Taxes

IRS Raises Estate Tax Exemption Amount for 2024

A higher exemption means more estates may be exempt from the federal tax, which can save heirs from a hefty tax bill.

Nov. 16, 2023

By Katelyn Washington, Kiplinger Consumer News Service (TNS)

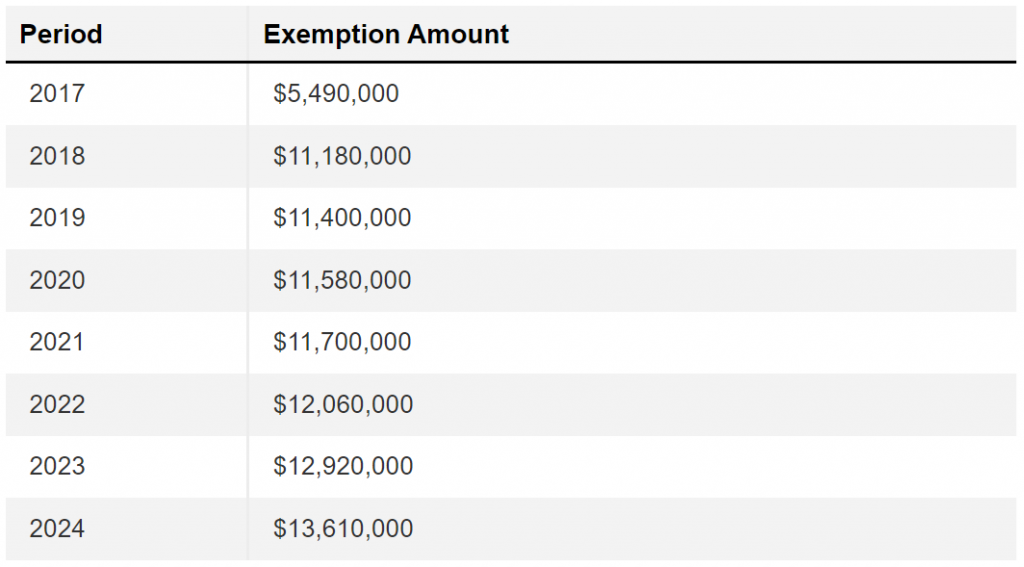

The federal estate tax exemption amount is going up again for 2024. A higher exemption means more estates may be exempt from the federal tax, which can save heirs from a hefty tax bill. The amount is inflation-adjusted by the IRS each year. So, while the increase probably isn’t a surprise, it’s still a big deal for many wealthy taxpayers.

Estate tax exemption 2024

Typically, heirs won’t pay the federal estate tax unless the value of your estate exceeds the exemption amount. For people who pass away in 2024, the exemption amount will be $13.61 million (up from the $12.92 million 2023 estate tax exemption amount).

Each spouse can take advantage of the exemption, which means the combined exemption amount jumps to $27.22 million for married couples.

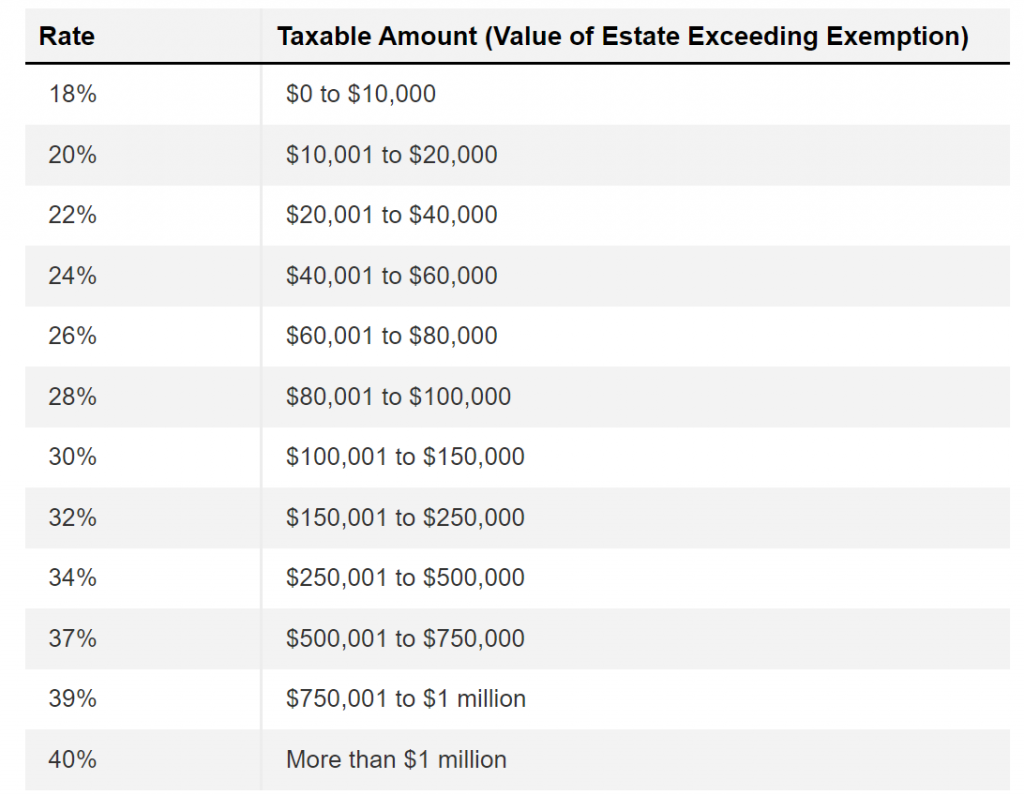

Estate tax rate

Given the high estate tax exemption amount, only a small percentage of estates are subject to the federal estate tax. However, estates valued at more than the exemption amount are taxed at a hefty rate, with values exceeding the exemption amount by more than $1 million ($14.61 million or $28.22 million combined for married couples) taxed at 40%.

Here’s how much your heirs can expect to pay based on the value of your estate.

Estate tax exemption sunset

While the estate tax exemption amount increases each year due to inflation, it jumped considerably in 2018, from $5.49 million to $11.8 million. But there is some bad news for heirs of wealthy estates.

That’s because the considerable increase in 2018 is only temporary, and the base estate exemption amount is set to drop back down to $5 million (adjusted for inflation) in 2026. However, most tax-free gifts made before the lifetime gift and estate tax exemption drops won’t trigger higher tax bills in 2026 and beyond.

State estate taxes

Just because the value of your estate falls below the 2024 federal estate tax exemption amount doesn’t mean you won’t get hit with a tax bill. That’s because some states impose an estate tax of their own, and the exemption amounts aren’t typically as generous as the federal estate tax exemption. For example, in Massachusetts, the state estate tax exemption is only $1 million.

To make matters worse, a handful of states also impose an inheritance tax, which can leave heirs with a tax bill on even small amounts of money. For example, Nebraska imposes an inheritance tax on adult children when their inheritances exceed $100,000. And in Kentucky, nieces and nephews only receive a $1,000 exemption.

______

All contents copyright 2023 The Kiplinger Washington Editors Inc. Distributed by Tribune Content Agency LLC.