What Is Deferred Revenue: Accounting Principles and Tax Treatment

inDinero Accounting

JANUARY 22, 2024

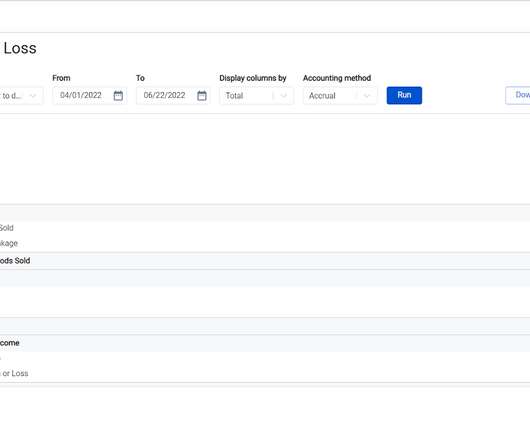

Table of Contents Deferred Revenue Accounting Principles Why Use Deferred Revenue Reporting Over Cash Accounting? Deferred Revenue Accounting Principles Since deferred revenue is an aspect of accrual accounting, let’s begin by distinguishing between the two primary accounting methods.

Let's personalize your content