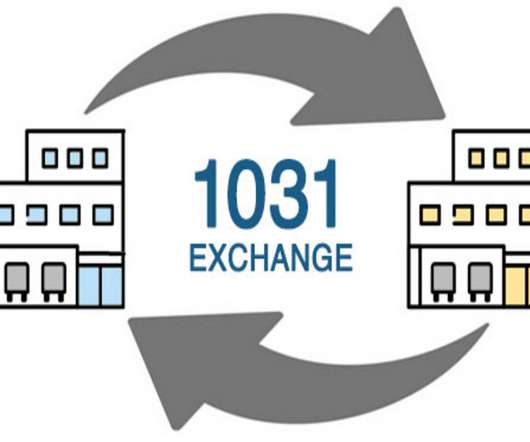

Tax Deferral Strategies for Real Estate: Basics of the 1031 Exchange

CTP

APRIL 10, 2024

A common conversation with clients is how to minimize taxes on their investments. When it comes to business or investment properties, taxpayers may be hesitant to sell, even if the investment is turning out to be an unprofitable one, because doing so will mean paying a sizable capital gains tax. What other options are available?

Let's personalize your content