This article provides an overview of the penalty regime for income tax self-assessment matters as it applies to the most frequently occurring scenarios where HMRC issue a penalty, as follows –

- Penalties for errors or omissions in submitted returns

- Penalties for failing to notify HMRC of a liability to tax

- Penalties for failing to submit a return on time, and

- Penalties for paying tax late.

To dissuade taxpayers from all forms of non-compliance, the UK tax code contains many other types of penalties that apply in alternative scenarios. It is not possible to cover all those here, but taxpayers and their advisors ought to understand what these are as in most cases there will exist the opportunity to appeal.

The penalties referenced in this article are those which apply as of May 2023, often referred to by advisors and HMRC as the “new” penalties, because they were gradually introduced between 2007 to 2009. The penalties which apply in the circumstances noted above were introduced in the Finance Acts 2007, 2008 and 2009.

Errors or omissions in returns

Penalties that apply where there is an inaccuracy in a return submitted to HMRC are as follows:

| Behaviour | Maximum penalty % | Minimum penalty (prompted) % | Minimum penalty (unprompted) % |

| Careless | 30% | 15% | 0% |

| Deliberate (not concealed) | 70% | 35% | 20% |

| Deliberate (concealed) | 100% | 50% | 30% |

The penalty percentages above are a % of the tax due and are increased if the reason for the error or omission relates to an offshore matter, and the respective country or jurisdiction is in “category 2 or 3”. Details of which category each country or jurisdiction is allocated to is available on the Gov.UK website. Broadly, the more difficult (or impossible) it is to obtain tax information through an exchange of information, the more likely it is that the country will be allocated to a higher category. The standard percentages above are multiplied by 150% for category 2 and 200% for category 3 countries.

Failure to notify

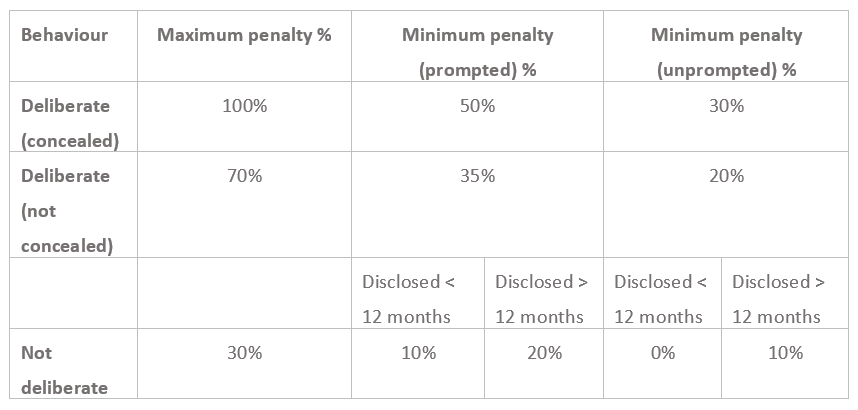

Penalties that apply where the taxpayer has failed to notify HMRC of their liability to tax are as follows:

As with the errors and omission penalties, the tax code provides a range with a minimum and maximum penalties that can be charged and the above are a % of the tax due. The offshore category uplifts referred to above will also apply where relevant.

Late returns

An initial penalty of £100 applies when a return is submitted late. If the return has still not be submitted after three months, then £10 daily penalties apply for a maximum of 90 days (i.e. £900 is the maximum in daily penalties that can be applied).

If the return is still outstanding after 6 months then HMRC can charge a penalty equal to the greater of £300 or 5% x tax due.

Again, if the return is outstanding after 12 months HMRC can charge a penalty equal to the greater of £300 or 5% x tax due. However, where a return is still outstanding after 12 months and the reason for this arises from the taxpayer’s deliberate behaviour, the following penalties will apply instead of the standard £300 or 5% x tax penalty mentioned above and are a % of the tax due:

| Behaviour | Maximum penalty % | Minimum penalty (prompted) % | Minimum penalty (unprompted) % |

| Deliberate (not concealed) | 70% | 35% | 20% |

| Deliberate (concealed) | 100% | 50% | 30% |

From 2016/17 onwards, the minimum penalties (both prompted and unprompted) are uplifted by 10% in the table above. The offshore category uplifts referred to earlier can also apply.

It is expected that from 6 April 2024 a new points-based penalty system will be introduced to replace the existing penalty regime for late returns.

Late payment of tax

Penalties that apply where tax is paid late are as follows:

| Length of time tax remains unpaid | Penalty charged % |

| 30 days | 5% |

| 6 months | 5% |

| 12 months | 5% |

The above % rates apply to the amount of tax outstanding but will not apply in cases where a time to pay arrangement has been agreed with HMRC in advance of the penalty becoming due.

Failure to Correct penalties

For the tax year 2015/16 and earlier, where the matter being disclosed has an offshore link or involves an offshore transfer, Failure to Correct (FTC) penalties may also apply. FTC penalties were introduced from 1 October 2018 after taxpayers were statutorily required to correct (RTC) their historic UK tax position before 30 September 2018. This applied where the underlying issue had an offshore aspect to it.

FTC penalties are a % of the tax due and are as follows –

| Prior contact from HMRC? | Maximum penalty % | Minimum penalty % |

| Unprompted | 200% | 100% |

| Prompted | 200% | 150% |

So, if a taxpayer had a previously undisclosed tax liability of £10,000 and the FTC penalties applied, then in addition to the late payment interest they could also be charged penalty of up to £20,000 (i.e. 200% x tax). The punitive FTC penalties can be appealed if the taxpayer has a reasonable excuse. There are only a limited number of circumstances where HMRC will accept the taxpayer has a reasonable excuse to have not corrected their UK tax position during the RTC period.

In addition to the FTC penalties, additional “offshore asset moves” and “asset-based” penalties can also apply.

A complex set of rules

This article only provides a high-level overview of the new penalty regime as it applies to income tax self-assessment, and where other heads of tax are in point alternative penalty rates are likely to apply. This is a complex area and any taxpayer or agent advising clients needs to be familiar with both existing and historic rules to ensure HMRC do not seek to charge an excessive penalty.

If you would like to discuss time limits as they relate to tax assessments, or challenging HMRC decisions further, please contact Menzies’ Tax Disputes and Disclosures team on our free confidential helpline below: