The Internal Revenue Service showed off its upcoming Direct File free tax preparation service Thursday ahead of its pilot test in a dozen states starting in March.

The online demonstration with members of the media revealed a fairly sophisticated tax prep system, albeit one limited to taxpayers who claim the standard deduction and fall within certain types of income categories. The bilingual system is available in both English and Spanish and provides links to information and advice to help taxpayers through the tax prep process, much like commercial tax prep software.

The IRS has only been developing the system since last year, when it announced plans to

"The states are a crucial partner for the IRS in the nation's tax system," said IRS Commissioner Danny Werfel during a press conference. "We will be working closely with the 12 pilot states in this test run, which will help us gather information about the future direction of the Direct File program. Overall, the Direct File pilot will allow us to further assess customer and technology needs and evaluate and develop solutions to meet the needs of taxpayers in the years to come."

An IRS official, who asked not to be identified, said there will be no limit on the number of people who can participate in the pilot program, but the service will be taking a phased approach in inviting and admitting people to the pilot.

The Inflation Reduction Act of 2022 required the IRS to study the feasibility of delivering a free direct-filing service. The agency issued a

The IRS said it remains committed to its longstanding relationship with Free File and recently signed an extension of a memorandum of understanding with the Free File Alliance. At a number of points in the Direct File pilot software, the program tells taxpayers when their tax situation doesn't fit in with the eligibility requirements for the pilot and directs them to other commercial software options such as Free File, as well as the Volunteer Income Tax Assistance program.

Accounting Today also asked if the IRS would be prepared if Congress

Live support from the IRS

When taxpayers start the program at

Taxpayers will be able to click on every page and toggle back and forth between English and Spanish. The IRS has done user testing with over 100 taxpayers, and one of the things it heard from bilingual taxpayers was that while they want to use Direct File in Spanish, there might be certain pages where they want to be able to see the same information in both English and Spanish, so the ability to switch back and forth on every page was important to them.

In addition to the Spanish language button, they will have a chat button where they can participate in a live chat with a trained customer service representative. On every page, if taxpayers have a question, they can click on the chat button and get assistance from a trained IRS Direct File assistor. The assistors can provide both technical assistance in terms of how to navigate Direct File itself, as well as limited tax law information related to topics such as the Earned Income Tax Credit.

"Direct File provides an additional choice for taxpayers and gives the IRS an opportunity to learn from taxpayers as they continue to improve service and technology across the agency," said Laurel Blatchford, chief implementation officer for the Inflation Reduction Act at the Treasury Department. "The IRS has built an impressive, taxpayer-friendly product with the look and feel of tax preparation software taxpayers may have used before and are familiar with. This year, the limited Direct File pilot will enable many Americans to use a simple software to file their taxes directly with the IRS for free — making it easier and cheaper for them to meet their tax obligations, access the tax credits and deductions they are eligible for, and contribute to our country's success. The 2024 pilot is an opportunity for the IRS to learn how best to deploy Direct File to meet the needs of taxpayers and test core improvements to the tax filing experience for taxpayers."

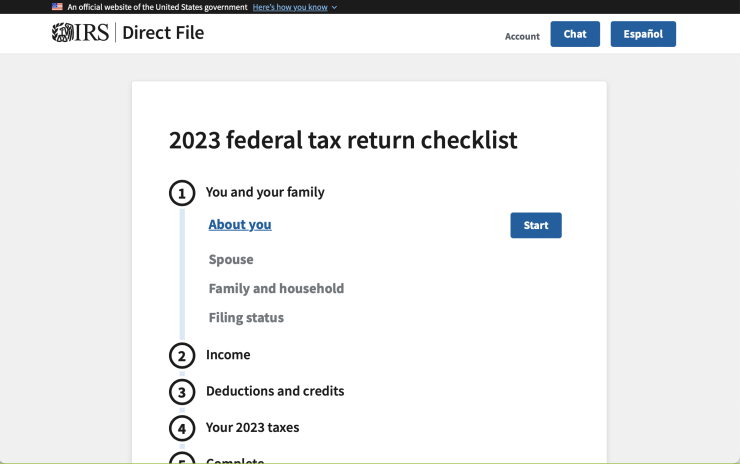

Taxpayers are asked to check their eligibility before they start entering their information. Once they're sure they qualify, they can start inputting their data. They will need to have an IRS online account or an account with ID.me to use Direct File. That enables the IRS to verify their identity and avoid tax fraud or identity theft.

In terms of wages and income, the Direct File program supports W-2 income, unemployment compensation, Social Security benefits and interest of $1,500 or less. Any other types of income other than those four are not supported by Direct File and cannot be reported through the program. While eligibility for the program is not limited by adjusted gross income, there are certain provisions for higher-income earners that aren't supported by Direct File.

