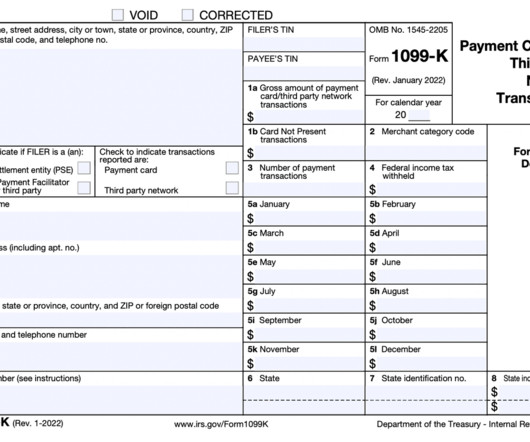

Sales tax isn't simple: Is outsourcing the answer?

TaxConnex

APRIL 25, 2024

There’s nothing like just walking down the hall of your office or clicking into a virtual team meeting to get an answer on something as complex and important as your company’s sales tax obligations. Almost as many (43%) relied on internal resources for the all-important task of calculating the correct sales tax.

Let's personalize your content