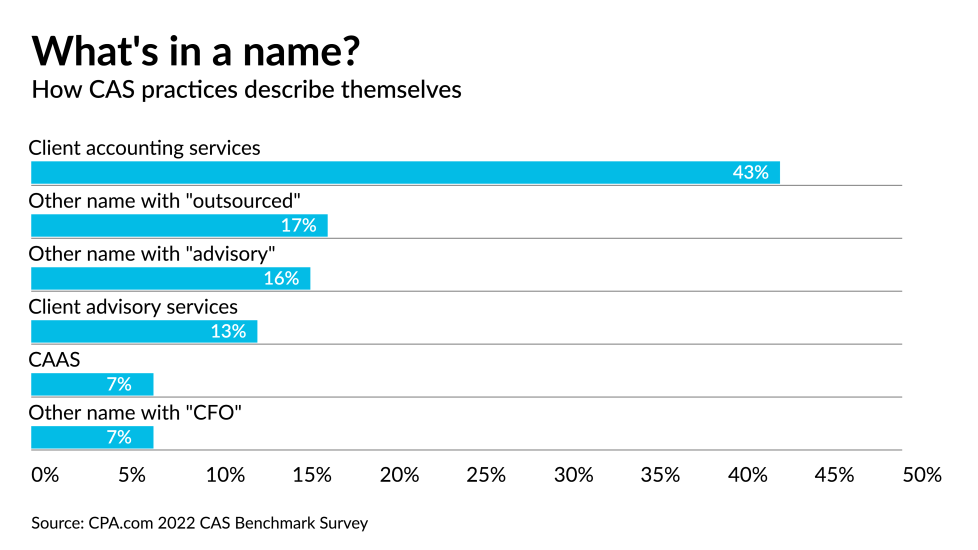

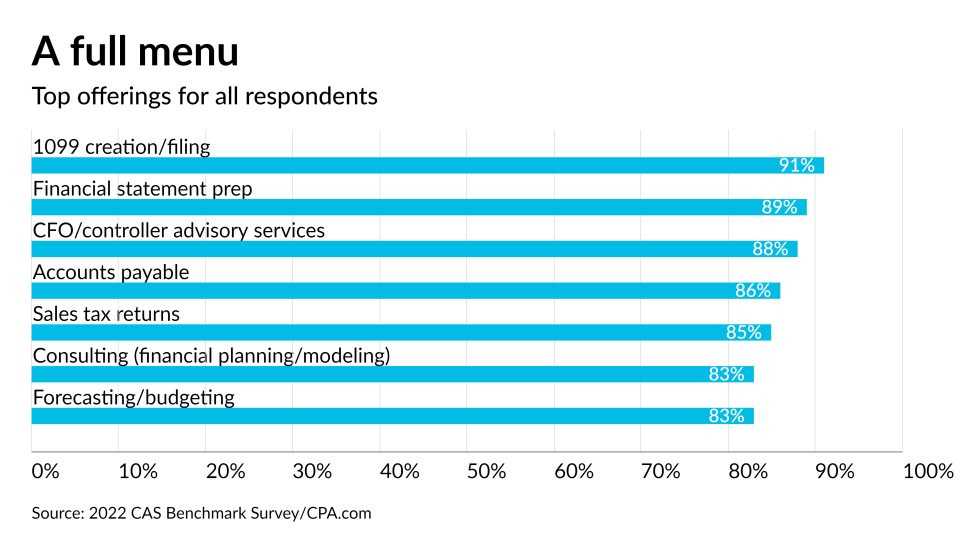

As a relatively young practice area, CAS is still a fluid discipline — so fluid, in fact, that not everyone agrees on what CAS actually means, or what these practices consist of. There is widespread agreement, however, that it's an extraordinarily profitable area, with growth rates that are often double those of the accounting profession's more well-established service lines.

