Estate and Gift Taxes – Plan Now for Reduced Exemption in 2026

Dent Moses

MARCH 21, 2024

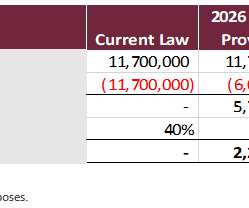

billion in taxes The critical point is that unless Congress takes further action, the exemption provisions of the Tax Cuts and Jobs Act of 2017 are set to “sunset” on December 31, 2025. To navigate these changing tax dynamics, taxpayers should consult their estate planning professionals.

Let's personalize your content