Transfer Minority Business Interests to Take Advantage of the Expanded Lifetime Estate and Gift Tax Exemptions Before 2026

Anders CPA

JANUARY 16, 2024

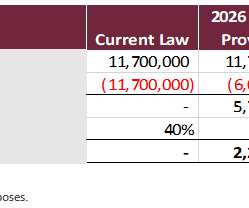

The looming sunset of the expanded lifetime estate and gift tax exemption will arrive on January 1, 2026. Gifting minority interests in the business over the next two years can help you maximize the potential tax benefit of the increased gifting thresholds. million for an individual and $27.22 million for individuals and $11.18

Let's personalize your content