What does an accountant do? What are the bookkeeper’s duties? These topics remain hot because there’s often a lot of confusion about them.

Sometimes, grasping the difference between bookkeeping and accounting can be tricky. Both bookkeepers and accountants work with your finances and help make your tax reporting a smooth experience. But to properly manage your ecommerce business, you need to dive into the differences to know whom to hire.

How to choose a bookkeeper? Do I need one permanently, or can I contact them every so often? Do I only need an accountant if I own a mid or large-sized business? Is an in-house accountant a necessary investment? And finally, how can I find out whether I need a bookkeeper or an accountant, and what’s the difference between bookkeeping and accounting in general?

In this article, I’ll cover these and some other key questions that may help you choose what fits your business best.

Key takeaways:

- Bookkeepers record transactions, while accountants analyze data for insights and advice.

- Bookkeepers need certifications like AIPB or CPB, while accountants require an accounting degree. Consider hiring one based on business needs and available resources.

- Automation software helps both bookkeepers and accountants maintain healthy finances.

- Outsourcing offers cost flexibility. Assess business needs to determine whether to hire in-house or outsource

Contents:

1. Bookkeeping vs accounting: What’s the difference

2. Duties of accountants and bookkeepers

3. How Synder can help accountants and bookkeepers

4. How to decide which specialist is best for you

5. What else you need to know about bookkeepers and accountants

- Hiring a bookkeeper

- Hiring an accountant or CPA

- Qualifications required for bookkeeping services

- Qualifications required for accounting services

- How much does hiring bookkeepers cost?

- How much does hiring accountants cost?

6. Bookkeeping vs accounting: Wrapping up

7. Bookkeeping vs accounting: FAQs

Bookkeeping vs accounting: What’s the difference

The bookkeeper’s responsibilities are typically connected with day-to-day financial transactions and general business administration, while the primary functions of accounting are processing the financial information produced by the bookkeeper and, based on it, generating business insights, reporting, and providing financial forecasts.

In practice, the distinction can get quite hazy. With many accounting automation solutions available on the market, bookkeepers have been freed from the manual tasks of data entry. Nowadays, bookkeepers can use the opportunity to give more insight and sometimes play the role of an advisor.

This way, bookkeeping and accounting can sometimes overlap. But certain points of difference remain: the bookkeeper will likely manage your ongoing financial records, ensuring the accuracy of the data in your books. And what does an accountant do? An accountant will analyze this data, do reporting, give you financial advice, and offer you tax processing services.

Duties of accountants and bookkeepers

Typically, professionals in bookkeeping and accounting spheres work together. Often the bookkeeper will serve as an expert at using the latest software to track transactions and generate financial reports, while the ultimate purpose of the accountant will be to have a larger perspective in overseeing your business.

Bookkeeper

Among some of the daily, weekly, and monthly operations that the bookkeeper can help you with are:

- Transaction recording;

- Accounts payable;

- Accounts receivable (invoicing);

- Payroll processing services;

- Expenses and petty cash management;

- Bank account reconciliation;

- Bank deposits;

- Financial statement management (cash flow, balance sheet, income statement).

The main responsibility of a bookkeeper is to be perfectly accurate, that’s why there has been an increasing transition to using bookkeeping or accounting automation software to avoid mistakes that come from manual data entry.

Accountant

Among the primary functions of accounts are to prepare and analyze:

- Financial audits;

- Forecasting;

- Financial planning and long-term budgeting;

- Tax returns;

- Performance optimization.

Accountants might perform tasks such as budgeting, analyzing, and planning, but are unlikely to deal with everyday processes of recording transactions. Understanding the nuances between temporary accounts vs permanent accounts is crucial for accurate financial analysis and reporting. Accountants are also responsible for providing tax and representation on taxation matters.

Browse our CPA directory to find accounting experts with ease.

