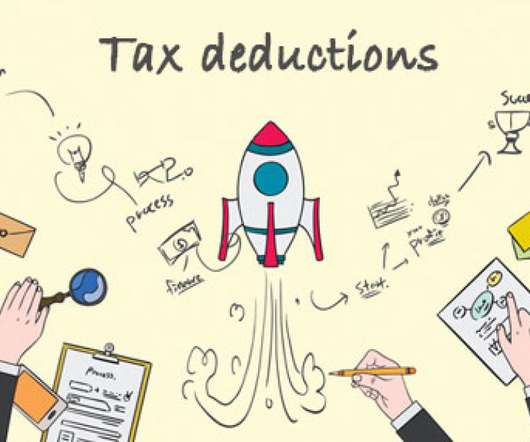

Startup Costs and Taxes: What You Need to Know Before Filing

RogerRossmeisl

AUGUST 2, 2025

If you’re one of the entrepreneurs, you may not know that many of the expenses incurred by start-ups can’t currently be deducted on your tax return. You should be aware that the way you handle some of your initial expenses can make a large difference in your federal tax bill.

Let's personalize your content