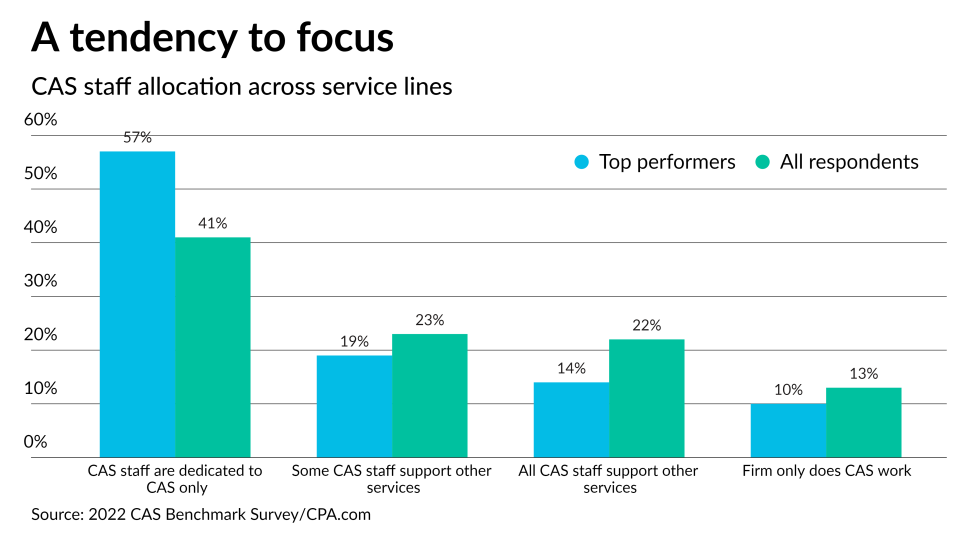

That level of profitability has plenty of firms building or exploring launching their own CAS offerings, but with CAS varying so much from firm to firm, and many of the practices being so young, it can be difficult to get a clear picture of what the optimal structure might be, and what sort of metrics to pay attention to.

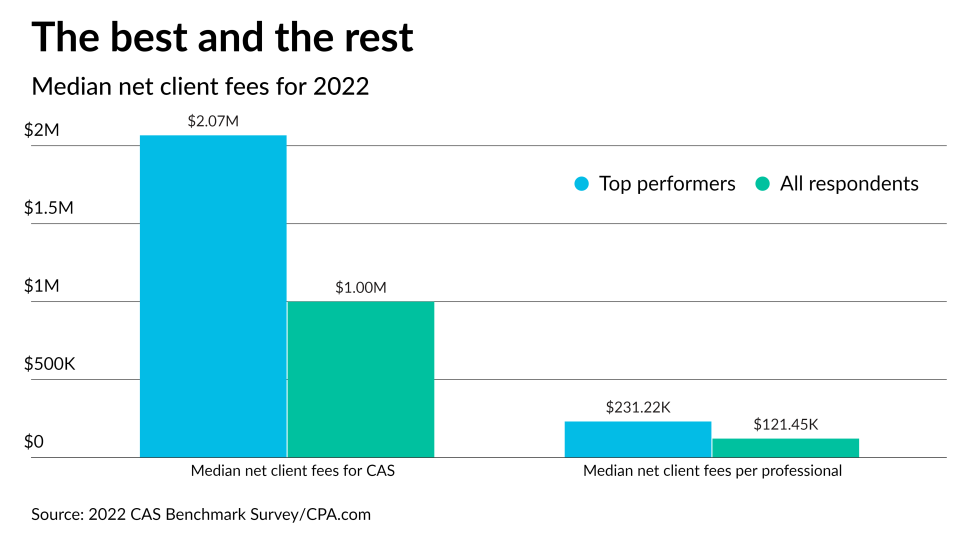

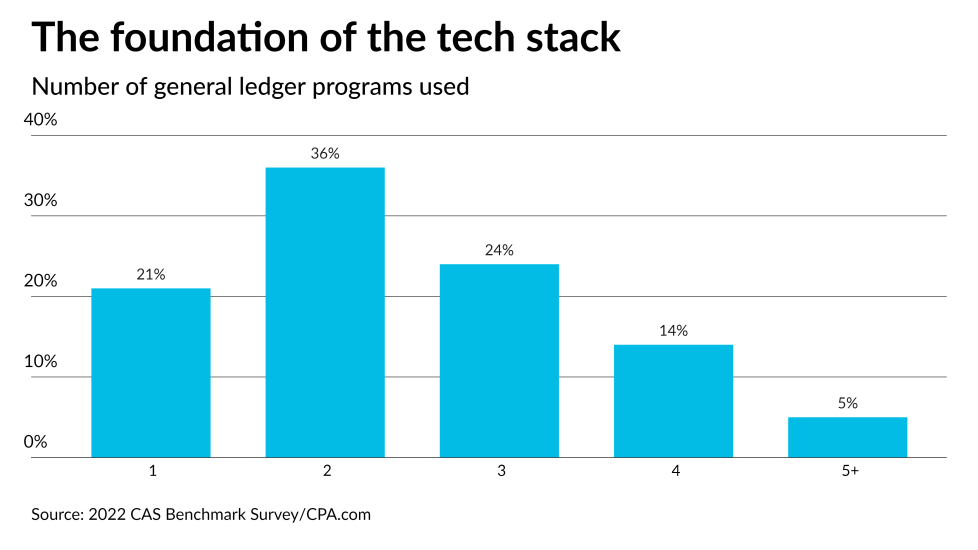

Enter CPA.com's CAS Benchmark Survey, now in its third iteration, which gathers data on key metrics, best practices and more to create a benchmarking tool to help both new and established CAS practices operate more efficiently and profitably. The 2022 survey is based on responses from almost 170 firms, and reports data from both the entire group, and from the "Top Performers" — the responding firms who are in the top quartile by net client fees per professional.

Below is a selection of important data from the survey; the entire survey report is