Now, let’s take a closer look at the duties of a bookkeeper and accountant.

| Bookkeeper duties | Accountant duties |

| Recording business financial transactions | Producing financial statements |

| Maintaining a chart of accounts, general ledger, and budgets | Making adjusting entries |

| Sending out and recording invoices and invoice payments | Reviewing payroll |

| Processing bill payments | Optimizing revenue and expenses |

| Processing payroll | Performing internal audits |

| Keeping a balanced track of debits and credits | Preparing tax returns |

| Regularly reconciling every bank account | Approving tax payments and calculating tax deductions |

| Singling out items for special tax treatment | Advising on financial management |

While there can be some overlap in responsibilities, to avoid the confusion caused by the sometimes blurred lines between bookkeeping and accounting, one can see them as part of one accounting cycle. Recording of data is a part of the process, and both accountants and bookkeepers contribute to successful tax filing. The results of work done by the bookkeeper allow the accountant to provide business forecasts, that’s why many mid- and large-sized businesses will need to hire both.

How Synder can help accountants and bookkeepers

How Synder can help bookkeepers

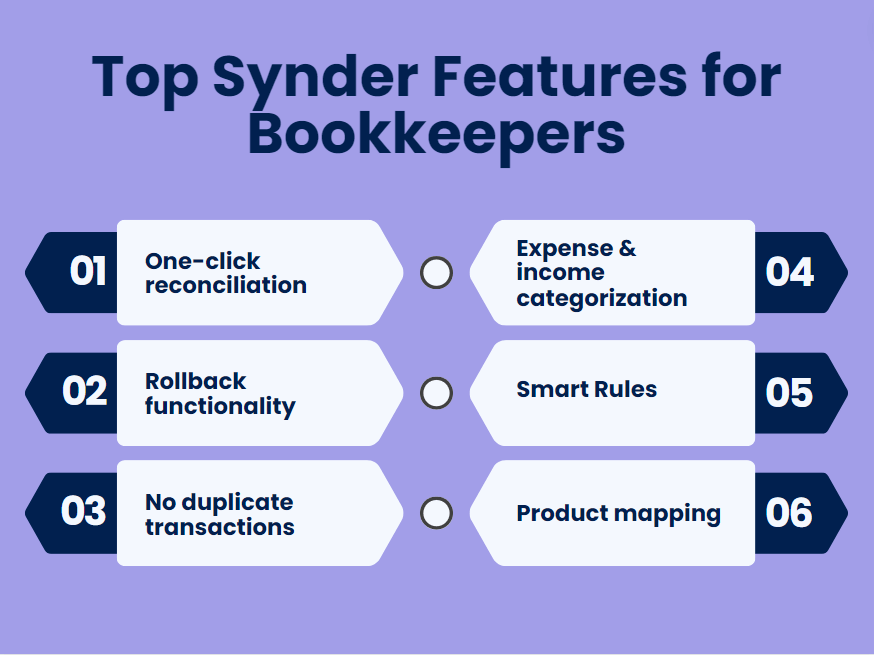

Many bookkeepers are turning to accounting automation tools to save time on manual bookkeeping tasks such as data entry, income & expense categorization, and reconciliation.

Related reading: Ecommerce Automation Solutions: Sell More, Spend Less!

One such example is Synder, which facilitates the automatic sync of financial information between the data source where the original data is generated (ecommerce platforms such as Stripe, PayPal, Shopify, etc.) and the target system (accounting company platforms like QuickBooks Online, QuickBooks Desktop, Xero, or Sage Intacct).

Here are some key features of Synder.

1. One-click reconciliation

Having connected your ecommerce platform, for example, Shopify store to QuickBooks Online, Synder mirrors your money flow in QuickBooks. When clients buy something, transactions go to your payment processor first, and then the payment processor transfers the money to your actual bank account (‘Checking’).

Synder syncs sales and expense transactions to the ‘Clearing’ account in QuickBooks, named ‘Shopify Bank Account.’ When the payout occurs, the app syncs and creates a transfer from the ‘Clearing’ to your ‘Checking’ account, reflecting the actual money flow. This simplifies reconciliation with just a few clicks in the ‘Banking’ section, where Synder’s synced info matches real money transfers automatically.

