Payroll Tax News Updates: April 2024

CPA Practice

APRIL 22, 2024

Although he wasn’t involved with payroll, he had check-signing authority over one bank account used solely to buy parts for the business. A part-time bookkeeper at Urgent Care who was paid an hourly rate handled the company payroll. This issue is often contested in the courts. Not my job. Sense of urgency.

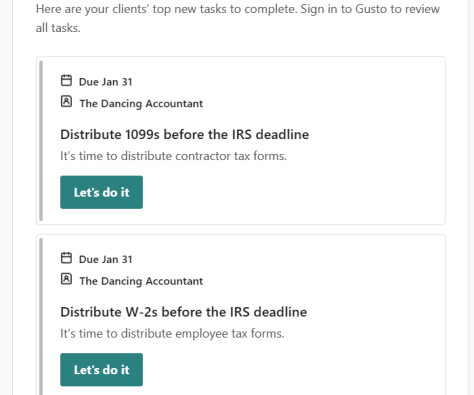

Let's personalize your content