Taxes

Can’t File Your Taxes Yet? Anyone Can Get an Extension – Here’s How

Anyone can request an automatic six-month extension to file. An extension allows for extra time to gather, prepare and file paperwork with the IRS.

Apr. 07, 2023

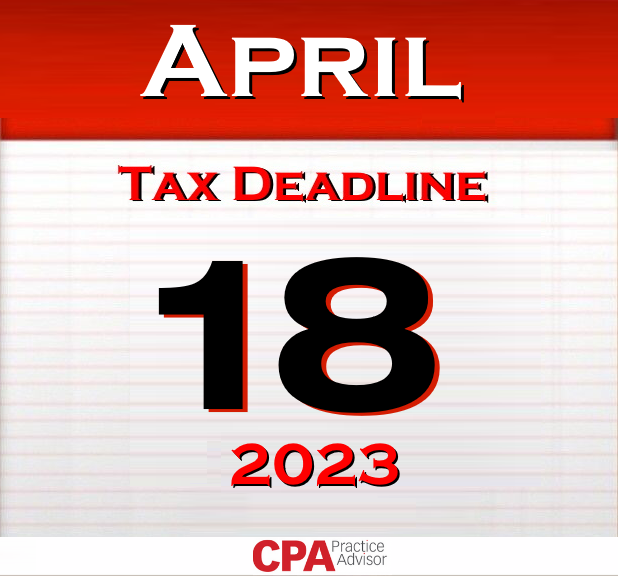

Taxpayers who are unable to file their tax return by this year’s April 18 deadline have an easy, online option to get more time to complete their return. Anyone can request an automatic six-month extension to file. An extension allows for extra time to gather, prepare and file paperwork with the IRS.

However, taxpayers should be aware that:

- An extension to file their return does not grant them an extension to pay their taxes. If you are due a refund, an extension will not affect that.

- They should estimate and pay any owed taxes by their regular deadline to help avoid possible penalties, and

- They must file their extension no later than the regular due date of their return.

E-File an extension form for free

Individual tax filers, regardless of income, can use IRS Free File to electronically request an automatic tax-filing extension. The fastest and easiest way to get an extension is through IRS Free File on IRS.gov, or to use the online tax system you are using to prepare your taxes. Taxpayers can electronically request an extension on Form 4868. Filing this form gives taxpayers until October 17 to file their tax return. To get the extension, taxpayers must estimate their tax liability on this form and should timely pay any amount due.

Get an extension when making a payment

Other fast, free and easy ways to get an extension include using IRS Direct Pay, the Electronic Federal Tax Payment System or by paying with a credit or debit card or digital wallet. There’s no need to file a separate Form 4868 extension request when making an electronic payment and indicating it’s for an extension. The IRS will automatically count it as an extension.

Check the rules for your state

Many states accept the federal extension without requesting that you file a separate extension form in the state. However, some states require that you file a state extension as well, so if you are planning on filing a federal extension, be sure to check the extension rules for your state as well. And of course, as with the federal tax, any state tax owing will need to be paid by the original due date of the return even if you extend the filing of the actual return.

Important reminders on extensions

The IRS reminds taxpayers that a request for an extension provides extra time to file a tax return, but not extra time to pay any taxes owed. Payments are still due by the original deadline. Taxpayers should file even if they can’t pay the full amount. By filing either a return on time or requesting an extension by the April 18 filing deadline, they’ll avoid the late-filing penalty, which can be 10 times as costly as the penalty for not paying.

Taxpayers who pay as much as they can by the due date, reduce the overall amount subject to penalty and interest charges. The interest rate is currently four percent per year, compounded daily. The late-filing penalty is generally five percent per month and the late-payment penalty is normally 0.5 percent per month.

The IRS will work with taxpayers who cannot pay the full amount of tax they owe. Other options to pay, such as getting a loan or paying by credit card, may help resolve a tax debt. Most people can set up a payment plan on IRS.gov to pay off their balance over time.

Other automatic extensions

Certain eligible taxpayers get more time to file without having to ask for extensions. These include:

- U.S. citizens and resident aliens who live and work outside of the United States and Puerto Rico get an automatic 2-month extension to file their tax returns. They have until June 15 to file. However, tax payments are still due April 18 or interest will be charged.

- Members of the military on duty outside the United States and Puerto Rico also receive an automatic two-month extension to file. Those serving in combat zones have up to 180 days after they leave the combat zone to file returns and pay any taxes due. Details are available in Publication 3, Armed Forces’ Tax Guide.

- When the President makes a disaster area declaration, the IRS can postpone certain taxpayer deadlines for residents and businesses in the affected area. People can find information on the most recent tax relief for disaster situations on the IRS website.

Why April 18 is the Tax Deadline This Year

The deadline to submit 2021 tax returns or an extension to file and pay tax owed this year falls on April 18, instead of April 15, because the 15th falls on a Saturday, and Monday, April 17 is the Emancipation Day holiday in the District of Columbia, and Monday is also the Patriot’s Day holiday in Maine and Massachusetts.