States participating in the pilot

One of the findings in the feasibility report was that taxpayers would be more interested in using Direct File if it allowed them to seamlessly file both their federal and state returns, so one of the things the IRS is testing in the pilot is the ability to allow taxpayers in a handful of states to seamlessly file their federal and state returns.

After filing their federal return with Direct File, taxpayers in Massachusetts, Arizona and New York will be offered the opportunity to then move on to a state-filing tool provided by the state. They can log into that state tool, bring their information with them from Direct File, answer a few extra questions specific to that state, and then complete the filing of their state return. Taxpayers in California won't be able to take their information from Direct File with them, but will be directed to California's CalFile tool, which does some pre-populating of information, and then taxpayers can complete the filing of their California return through CalFile. However, their information from Direct File does not transfer over as it does with Massachusetts, Arizona and New York.

Washington State does not have a state income tax, but does have a Working Families Tax Credit, and taxpayers there will be provided with a link to the website where they can claim that tax credit.

Tax deductions and credits

Direct File supports the standard deduction but doesn't support itemizing deductions. The program provides additional information about what it means to itemize deductions and some of the common reasons why taxpayers might itemize, as well as some information for taxpayers on how to choose between the standard or itemized deduction.

In addition to the standard deduction, Direct File also supports adjustments for educator expenses and student loan interest. It also supports multiple types of health insurance, but there are certain types that it does not support. If taxpayers bought health insurance through the Affordable Care Act marketplace, or withdrew money from a health savings account, the system doesn't support the ACA's Premium Tax Credit or handle the tax implications of withdrawing money from an HSA.

Direct File supports the Child Tax Credit, the EITC, and the Credit for Other Dependents. While it doesn't currently support the Child and Dependent Care Tax Credit, it offers advice on how taxpayers might be able to use other tax software to claim the credit.

The Direct File interface includes "radio buttons" where taxpayers can answer questions with a simple yes or no. Many of the pages also include links and pop-up boxes that lead to tax tooltips on topics where taxpayers may want to get additional information, such as on identity protection personal information numbers. The pop-up will provide information about what it means to have an IP PIN. In some situations, there will be links to additional information on the IRS.gov website.

Summary screens

When taxpayers reach the end of a section, they get a quick summary screen where they can look at all of the information they have provided so far. If they have anything they need to edit, they can click to go back to that specific section, make a change and then come back to that summary screen. That way, they don't have to wait until the very end. They can review and edit their information as they go.

"Direct File walks the taxpayer through the complexities of the Internal Revenue Code to complete their filing easily with an accurate calculation of their refund or remaining balance," said Werfel. "Direct File is designed to be transparent — at every step, it shows the work behind the calculations, so users can be confident that the return is complete and accurate."

The program asks about the taxpayer's family and household and whether they have anybody who can be claimed as a dependent. Direct File will make a recommendation on the filing status that is most advantageous for the taxpayer based on the information that they have provided.

Taxpayers also enter the information from their W-2 forms. They can enter as many W-2 forms as needed.

If taxpayers get interrupted during the process, they can come back at any point, re-log into their accounts and pick up where they left off. Direct File will save the information as they go along. The software warns whenever the taxpayer tries to enter income that it currently does not support, such as tip income. However, the software does support combat pay income, which is nontaxable. If a taxpayer is eligible, the program will suggest they enter combat pay as part of their income in order to claim a larger Earned Income Tax Credit, while showing them their options for comparison.

A summary screen displays the amounts claimed from the various tax credits and breaks down the information to show where it originated. Taxpayers can finalize and review their returns and find out their total tax refund amount on a final summary screen. They can then decide how they want to receive their tax refunds. The IRS recommends direct deposit because it's faster, but taxpayers have the option to have a check mailed to them. If taxpayers end up owing money, they can ask to have it directly withdrawn from their bank account. They can also mail in a check or pay through any of the other methods the IRS has available.

Reviewing and submitting

Taxpayer are also given the opportunity to download a copy of their draft Form 1040 for review with all of the applicable schedules and the W-2. If they need to make a change, they can go directly to the specific section they need to change and go in and edit their information.

Once they're finished reviewing their taxes, taxpayers can sign and submit their returns with a self-selected PIN or by entering the AGI on last year's return. They have one last opportunity to double-check the return before submitting it. In some cases, they will be reminded of their state tax filing obligations and be taken to the online tools offered by some states like New York. Residents will be able to bring their information from Direct File, answer some additional questions and then complete the filing of their New York State return.