Transfer Minority Business Interests to Take Advantage of the Expanded Lifetime Estate and Gift Tax Exemptions Before 2026

Anders CPA

JANUARY 16, 2024

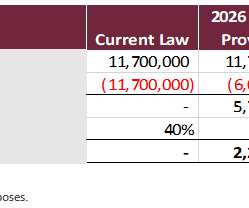

The looming sunset of the expanded lifetime estate and gift tax exemption will arrive on January 1, 2026. As of January 1, 2026, the current lifetime estate and gift tax exemption will be cut in half and adjusted for inflation. Key Takeaways: As of 2024, the lifetime estate and gift tax exemption stands at $13.61

Let's personalize your content