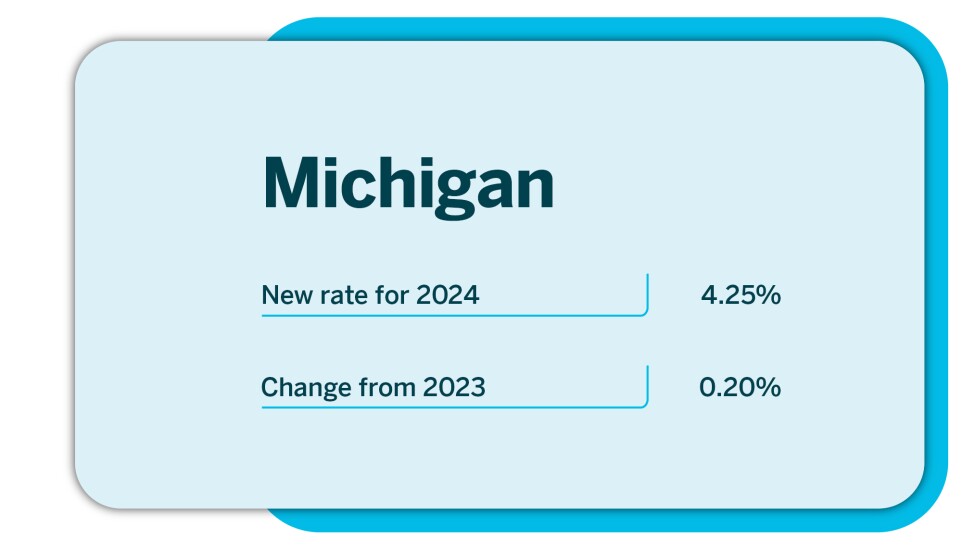

For the 2024 tax year, 15 states are making changes to the top marginal rate for personal income tax. In most cases, taxpayers will benefit from a reduced rate, but in two states the rate has increased.

Scroll through to find out where the changes are being made and what the new rates are in these states.

Source: