25 stats show costs of inefficient AP processes.

Accountant Advocate Submitted Articles

JULY 13, 2022

Check out 25 stats on the costs of inefficient AP and reimbursement processes | Airbase It’s time to get serious about operational efficiency.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

AP Processes Related Topics

AP Processes Related Topics

Accountant Advocate Submitted Articles

JULY 13, 2022

Check out 25 stats on the costs of inefficient AP and reimbursement processes | Airbase It’s time to get serious about operational efficiency.

PYMNTS

AUGUST 14, 2020

The COVID-19 pandemic and its resulting economic downturn have placed new strains on corporate buyers that could persuade them to more quickly replace manual AP processes with digital ones. Companies that relied on local AP processes were caught flat-footed by the public health need for employees to work remotely whenever possible.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

PYMNTS

DECEMBER 31, 2019

Mishaps and delays can have dire financial consequences for firms, as lengthy invoice processing can expose companies to late fees and prevent them from accessing early payment discounts. Manual AP processing can also give rise to other inefficiencies. Firms largely miss out on monitoring and tracking their payments’ progress.

PYMNTS

APRIL 14, 2020

Legacy accounts receivable (AR) and accounts payable (AP) operations aren’t only inefficient, they’re costly. PYMNTS’ latest The Optimizing AP and AR Playbook , a collaboration with OnPay Solutions, found that businesses in the U.S.

PYMNTS

AUGUST 28, 2019

Accounts payable automation company AvidXchange is strengthening its position in the banking and financial services sector through the acquisition of BankTEL, the company said Tuesday (Aug. AvidXchange has reached an agreement to acquire BankTEL Systems, which provides accounting technology to banks.

CPA Practice

DECEMBER 17, 2023

AP automation is a key strategy for many finance leaders In the survey, finance leaders ranked AP automation as their top digitization priority in the back office—ahead of Accounts Receivable (AR), expense management, close management, and forecasting.

Airbase

NOVEMBER 29, 2023

Audit trails and reporting: Audit audit trails to track changes, approvals, and actions taken throughout the AP process. Develop comprehensive reporting capabilities to gain insights into processing times, bottlenecks, and areas for improvement. Scalability: As businesses grow, their AP processes need to scale accordingly.

MineralTree

OCTOBER 26, 2023

Automation is reshaping the way companies manage their financial operations, especially in accounts payable (AP). Understanding how AP automation works and how it streamlines AP processes is vital to keeping your company ahead of the curve in a rapidly evolving business finance landscape.

MineralTree

SEPTEMBER 28, 2023

The upcoming State of AP Report 2023 highlights that almost half of respondents (49.1%) express concerns about reducing AP processing costs. For example, businesses that rely on manual invoice processing spend up to $12.44 The State of AP Report 2023 highlights that a staggering 84.7% per invoice on average.

PYMNTS

AUGUST 21, 2019

The drive to eliminate paper in the accounts payable process, to cut the steps that lead to inefficiencies, continues to get a boost from technology.

MineralTree

AUGUST 24, 2023

Improving the QuickBooks AP Workflow: 11 Reasons to Automate While many organizations continue to rely on the current AP workflow in QuickBooks, the need for a more streamlined process is becoming increasingly clear. Automation tools eliminate this manual work and streamline the entire AP process so you can pay vendors faster.

MineralTree

MARCH 7, 2024

Optimizing your AP process QuickBooks is the obvious first choice for many small businesses seeking an accounting software solution. But the right accounts payable (AP) automation solution can help bridge the gap for a smooth migration process, ensuring data accuracy and consistency—and an overall more efficient AP process.

Accounting Seed

FEBRUARY 6, 2024

“AP Automation is the answer to the market’s desire for truly embedded finance,” said Ryan Sieve, chief technology officer at Accounting Seed. “We We know the entire AP process is cumbersome, but with AP Automation, we are enabling our customers to save time and streamline all the activities that touch the AP process.

