Financial Statement Fraud: Don’t Believe Everything You Read

RogerRossmeisl

JUNE 19, 2023

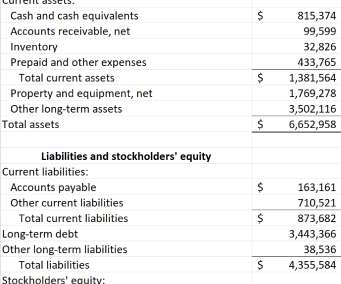

Financial statements are central to understanding any business. A public company’s balance sheet, income statement and cash flow statement enable investors, lenders, the media and other stakeholders to value the company, forecast short- and long-term performance, and determine potential credit risk, among other purposes.

Let's personalize your content