Deloitte gives its auditors more agentic AI capacities

Accounting Today

JULY 15, 2025

Deloitte said its auditors will now have enhanced agentic AI capacities within Omnia, the firm's global cloud-based audit and assurance platform.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

auditor Related Topics

auditor Related Topics

Accounting Today

JULY 15, 2025

Deloitte said its auditors will now have enhanced agentic AI capacities within Omnia, the firm's global cloud-based audit and assurance platform.

CPA Practice

OCTOBER 24, 2024

Webinar : This webinar, led by expert staff in the PCAOB’s Office of the Chief Auditor, provides an overview of QC 1000 requirements and is designed to help auditors prepare for the standard’s implementation. 1, A Firm’s System of Quality Management , adopted by the AICPA.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

AI In Accounting: A Practical Roadmap For Smarter AP

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

RogerRossmeisl

AUGUST 2, 2025

Tax auditors are adept at rooting out inconsistencies, omissions and errors in taxpayers’ records, as illustrated by one recent U.S. In some cases, taxpayers have incomplete documentation or try to create records months (or years) later. In doing so, they fail to meet the strict substantiation requirements set forth under tax law.

AI In Accounting: A Practical Roadmap For Smarter AP

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

CPA Practice

MAY 7, 2025

Artificial intelligence is set to transform internal audit in 2026, with adoption expected to double next year to80% from its current adoption rate among internal auditors of 39%, according to new research from Wolters Kluwer.

Advertisement

ART’s flexible access for auditors ensured tight deadlines were met effortlessly. By ditching paper and manual checklists, UNIFY embraced ART’s cloud-based solution for seamless automation. The robust dashboards, exception reports, and completion date reports allowed the team to easily track progress and resolve bottlenecks.

Accounting Today

JULY 16, 2025

The Institute of Internal Auditors presented its updated competency framework for internal auditors during its international conference this week in Toronto.

CPA Practice

OCTOBER 17, 2024

The public deserves to know its tax dollars are being spent as intended — and that requires strong government finance teams and experienced auditors.” Evaluation of external auditors should consider CPA firm qualifications, not just proposed fees.

Accounting Today

JUNE 9, 2025

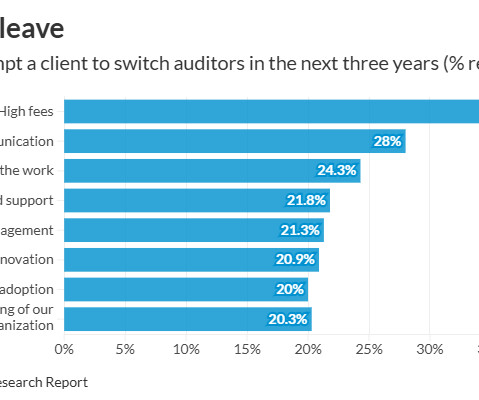

Businesses" report found that 34% of respondents said they are "very likely" to switch auditors in the next three years, 36% are "somewhat likely" and 15% are "not sure." Gary Boomer June 9 Audit Two-thirds of clients ready to change auditors Seventy percent of U.S. Inflos "Creating a New Audit Experience for U.S.

CPA Practice

JUNE 17, 2025

OBannon Cherry Bekaert has been included in Hedge Fund Alert’s 2025 list of Top Hedge Fund Auditors. Spicer Jeffries LLP has been a perennial top 10 hedge fund auditor for over a decade, and its knowledge and reputation in the securities industry have significantly contributed to this achievement.

Advertisement

Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Going Concern

JULY 3, 2025

After a review, EY concluded that it was not in compliance with the SEC’s auditor independence rules for the audits of the applicable years. EY audited SWSF from the financial year ended December 31, 2009 until its resignation as auditor in April of 2021.

CPA Practice

NOVEMBER 19, 2024

A new analysis of audit committee disclosures of companies in the S&P 1500 reveals a plateau in disclosure rates across several areas important to investors, including considerations in appointing or reappointing the external auditor, length of auditor tenure, and how the audit committee evaluates audit fees in relation to audit quality.

Going Concern

JANUARY 9, 2025

AARP The Council of Institutional Investors Hmm there’s a pattern here I just can’t put my finger on it… Conway’s position is that the large audit firm staffing model is a mismatch for the complexity auditors are expected to master. This is not the staffing model we would adopt if we were starting from scratch.

Accounting Today

JULY 8, 2025

The International Auditing and Assurance Standards Board has revised its standard on the auditor's responsibilities relating to fraud.

CPA Practice

JULY 16, 2025

Deloitte has rolled out a series of new artificial intelligence capabilities within its global cloud-based audit and assurance platform, Omnia, designed to evolve the audit process.

CPA Practice

NOVEMBER 19, 2024

The evolving role of auditors Future auditors aren’t being replaced—they’re being empowered. From sample testing to complete coverage: Where auditors once spent hours selecting and testing transaction samples, standardized granular data enables: 100% population testing rather than sample-based approaches. Increasingly, it’s us.

ThomsonReuters

NOVEMBER 25, 2024

← Blog home As a new presidential administration takes shape, the potential for substantial shifts in tax laws and other financial regulations is top of mind for auditors. In particular, auditors should look for: New significant risks. Uncertain tax positions. Disclosure of tax rate impacts. Future tax obligations.

CPA Practice

JULY 7, 2025

This edition of "Audit Focus" highlights key reminders for auditors of small public companies or brokers and dealers on engagement acceptance and why it's a critical part of the audit process.

ThomsonReuters

DECEMBER 2, 2024

While it does not change the confirmation requirements, it prompts auditors to re-examine inherent risk factors closely, particularly for areas like cash and cash equivalents, where fraud can be more prevalent. A critical takeaway for auditors is that if controls are not tested, then the RMM equals the inherent risk.