AccountingDepartment

JUNE 8, 2023

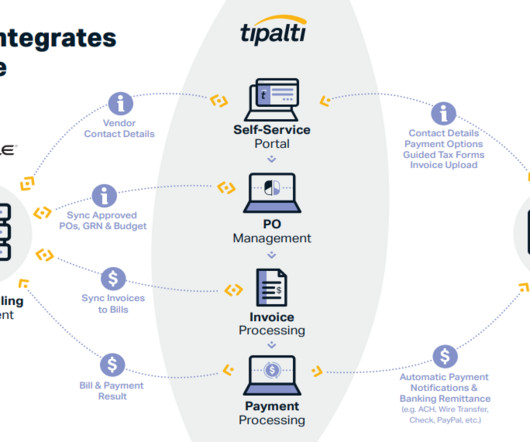

Imagine having the ability to scale accounts payables (AP) operations for your e-commerce business, with the same amount of staff, or even less. With Tipalti's AP automation technology, businesses can do just that and accelerate their AP processes across the board.

CPA Practice

DECEMBER 20, 2023

When combined with Quadient’s AP automation solution, users benefit from seamless synchronization of all AP processes. Xero helps 3.95 million subscribers worldwide to run their business accounting online and in one place.

CPA Practice

APRIL 24, 2023

Whether you’re in the midst of digital transformation or just beginning to explore, you’re probably seeing new opportunities to improve your company’s AP processes with the help of technology. Speak to the costs of manual invoice processing and the benefits of automating it.

MineralTree

MARCH 14, 2024

End-to-end automation enables businesses to efficiently process invoices and pay vendors quickly and easily. By adhering to AP best practices, businesses can enhance efficiency, improve accuracy, and streamline the entire AP process. The ability to scale Companies often struggle to scale their AP processes.

MineralTree

NOVEMBER 9, 2023

An Overview of MineralTree’s Integration Capabilities MineralTree offers a wide range of ERP integration options , simplifying the transition to digital AP processes. Sage Intacct The integration with Sage Intacct allows seamless data exchange, helping AP teams efficiently manage their financial data.

AccountingDepartment

FEBRUARY 7, 2023

Using a high-level software system like NetSuite for business operations, like accounts payables, provides small to medium-sized businesses opportunities to save money, reduce risk, and increase efficiency throughout the full AP process.

MineralTree

JANUARY 25, 2024

AP automation remains a top priority because it provides substantial operational efficiencies and helps teams track payment flows and gain control over payment transaction timing. Key Takeaway: As you embark on digital transformation efforts, take it one financial function at a time — but remember that AP is a great starting point.

CPA Practice

OCTOBER 25, 2023

Purchase order (PO) and receipt details can now be synced from QuickBooks Desktop to BILL, so customers can track the progress and status of POs, and automate two-way and three-way matching between POs, receipts, and invoices to streamline AP processes.

PYMNTS

APRIL 9, 2020

To help additional middle-market companies automate their accounts payable (AP) processes, MineralTree announced that it has grown its integration abilities, according to a press release. In separate news, OpenText unveiled its new Trading Grid with a rollout that connects ERP with AP, among other systems.

PYMNTS

DECEMBER 13, 2020

We are excited to provide B2BE with additional tools to help accomplish that mission by eliminating paper-based payments in the AP process," he said, according to the release. Shadrach added that the company wanted to add to its AP Automation to make sure that both ends of the AP process are covered.

Accounting Insight

OCTOBER 18, 2022

CFOs wear many hats and are well-positioned to help to head off costly supply chain disruptions, with the support of their Supply Chain Manager, a profession which has historically faced challenges when it comes to Accounts Payable (AP) processes. billion by 2026.

PYMNTS

OCTOBER 6, 2020

The pandemic has upended supply chains, and upended accounts payable (AP) processes – requiring companies of all sizes and types to move toward digital (and high-tech-powered) means to transform back-office functions. And for that, the AP process has to be smooth.

MineralTree

NOVEMBER 30, 2023

Invest in Paperless Processes Transitioning to a paperless AP process minimizes manual paperwork requirements and expedites document retrieval and approval cycles. Automate the Entire End-to-End AP Process AP automation encompasses invoice capture , approval workflows, payment processing, and reconciliation.

MineralTree

DECEMBER 14, 2023

As a result, they partnered with MineralTree to streamline their entire AP process. Final Thoughts According to our State of AP Report , almost 30% of companies have not yet automated their invoice approvals. However, companies can benefit by expanding their automation capabilities to the entire end-to-end AP process.

PYMNTS

APRIL 16, 2020

The technology, which can be put into place within seven days, will let companies provide their suppliers with the ability to electronically submit invoices and keep their accounts payable (AP) processes running with on-time invoice payments per an announcement. As a result, AP processes and payments to suppliers are facing disruption.