Ease your reconciliation by pre-checking all transactions in QuickBooks Online from your connected platforms with Synder. You’re wondering how? Let’s find out.

Discover the step-by-step process of reconciling accounts in QuickBooks in our article “How to Reconcile in QuickBooks Online and QuickBooks Desktop: Account Reconciliations in QuickBooks.”

2. Rollback functionality

Synder allows you to undo transactions in case of any errors or discrepancies, ensuring that your financial records remain accurate and up-to-date.

3. No duplicate transactions

Human error is inevitable, especially when dealing with large volumes of data. Synder offers a feature that uses transaction ID, customer name, amount, and date for duplicate checks, ensuring protection from duplicates when using our app, but not for manually created or transactions from other apps.

4. Expense & income categorization

The app automatically categorizes expenses and income, saving you the hassle of manual categorization and ensuring consistency in your financial records.

5. Smart Rules

This functionality allows advanced customization for data entry and filling out missing information. It covers tasks like assigning classes, tracking inventory, categorizing income and expenses, and sending reminders to clients. Adjust settings to add missing data or send notifications, providing detailed reports for business analytics within your accounting company.

6. Product mapping

With product mapping capabilities, Synder enables you to map pairs of products on the payment platform side and the accounting platform side if the product names differ. This ensures that your product sales are accurately reflected in your accounting platform.

Sounds promising, right?

Take advantage of the opportunity to optimize your clients’ business processes and explore Synder features with a free trial. Book your seat on Synder’s Weekly Public Demo to gain more insights and tips.

How Synder can help accountants

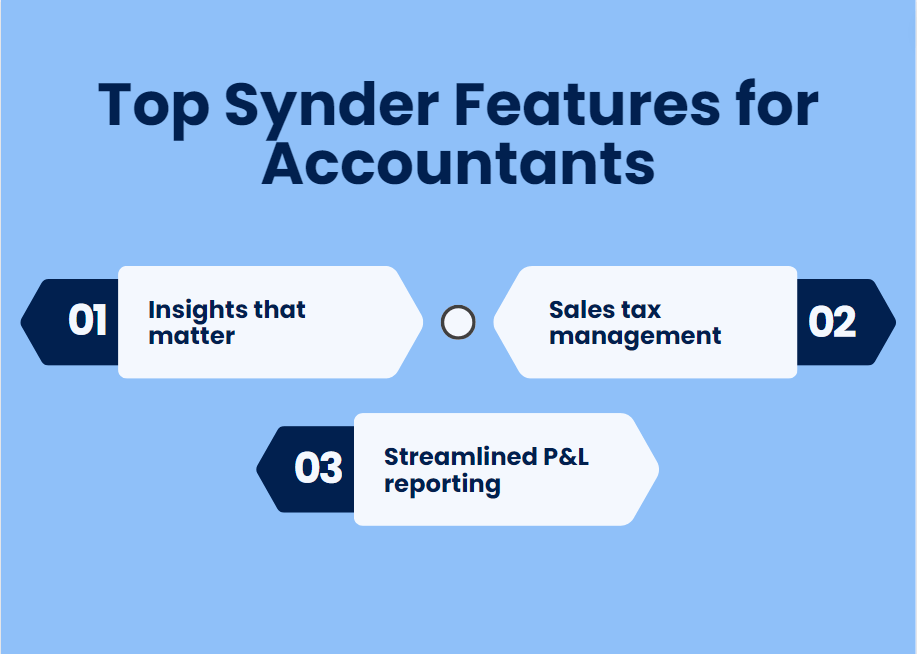

Synder accounting app can assist accountants who primarily analyze data, report, provide financial advice and offer tax processing services in several ways.

1. Insights that matter

Synder offers a built-in analytical tool — Synder Insights — that can process large volumes of financial data quickly and efficiently. It can become your all-in-one source of truth for strategic decision-making. It pulls real-time data, giving you an instant, accurate, and up-to-date report on your business’s vitals. The reports span financial metrics as well as product and customer-related insights. We’ll look at some of them more closely.

