.jpg?width=640&name=AdobeStock_314277037%20(1).jpg)

Contribution Margin is not a number you see on a traditional financial statement- it's a management accounting calculation.

If you want to do more than break-even and make a profit, you should understand your contribution margin. Analyzing your contribution margin is the fastest way to get your business to drive profits.

The Basics

Your contribution margin is the revenue left over after paying all the variable costs. The contribution margin formula is your revenue minus your “total variable costs”.

Contribution Margin = Revenue - Variable Costs

Contribution margin is the amount each client “contributes” toward pay for overhead and to generate a profit. That’s why it’s called “contribution” margin. It's your gross profit margin minus any “variable” overhead expenses, like sales commissions.

A business breaks even when contribution margin dollars equal fixed costs dollars. Your profit starts when contribution margin dollars exceed fixed cost dollars.

To calculate your contribution margin, you separate your expenses into two buckets: variable costs and fixed costs.

Why Do I Have To Know My Contribution Margin?

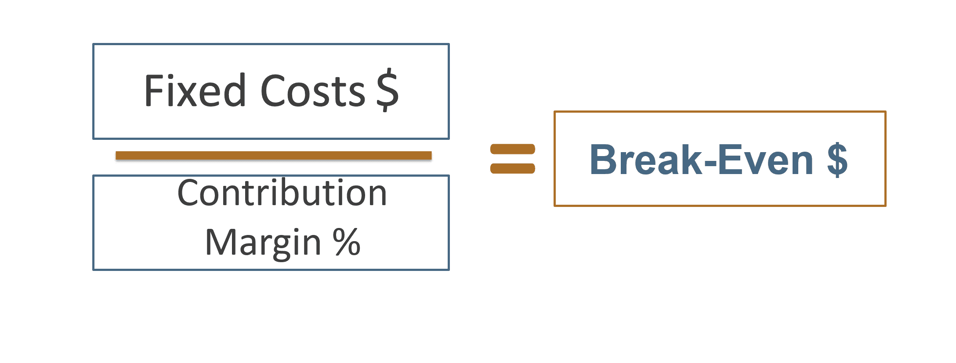

Contribution margin looks at the breakdown of each dollar that comes in, and shows how much of that revenue contributes in paying for overhead or generating a profit. Without your contribution margin, you can’t calculate your break-even point.

You cannot calculate your break-even point unless you know how much profit you make on the work that you do. You can calculate your break-even point with this simple formula.

At break-even, your total contribution margin dollars only covers your fixed costs. There's no extra money to generate a profit and free cash flow. That's what the break-even point shows: when the dollars of your contribution margin equals your fixed cost.

Contribution Margin Vs. Gross Profit Percentage

Contrary to popular belief, the most important number on a financial statement is not net income - it’s gross profit %.

Gross profit creates net income. If you increase your gross profit, all that extra money goes into the bottom line and straight to your bank account.

→ This is why the Sharks on Shark Tank™ always ask “What are you selling it for and how much is it fully loaded.” They are calculating gross profit percentage, not just looking at gross profit dollars, because that tells you how profitable your business is going to be. If you can maintain solid profit margins, your business will be more profitable.

The difference between gross profit margin (also known as gross profit or gross margin) and contribution margin is the “variable” costs. Variable costs are costs that happen when you add a new client.

Look at both contribution margin and gross profit margin as a percentage.

Why gross profit percentage % and not dollars $? Because your gross profit percent % shows how effective you are in running your business. It tells you if you're pricing your jobs right - the most important decision every business owner will make.

Contribution margin is not the same as gross profit margin. Both ratios are useful management tools. You look at them in both dollars $ and as a percent %, but they reveal different information. If you want to increase profits, you also need to study your contribution margin.

Gross Profit Margin = Revenue - COGS

The gross profit calculation already includes the above the line “direct” variable expense. You need to add the variable costs that are below the line.

The difference between gross profit margin and contribution margin is your indirect, or overhead, expenses that are variable.

Most business owners think all variable costs are above the line and stop at gross profit. But if you want to know your break-even point, you have to take it one step further and subtract the below the line costs that are variable (e.g. sales commissions).

What do below the line costs look like?

Below the line costs are your overhead costs. These are the costs your customer did not “directly” pay for. That is why they are also known as indirect costs.

These are your selling expenses, marketing expenses, accounting, IT, HR, facilities, legal, etc. If you had any of those expenses because you added a new customer, it's a variable cost. It’s indirect and is not above the line because the customer didn't directly pay for it.

The most popular example is sales commissions. Customers do not pay for the work that your salespeople do. That sales person created an opportunity for your service team to deliver value. Therefore, selling expenses are below the line.

For example, We had a client who needed to rent a house for house workers on an oilfield services project. It’s easier for the company to recruit people to work on an oil field if housing is included. The only reason the company had that rent was because of this project, so its variable. But it’s “indirect” below-the-line costs because the client is not paying for the house. We calculated contribution margin to show ALL the costs associated with that project.

If you're trying to figure out your break-even point, every time you add a customer, you have to subtract commissions out of gross profit. Why? You are trying to see your gross profit minus any other variable expenses. The purpose of break-even is to cover your fixed costs. If you have a commission to pay any profit that comes in, that dollar is not available to pay for your fixed costs.

What levers can help you to increase profits?

How do you increase your profits or get back to break-even? There are two primary levers you can pull:

- Increase contribution margin

- Cut your fixed costs

How do you increase your contribution margin? You can increase your contribution margin one of two ways: Increase your revenue or decrease your above the line costs (your direct labor and direct materials).

Increasing Your Contribution Margin: Time Leakage

The easiest way to increase your revenue is to find time leakage. Time Leakage is time YOU are paying for, but you're not charging the client for. It’s the dollar amount you are over-serving your clients, or under utilizing your staff.

→ The secret to increasing billings from time leakage is to track time and compare the actual costs of each job to the budget for that job (the costs you expected when you created the proposal).

In our experience, when you can tangibly show your customer the value they are getting but not paying for, the vast majority of clients are happy to pay for your work, as long as…

- They are happy with your service

- You can demonstrate the value that they're getting for the additional billings.

If you are giving time away and you are not happy with your profits, the fastest way to increase profits is to talk to existing clients about the value they are getting but not paying for. Value pricing experts will tell you to offer clients three options to get paid for the value of the work you do:

- Increase fees to reflect the real value they are receiving

- Decrease scope to help them stay in budget

- Transition them to another service provider.

This additional billing for time leakage is the simplest way to get back to even and increase your profitability.

Increasing Your Contribution Margin: Job Costing

Another way to increase your contribution margin is to properly price your new jobs. To do this, understand what it really costs (fully loaded) to deliver your services. Then you can make data driven decisions about how to price your jobs to get the right contribution margin to pay its share of overhead and generate a profit

Getting detailed visibility into your above the line costs enables you to accurately price your goods or services. You have to be able to see your above the line separated from your below the line. Here are simple steps to separating the above the line vs. below the line:

- Separate your chart of accounts to track above the line vs. below the line costs

- Allocate which people are above the line vs. the below the line and to a department or team.

- Allocate the labor costs of your people when you run the payroll.

- Review the P&Ls for each department or team to see where you have the opportunity for growth.

- Drill down on the lowest performing department or team to the customer and job profitability.

Bottom Line

If you want to make decisions backed by data, you first need to know your contribution margin percent. Knowing your contribution margin will show you what you need bring in or cut to break even.

The fastest way to drive your business profits is by increasing your contribution margin. You can do this two ways: increase your revenue or decrease your above the line costs. The easiest way to increase your revenue is to find time leakage or re-adjust your pricing strategy.