Are Gifts to customers and business associates deductible expenses?

Giving gifts to clients or customers can be a great way to build goodwill, foster customer loyalty and differentiate yourself from your competition. Gifts can be anything from a simple bouquet of flowers to something a bit more personalized based on your knowledge of the customer (it can be useful to listen carefully or probe gently to find out what your customers might want as a thoughtful gift can be tremendously impactful). A gift can be given around the holidays, on birthdays, after closing a sale or any other time as a simple thank you. Of course, if you are buying gifts on behalf of your business, it is important to understand if they qualify as tax deductible expenses and it what circumstances.

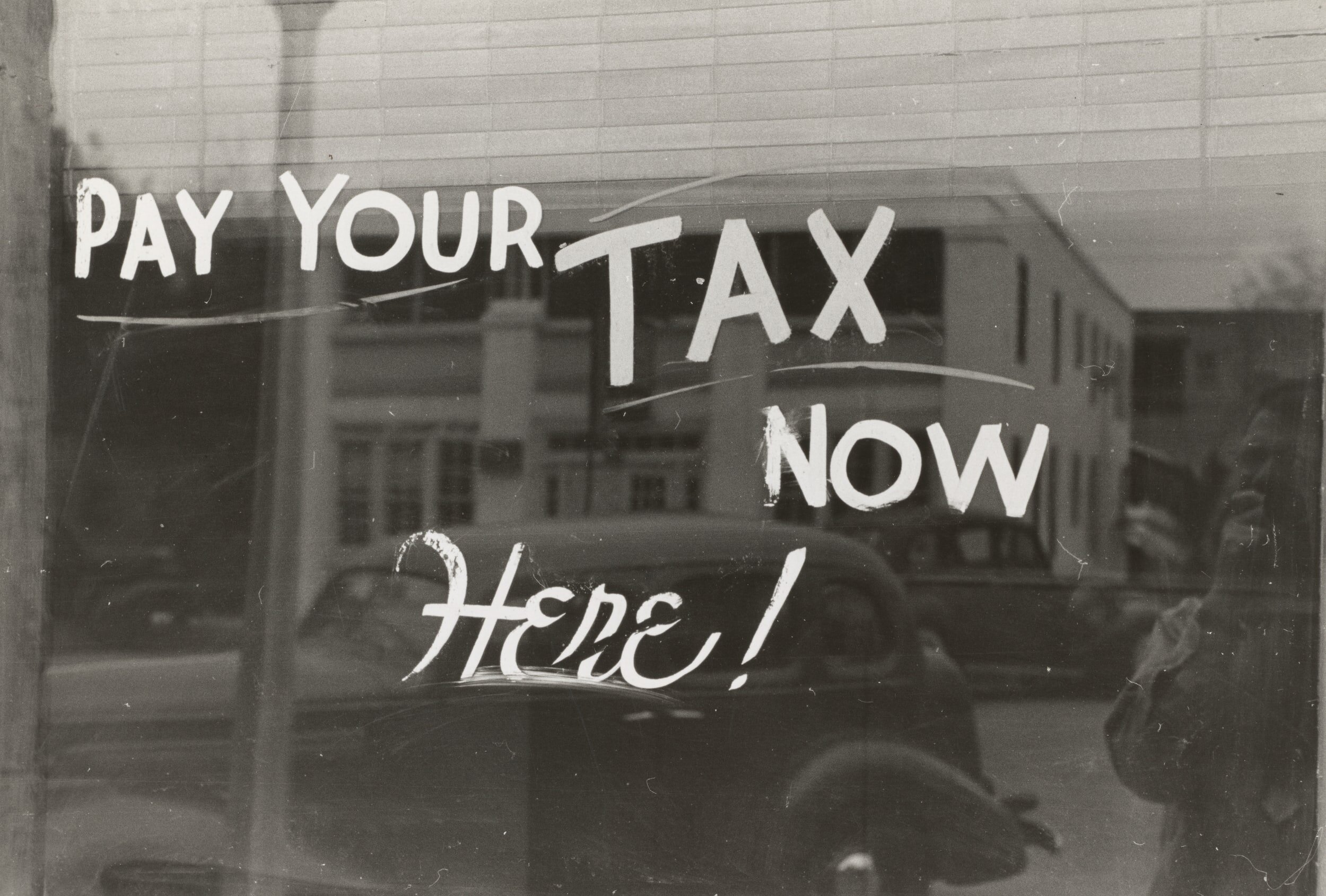

Gifts given to customers are tax deductible, however, there are certain qualifications that you should keep in mind:

You need to demonstrate that the person receiving the gift is in fact a business associate and that there is a business purpose for the gift . Customers, suppliers, banking associates, investors etc. would generally qualify. A family member, who occasionally comes in and does some office work might be more difficult to prove.

The amount of the gift should reasonable and in proportion to the nature of the business relationship. Sending a gift basket to a loyal recurring customer certainly makes sense. Sending a diamond bracelet to a customer who has purchased something from you once, will very likely be audited and disallowed.

Gifts that are specifically for meals or entertainment such as a gift certificates to a restaurant or tickets to a sporting event, even if you don’t accompany the client, are only 50% deductible and should be reflected as meals and entertainment in your accounting.

Spending money on a social function, such as wedding (see our case study below) where you simply hand out business cards is not sufficient to qualify as a deductible business expense.

It is best practice to indicate the nature of the business purpose on the receipt for the gift or as a memo in your accounting software. This will jog your memory in the event of an audit and provide a documentary trail that auditors are fond of seeing.

If you are giving a gift to a not for profit organization (see below for charities), ideally there should be some mention of your sponsorship or your contribution.

