Tips, multiple pay rates, and labor laws, oh my! When you have a restaurant business, there can be a lot that goes into payroll. From learning tip requirements to setting up a restaurant payroll solution, we’re here to help you become a pro at handling restaurant payroll.

How to do restaurant payroll

Payroll for restaurants is a little different than running payroll for a “regular” business. It includes special rules and requirements for tips, payroll calculations, and more. To ensure your restaurant’s payroll is accurate and ready to roll for your employees, follow these seven steps.

1. Get all necessary tax ID numbers

Like any other business, you need to obtain a few tax ID numbers before you can begin running payroll for your restaurant. Not sure where to start? Here’s a mini checklist to help you out:

- Employer Identification Number (EIN)

- State tax ID numbers

- Local tax ID numbers

You may also need to do some other tasks, like get workers’ compensation insurance, before you can get started running payroll.

Check with your state and locality to find out which tax ID numbers you need to apply for ahead of time. To avoid a lag in payroll, make sure you apply for tax ID numbers as soon as possible.

2. Have employees complete paperwork

Each and every employee you hire needs to complete some paperwork before you can hand over their first paycheck to them. New hire paperwork includes:

- Form I-9 for employment eligibility

- Form W-4 for federal income tax withholding

- State W-4 form, if applicable, for state income tax withholding

Depending on your business, you may also require employees to fill out other forms before you can get the ball rolling on their payroll, such as benefits forms or a bank account information form for direct deposit.

Once you gather all of the forms you need from your employee(s), keep them secure and easily accessible by storing them in your payroll records.

3. Decide how to run payroll

Next up: Deciding how to run payroll for your restaurant. Do you want to do payroll by hand to save some cash? How about using restaurant payroll software to do the calculations for you? Or, maybe you’ll have an accountant handle it for you. Whatever you do, you must make a choice before you begin paying employees.

Weigh the pros and cons of each method to help make your decision. For example, if you’re leaning toward using payroll software for restaurants, do your research to determine how to choose payroll software.

Look at factors like cost, ease of use, and how much time it will take when doing your research.

4. Choose a payment schedule and method

After you decide how to run payroll, you need to make a couple more payroll-related decisions, including:

- Pay frequency

- Weekly

- Biweekly

- Semimonthly

- Monthly

- Method of paying employees

- Direct deposit

- Cash

- Pay cards

- Mobile wallet

- Paper checks

Determine your pay schedule ahead of time so you know how frequently to pay employees. Brush up on pay frequency laws, too.

Consider the advantages and disadvantages of each method of paying employees before making a decision. Ask yourself questions, like Can I afford to pay employees using this method? and Do I have time for this method? Like with payment schedules, you also need to review payment laws (e.g., direct deposit laws by state) to make sure you are compliant.

5. Learn your payroll tax responsibilities

As an employer, you are responsible for withholding and remitting payroll taxes to the proper tax agencies. And, you need to contribute some taxes.

Some payroll taxes are shared by both the employer and employee while others are employee only or employer only. Here’s a breakdown of each type of payroll tax:

- Social Security tax: Employee and employer

- Medicare tax: Employee and employer

- Federal income tax: Employee

- State income tax: Employee

- Local income tax: Employee

- State-specific taxes: Employee

- Federal unemployment tax (FUTA tax): Employer

- State unemployment tax (SUTA or SUI tax): Employer and sometimes employee

Before you begin running payroll for your restaurant, get to know each type of tax, how much it is, when you need to pay it, and the tax agency to remit it to.

6. Brush up on labor laws

Each and every employer has labor laws they need to follow to protect their employees. And when it comes to restaurants, you need to pay close attention to the dos and don’ts of labor laws.

Prior to hiring your first employee and running restaurant payroll, brush up on these laws:

- Minimum wage requirements

- Child labor laws

- Overtime pay

- Tipped employee rules (if you plan on allowing tips)

- Tipped minimum wage (varies by state)

- Tip pooling

- Overtime for tipped employees

- Tip credits

If you plan on having tipped employees, get to know laws for tipped workers. These laws can impact how you calculate and run payroll for employees who receive tips. Generally, a tipped employees is someone who regularly and customarily receives more than $30 per month in tips.

Along with getting to know labor laws like the back of your hand, also know which labor law posters to display at your business.

7. Familiarize yourself with tip reporting

Many restaurant employees (e.g., servers) receive tips. If you plan on allowing your workers to receive tips, familiarize yourself with tip reporting requirements.

The IRS requires you to report the tips employees receive as taxable income if they exceed $20 or more per month.

Tips your employees receive are generally subject to withholding. And, employees are required to claim all tip income received, including cash tips and tips from credit cards. Employers must collect income tax, employee Social Security tax, and employee Medicare tax on tips reported by employees.

Employees must report tip income to you on Form 4070, Employee’s Report of Tips to Employer, or on a similar statement. To ensure tips are properly reported, make sure you have a solid tip reporting system and process in place ahead of time.

For more information on tip reporting requirements for you and your employees, check out the IRS’s website.

