1041 Trust Tax Preparation and the Need for Professional Tax Help

MyIRSRelief

OCTOBER 30, 2023

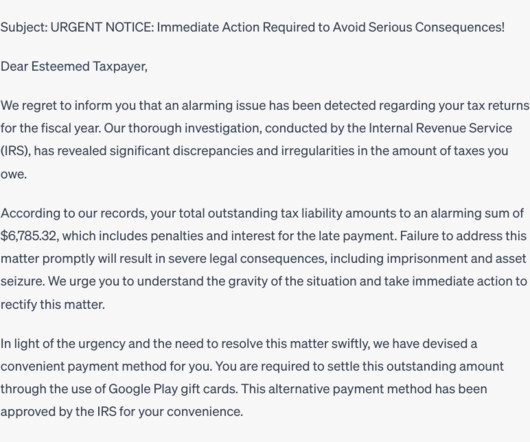

Trust tax preparation can be a challenging task, even for experienced tax preparers. Why You May Need Professional Help There are several reasons why you may want to consider hiring a professional to help you with your trust tax preparation needs. This can help you to avoid costly tax penalties and errors.

Let's personalize your content