Understanding Sales Tax Exemptions and Exclusions

TaxConnex

APRIL 1, 2021

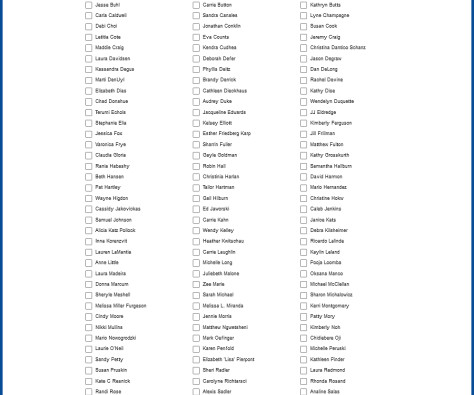

Every state can apply tax exclusions on goods and services within their state. However, there are further tax-exempt purchases. Tax exemptions can also be applied at the customer level as opposed to the product level. Exemption certificates generally fall into two categories: 1. Use-based exemptions. Use-based exemptions.

Let's personalize your content