Read more: How to Get Business Insights from Data: Data Insights with Synder

2. Sales tax management

Effective sales tax management is crucial for businesses operating across multiple sales channels and payment platforms. Synder simplifies this process by accurately calculating taxes based on transaction information received from payment processors. By seamlessly integrating with accounting software like QuickBooks or Xero, Synder ensures compliance with tax codes, offering businesses a streamlined solution for managing sales tax complexities.

Continue reading: Synder’s Multi-Tax & Multicurrency Features: Deep Dive for Canada

3. Streamlined P&L reporting

Synder handles transaction management and facilitates the generation of Profit and Loss (P&L) reports. By automatically categorizing transactions and syncing them with your accounting software, Synder provides accountants with the necessary data to compile comprehensive P&L reports efficiently. This streamlined process saves time and ensures accuracy in financial reporting, allowing accountants to focus on more strategic tasks.

Find out more: P&L Template: Understanding the Profit and Loss Statement (Plus a Template to Download)

By using Synder’s capabilities, accountants can optimize their workflow, minimize errors, and gain valuable insights into their clients’ businesses, ultimately enhancing their ability to provide accurate financial forecasts and strategic recommendations.

How to decide which specialist is best for you?

Young businesses often get away with doing their accounting and bookkeeping responsibilities themselves. In the long run, however, it wouldn’t be financially wise to continue doing that, as many errors might creep in, potentially costing you money and time.

There are several telltale signs that you might need to hire professional bookkeeping and accounting help.

- Problems with maintaining financial statements;

- Struggles with reconciling accounts every month;

- Confusion with using the Chart of Accounts;

- Issues with cash flow.

Many businesses might only need to hire a bookkeeper and invest in an accountant for tax preparation services during the tax season. Having a bookkeeper that regularly produces financial statements will give you enough data for an accountant to process tax returns.

As the business grows, you might have to enlarge your bookkeeping and accounting team to help you with cash flow for more than just the tax season.

You might want to acquire additional funds for your business to feel more confident by securing extra cash for emergency purposes. Diligently processed financial statements over an extended period can be a kind of insurance for you to receive the needed investment. A bookkeeper can assist with producing financial reports regularly.

While most small businesses can follow the model of hiring a bookkeeper for a month-to-month collaboration and investing in accounting help during the tax season, it’s important to note that combining bookkeeping and accounting will certainly guarantee that you’re covered.

What else you need to know about bookkeepers and accountants

Hiring a bookkeeper

Hiring a bookkeeper is an important decision that you need to take seriously because it can have a major impact on your company’s financial health. Bookkeeper duties are keeping track of your finances and producing regular budget reports, so ideally, they should be knowledgeable about ways to do so.

You can start by asking your colleagues for recommendations and browsing websites like LinkedIn.

The first thing to figure out is whether you need an in-house or outsourced bookkeeper. Typically, businesses hire in-house financial specialists when there’s a lot of payroll and invoices to process. If you’re a small firm that doesn’t do a great deal of payroll, you can start by outsourcing bookkeeping services to someone who would update your books, ideally every month.

Hiring an accountant or a CPA

If your business already has a bookkeeper, but you begin to struggle with legal financial questions, it might be time to hire an accountant. Typically, only larger businesses would need an in-house accountant. But if you work in a very tax-specific area, you might think of hiring both professionals for accounting and bookkeeping needs. Otherwise, you can outsource accounting to a CPA firm.

There’s a tool called CPA Verify that you can use to do a background check before hiring external help. It’ll confirm the license and check for any disciplinary action taken against a potential CPA.

Outsourced accounting isn’t always cheaper than in-house, so it’s good to compare the pricing by getting several quotes.

