Protect the “Ordinary and Necessary” Advertising Expenses of Your Business

RogerRossmeisl

APRIL 4, 2023

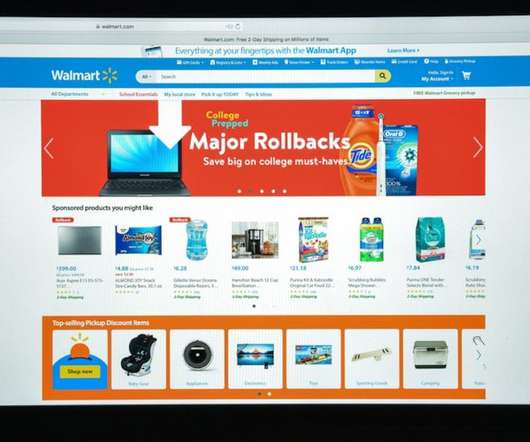

Under tax law, businesses can generally deduct advertising and marketing expenses that help keep existing customers and bring in new ones. However, in order to be deductible, advertising and marketing expenses must be “ordinary and necessary.” This valuable tax deduction can help businesses cut their taxes.

Let's personalize your content