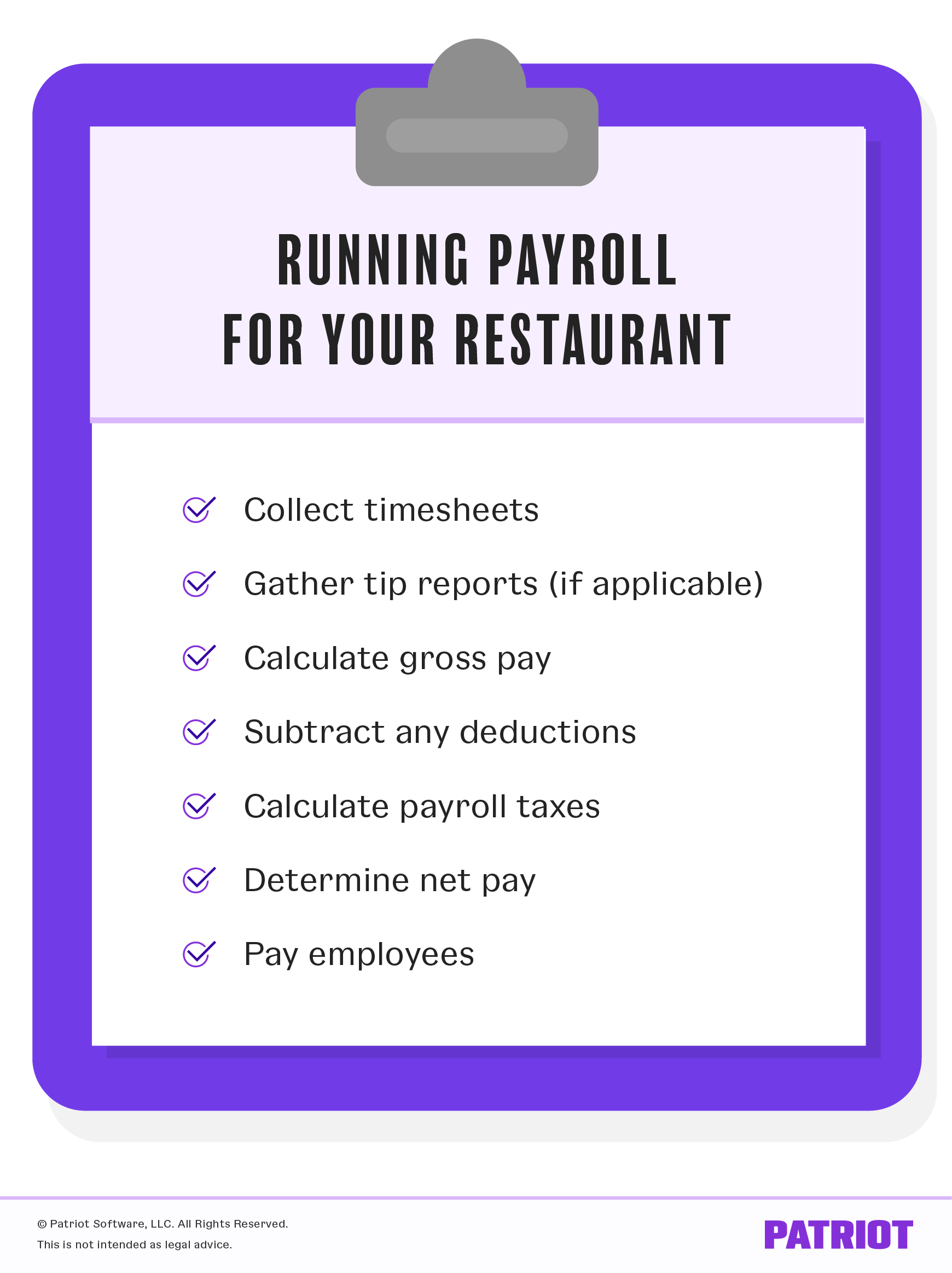

Running payroll for your restaurant

Your restaurant’s payroll may look a little different than another restaurant’s or business’s payroll depending on if you allow tips, have multiple pay rates for different jobs, etc.

But, restaurant payroll typically boils down to similar steps:

- Collect timesheets from employees

- Gather tip reports from tipped employees, if applicable

- Calculate gross pay (i.e., amount before taxes and deductions)

- Overtime

- Multiple pay rates

- Tips

- Subtract any deductions (e.g., health benefits)

- Calculate payroll taxes

- Determine net pay

- Pay employees and distribute a restaurant pay stub to each

- Keep a copy of each employee’s pay in their employee personnel file

Keep in mind that the above steps can vary depending on your business. For example, if you don’t have tipped employees, you don’t have to worry about calculating overtime and gross pay using a different method.

Restaurant payroll tips: To make things easier when calculating payroll (especially when you add tipped employees into the mix) map out your steps, and consider looking into payroll software for restaurants. The software handles all of those pesky gross pay and tax calculations for you so you don’t have to fret about doing it yourself.

Common restaurant payroll FAQs

Have questions? We’ve got you covered. Here are some common restaurant payroll questions and their answers.

Are tips taxable?

Yes! Tips that total $20 or more during a month are subject to federal income, Social Security, and Medicare taxes.

How long should you keep payroll records?

So, how long should you keep payroll records for your restaurant? Typically, you should keep payroll records for at least three years. However, you can keep them even longer if you’d like.

When it comes to keeping payroll records, it never hurts to store them longer than the suggested timeframe. So when in doubt, keep those records on hand!

How does the tip credit work?

A tip credit means you can pay your tipped employees a lower wage than the federal minimum wage.

The current federal minimum wage is $7.25 per hour. Employers can claim a maximum tip credit of $5.12 per hour. So, the minimum cash wage after the tip credit is $2.13 per hour. This means you have to pay your tipped employees at least $2.13 per hour.

Some states don’t have a tip credit. If you’re in a state without a tip credit, you must pay employees at least the standard minimum wage even if they receive tips. And if your state or locality has a minimum wage, you must pay the restaurant employee the highest rate.

This is not intended as legal advice; for more information, please click here.