CPA Practice

OCTOBER 11, 2023

Some key themes highlighted in the report, include: Recessionary headwinds, rising costs and hybrid workplaces are pressuring AP teams to do more with less With increasing corporate belt-tightening, finance leaders are focused on boosting the productivity of lean AP teams and taking measures to cut costs.

CPA Practice

DECEMBER 11, 2023

In a recent survey of North American finance leaders by AP and payment automation provider MineralTree, 59% of respondents cited the need to do more with less, followed by reducing AP processing costs (49%), improving their ability to manage cash flow (43%), and gaining better visibility into their current cash position (42%).

PYMNTS

MAY 1, 2019

PYMNTS surveyed executives at 2,570 firms to examine their AP processes and how automation could help them address common AP frictions. When it comes to AP automation, firms seem to be facing a “chicken or the egg” dilemma. percent, said they already have “very” or “extremely” efficient AP processes in place.

MineralTree

NOVEMBER 10, 2022

These mistakes are especially prevalent in hybrid workforces, where invoices may be sent to one location, while it’s already being processed digitally somewhere else. Miscommunication & Lack of Visibility into the AP Process. Manual AP processes make it easy for duplicate vendor entries to happen.

Accounting Insight

JANUARY 2, 2024

When combined with Quadient’s AP automation solution, users benefit from seamless synchronisation of all AP processes. Xero helps 3.95 million subscribers worldwide to run their business accounting online and in one place.

Ryan Lazanis

APRIL 4, 2022

Streamlining bill payments can often get overlooked, but the accounts payable process or AP process has a number of benefits such as: 1. An AP automation software will likely be much quicker to resolve any sort of payable issue. A reconciliation process with your bookkeeping solution, to keep your books clean.

PYMNTS

MAY 13, 2020

It also looks at how digital AP tools are helping corporate buyers get the data they need to streamline their invoice processing and speed up payments. Around The AP Automation World. For more on these and the rest of the latest AP automation headlines, download the Tracker. Find the full story in the Tracker.

MineralTree

AUGUST 10, 2023

6 Tips to Improve Cash Flow A streamlined AP process helps businesses better monitor, manage, and forecast their cash flows. The following strategies can increase AP transparency and efficiency: 1. There is no such thing as a bad DPO, but it’s important that businesses be strategic when decreasing or increasing payment terms.

PYMNTS

JULY 10, 2020

These slow processes make it difficult for AP professionals to quickly pull up information on payment obligations, and they also present plenty of opportunities for human error. SMBs are more likely than larger firms to have old-school AP methods that cause undue frictions. Cutting Out Inefficiencies.

PYMNTS

NOVEMBER 2, 2020

The connection will let firms that have invested in Aptean digitize their AP processes with Palette's offering. Palette lets these companies take in bill data from vendors quickly, process invoices with an automated flow for approvals and offers a trail that auditors can look at.

MineralTree

NOVEMBER 3, 2022

An organized, digital AP process is the key to providing reliable, timely visibility to both the AP team and business leaders. How Your AP Team Can Help Fight Recession. If your AP team isn’t sure how to prepare for a recession , these are a few places you can start.

Accounting Insight

JANUARY 17, 2024

A series of requests exploring data from 1 st August 2022 until 31 st July 2023, found that despite 100% of universities digitising their Accounts Payable (AP) processes, for example via email or online portals, many still cannot overcome invoicing challenges.

MineralTree

MARCH 9, 2023

In this article, we explore the common issues with B2B cross-border payments and the steps companies can take to improve their international AP process. Leverage automated AP workflows Automated AP workflows increase speed, visibility, and efficiency across the AP process. What are B2B Cross-Border Payments?

CPA Practice

MARCH 9, 2023

Integrated seamlessly with AvidAscend, this solution allows credit unions to save resources like time and costs by transitioning from paper-based manual systems, to streamlining the AP process via one automated, cloud-based solution.

CPA Practice

MARCH 9, 2023

Integrated seamlessly with AvidAscend, this solution allows credit unions to save resources like time and costs by transitioning from paper-based manual systems, to streamlining the AP process via one automated, cloud-based solution.

MineralTree

OCTOBER 5, 2023

Lack of Information or Incorrect Information Manual AP processes can lead to inaccurate data entry, resulting in discrepancies that need to be reconciled during the month-end close. Additionally, AP teams may waste valuable time tracking down information buried in paper invoices that wasn’t transferred accurately to their ERP system.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content