Qualifications required for bookkeeping services

The United States doesn’t have a standardized qualification for practicing bookkeepers. The U.S. Bureau of Labor Statistics states that those practicing bookkeeping should hold at least a high school diploma but usually have postsecondary education. For the purpose of certification, they’re mostly required to have at least 2 years of job experience.

A lot of U.S. bookkeepers get the American Institute of Professional Bookkeepers (AIPB) certification. It proves that the bookkeeper has signed the AIPB’s Code of Ethics and has successfully fulfilled its certification standards. The National Association of Certified Public Bookkeepers also offers the Certified Public Bookkeeper (CPB) certification.

As you can see, while most states won’t require certification for practicing bookkeepers, you can look at the experience and different certifications to make sure you’re hiring the right professional for a fruitful long-term collaboration.

Certified Public Accountant (CPA) granted by The American Institute of Certified Public Accountants (AICPA). Certified Public Accountants can represent their clients before the IRS, work for a public company, and assist with an array of official bureaucratic and financial matters on all levels.

How much does hiring bookkeepers cost?

The exact salary will depend on the amount of work that needs to be done and whether you’re hiring someone to work in-house or remotely. The U.S. Bureau of Labor Statistics stated that the average (median) wage is $45,560 per year ($21.90 per hour), while other sources quoted bookkeeper salaries in the US in the range of $38,215 and $47,431.

Many outsourced bookkeeping services can start with as much as $500 a month, but bear in mind that this will mean that the bookkeeper will be working for several businesses and won’t be as available as an in-house professional.

How much does hiring accountants cost?

The difference between bookkeeping and accounting services is definitely reflected in the cost. Hiring an accountant is more expensive than hiring a bookkeeper. According to the Bureau of Labor Statistics, the median pay for accountants was $77,250 per year ($37.14 per hour).

If your business requires the support of a CPA-qualified accountant, their salaries are typically higher than those of non-certified accountants.

Bookkeeping vs accounting: Wrapping up

Bookkeepers and accountants have a mutual aim to help businesses stay on top of their financial record-keeping, tax filing, and overall financial health. Bookkeepers usually record business transactions in the books, ensuring accuracy and correct categorization. They’re also responsible for producing necessary financial statements. In their turn, accountants consult businesses based on those statements and help with taxation. Utilizing integrated accounting software like Synder can streamline these processes, enhancing efficiency and accuracy in financial management.

Though their practices generally differ, they may overlap, making it unclear which specialist is best for a business. So before you start looking for accountants or bookkeepers to hire, a good rule of thumb is to carefully analyze your business needs and available resources. Then, you can decide whether to hire an in-house specialist, outsource bookkeeping or accounting tasks, or turn to a CPA firm.

Bookkeeping vs Accounting: FAQs

1. Which is better: bookkeeping or accounting?

Both bookkeeping and accounting play essential roles in managing financial records. Bookkeeping involves recording daily financial transactions, while accounting interprets and analyzes those records to provide insights for decision-making. Neither is inherently better; they complement each other to ensure accurate financial management.

2. What is the difference between accounting and bookkeeping?

Bookkeeping involves the systematic recording of financial transactions, including sales, purchases, receipts, and payments. Accounting encompasses a broader scope, involving interpreting, analyzing, and summarizing those financial records to provide insights into business performance, prepare financial statements, and facilitate decision-making.

3. What comes first: accounting or bookkeeping?

Bookkeeping typically precedes accounting. Bookkeeping involves recording financial transactions as they occur, providing the raw data needed for accounting. Once transactions are recorded, accountants analyze and interpret those records to prepare financial statements, analyze performance, and provide strategic guidance.

4. Do you need a bookkeeper or an accountant?

The need for a bookkeeper or an accountant depends on the complexity of your financial management needs. An accountant offers financial analysis, prepares statements, gives strategic advice, and ensures tax compliance. Many businesses benefit from having both as they perform different but complementary roles in financial management.

5. What is the difference in salary between bookkeeping and accounting positions?

Generally, accounting positions offer higher salaries than bookkeeping roles due to the additional skills, qualifications, and responsibilities required in accounting, such as financial analysis, strategic planning, and tax compliance.