Corporations and small business owners can contribute freely to registered charitable organizations in exchange for an official donation receipt. This can then be deducted in the charitable donation section of either the corporate tax return (T2) or if you are not incorporated, the donation is simply deductible as a tax credit on your personal tax return (T1).

Accounting for gifts given to clients/customers would generally be included in your marketing/advertising/promotion category, unless it relates in any way to meals and/or entertainment in which case it should be allocated to the meals and entertainment account since it is only 50% deductible and it is better to track this separately.

For a more detailed understanding of types of marketing/advertising expenses , you can refer to my post on deducting advertising expenses.

An interesting (and somewhat humorous) case study relating to deductibility of gifts by businesses can be found in Ngai vs the Queen in which a taxpayer tried to claim some preposterous gifts including jewellery, a cheque, that was clearly marked as a wedding gift and a Louis Vitton Purse where the recipient of the gift was not identifiable.

Some excerpts from the case are below:

when asked about certain claims for liquor that was purchased, he [i.e., Mr. Samaan] advised that the item had been taken to a party to which he had been invited, with friends. He said that he had handed out business cards at the party and so felt that the liquor he had purchased was a business expense. It is apparent, though, that the liquor was a gift to [Mr. Samaan’s] host when invited into a social event, unconnected with his business. One cannot convert this obvious personal expense into a business expense by handing out business cards while at a personal, social function.

…in discussing the Louis Vuitton purse purchased in 2005, on May 15, 2006, Mr. Ngai also purchased another Louis Vuitton purse at Holt Renfrew for a price of $1,300.[65] In computing his income for 2006, he deducted the amount of $1,404, representing the price of the purse plus provincial sales tax in the amount of $104. Mr. Ngai stated that the purse was given as a gift to promote his business. One of the difficulties that the CRA had with this deduction was that the identity of the recipient of the gift was not clear.

While some of the examples in this case seem a bit extreme (at least to me), it demonstrates how businesses who are claiming gifts as deductible expenses should have evidence that supports the reasonableness of the gift and provides a clear audit trail of the business purpose. This is a good rule to adopt in general when determining whether an expense is deductible.