The Ins and Outs of Real Estate Income: Tax Planning for Short-Term Rentals

CTP

DECEMBER 8, 2022

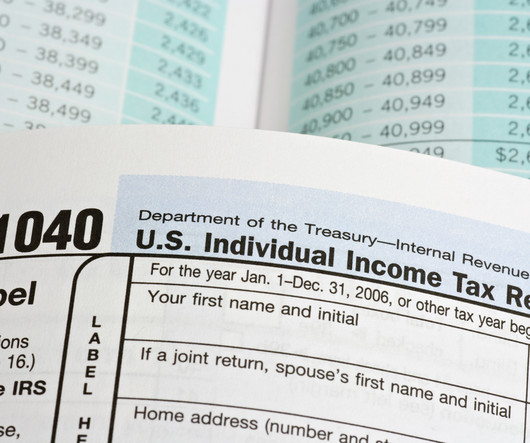

Using real estate as a source of income is only becoming more popular with the advent of sites like Airbnb and VRBO that enable homeowners to earn extra cash from property they already own. Taxpayers who are new to leveraging real estate for income may be unfamiliar with the tax loopholes available to them.

Let's personalize your content