Thanks for explaining the importance of Sole Traders & its role in developing company’s growth, very well researched post

Thank you so much!

As you rightly said, time is the most valuable thing a man can spend. Book-keeping is one troublesome task and it requires a lot of time and effort. So, it is best to outsource your business to proficient accounting firm as it is cost-effective and saves more time.

Thanks for your opinion, Sherwin

Hi, Loved to post! Well written article and helpful for anyone looking to learn ways to save their time on their bookkeeping and accounting services or looking for some other financial tips. Well done for your work. Keep on helping the world.

Hi Michael, thanks for stopping by!

Thanks for sharing such nice information about Accountant vs Bookkeepers. it is a very helpful article.

Thanks, Bhargey! Appreciate your comment.

Hello there! I simply would like to give you a huge thumbs

up for your great info you have got here on this post. I am returning to

your web site for more soon.

Thanks a lot! Come back any time )

Great Post! Thanks for sharing such beautiful information with us. Please keep sharing.

Thank you so much!

This valuable information is not at all what we find in blogs. Congratulations, I was looking for something like that and found it here.

Thank you Pearson! Appreciate your comment.

Generally I don’t read article on blogs, however I wish to say that this write-up very pressured me to check out and do it!

Your writing style has been amazed me. Thank you, quite great article.

Thanks for stopping by!

Good information. Lucky me I discovered your site by accident (stumbleupon).

I’ve book-marked it for later!

Hi there to all, it’s actually a nice for me to visit this web page,

it includes precious Information.

Thank you for sharing. It is really interesting.

Thanks for helping me understand that bookkeepers would help you keep track of your finances and produce regular budget reports for you which is why they have to be knowledgable about what they do. I can imagine how important it is for business owners to look for those with a good reputation in order for them to get the services they needed. Also, they have to be good at what they do to ensure that they provide accurate information that can directly impact their finances as a business.

Hurrah, that’s what I was exploring for, what a information! existing here at this web site, thanks admin of this web page.

Excellent beat ! I would like to apprentice at the same time as you

amend your web site, how can i subscribe for a blog website?

The account helped me a acceptable deal. I have

been tiny bit acquainted of this your broadcast provided shiny

clear concept

I was captured when you discussed that bookkeepers present vital insight into the financials of the company. My friend wants to hire a bookkeeping service. I should advise him to go for it to keep track their finances.

You are welcome, Victoria!

Its like you read my thoughts! You seem to understand a lot

about this, such as you wrote the ebook in it or something.

I feel that you just can do with some percent to drive the message house a little bit, however instead of that, that is wonderful blog.

An excellent read. I will certainly be back.

Thank you for your feedback! We’re doing our best to provide you with comprehensive pieces.

Heya i am for the first time here. I came across this board and I find It really helpful & it helped me out a lot.

I’m hoping to provide one thing back and aid others like you helped me.

I find it interesting when you said that there are situations when bookkeeping and accounting overlap, but their difference is the former manages your financial records while the latter analyzes those data and also processes your taxes for you. I heard that my aunt would need property accounting services to ensure that she knows the right amount of taxes she needs to pay for her house. She just doesn’t want to have any problems in the future because she lives on her own and she has to manage her budget wisely to prevent getting into debt.

Thank you! I am very glad you found our article helpful and informative!

This blog post does an excellent job of distinguishing between bookkeeping and accounting, two roles that are often confused. The clear explanations and real-world examples provided make it easy for readers to grasp the differences. It’s crucial for business owners to understand which service they need to manage their finances effectively. This article is a must-read for anyone seeking clarity on the distinctions between bookkeepers and accountants.

This excellent website definitely has all of the information I needed about this

subject and didn’t know who to ask.

I find it surprising that hiring accounting services makes it easier for businesses to avoid unexpected expenses due to financial record inaccuracies. I have a friend who wants to start a new business this year. I will talk to him about hiring an accounting expert for advice when we meet again.