CPA Practice

JULY 7, 2025

The proposed Statement on Auditing Standards contains a number of changes, including the establishment of required procedures for when an auditor has identified fraud or suspected fraud.

Going Concern

JULY 9, 2025

According to a recent paper in Contemporary Accounting Research , auditors with “uncommon” names are more likely to allow bending of audit standards. Collectively, our study provides novel evidence on the role of auditor individualism in earnings comparability. Phys.org continues: Why is this issue worth looking into?

TaxConnex

JANUARY 21, 2025

Sans a valid exemption/resale certificate, an auditor examining your records one day might conclude that a transaction was taxable when you claim it wasnt and that you collected and remitted no sales tax on it. The responsibility to determine the validity of the exemption certificate , though, rests with you the business.

CPA Practice

DECEMBER 3, 2024

The separation of audit and non-audit services allows the firm to comply with securities laws prohibiting conflicts of interest that could impair the objectivity of the firms’ auditors.

CPA Practice

NOVEMBER 11, 2024

First, on multiple occasions, the accounting firm failed to timely report the participants in its issuer audits on PCAOB Form AP, in violation of PCAOB Rule 3211, Auditor Reporting of Certain Audit Participants.

Going Concern

NOVEMBER 8, 2024

Municipal Messes Delayed audit finds ‘material weaknesses’ in Elton’s finances and procedures [ KPLC (Louisiana)] The town agreed to address such deficiencies including timely adopting an operating budget, hiring someone qualified to prepare financial statements, and submitting required paperwork to the Legislative Auditor’s Office by the due date.

CPA Practice

NOVEMBER 13, 2024

Wolters Kluwer, a provider of information, software, and services for professionals, has collaborated with The Institute of Internal Auditors’ Internal Audit Foundation on a research report: Harnessing Generative AI for Internal Audit Activities.

Withum

JANUARY 30, 2025

The accelerated and large accelerated filers are required to comply with SOX 404(b) requirement, which mandates external auditors opinion on ICFR. Coordinate with Key Stakeholders Engage your finance team and external auditors early to set expectations and address questions. All publicly traded companies in the U.S.

CPA Practice

MAY 21, 2025

The new credential is designed to meet the needs of IT auditors who are facing an evolving tech and compliance landscape with artificial intelligence at the forefront, the ISACA says.

TaxConnex

AUGUST 7, 2025

Well-organized documentation gives auditors the information they need to confirm the accuracy of your transactions and tax decisions. In those situations, auditors may default to treating sales as taxable or use estimates and historical data to determine liability, which often results in higher assessments.

Summit CPA

OCTOBER 10, 2024

Do not withhold information from an auditor intentionally. Hiding information from an auditor may create a fraudulent situation. Padding business deductions with non-deductible personal expenses may be considered tax fraud. Information concealed during an audit. It’s stressful enough just going through a tax audit.

Withum

MAY 5, 2025

Make sure you inquire regarding what types of internal process documentation would need to be documented for auditor review. First, the company should communicate with the auditors their process for maintaining and recognizing revenue (for more on revenue recognition, refer to the Technical Memos section below ASC 606 Revenue Recognition).

ThomsonReuters

NOVEMBER 4, 2024

As emerging technologies and regulations reshape the field, many auditors find themselves grappling with outdated processes and inefficiencies. By seamlessly integrating into existing workflows, this cutting-edge tool solution allows auditors to focus on high-risk areas, reduce manual workloads, and deliver superior client service.

ThomsonReuters

JULY 30, 2025

Instead of printing, mailing, and manually tracking confirmation requests, auditors can initiate and manage the entire process digitally through secure platforms. Digital platforms can identify patterns, anomalies, and trends across confirmation responses, providing auditors with deeper insights into client financial positions.

Going Concern

JANUARY 3, 2025

Check out Accountingfly’s top remote accounting candidates of the week and sign up for Always-On Recruiting to get a new batch of accountants and auditors for hire in your inbox every week — free! We dont know, Matthew Dunlap, Maines state auditor, said. To Be Continued… Oh do we have things to say about this.

CPA Practice

JUNE 9, 2025

AuditPro.ai is an intuitive and affordable assurance platform where accounting and finance professionals can easily discover and quickly benefit from the most advanced technologies.

Going Concern

JANUARY 1, 2025

Ongoing sexism in promotions Mental health Remote work is affecting training and supervision of associates Mental health impact of public No one wants to be “us” Incompetence of regulators Impact of years of remote working on junior staff training, ensuing pressure on upper level auditors, causing significant lapses in audit quality.

CPA Practice

JULY 14, 2025

CCH Validate reimagines bank confirmations, putting auditors in full control to obtain confirmations with unprecedented speed. Leveraging advanced technologies—including blockchain for tamper-proof assurance—it enables 100% bank statement retrieval from banks worldwide.

Shay CPA

FEBRUARY 19, 2025

3: Organize your documents When you hire an auditor, theyll give your startup a provided-by-client (PBC) list. 5: Find the right partner The auditor you choose will directly impact how smoothly and successfully the audit goes. As you seek out the right auditor, ask about their experience with tech companies.

Going Concern

JULY 11, 2025

billion ($1 billion), alleging the auditor failed to detect fraud and misstatements that contributed to the Toronto private lender’s collapse. The focus of the probe is on the audits conducted between 2017 and 2023, a period during which Deloitte succeeded Azets as the auditor for the 2023 financial year.

Going Concern

JANUARY 6, 2025

Several accounting firms argued disclosing the metrics to the audit committee of a companys board would be better than making them public for shareholders because that is the committee that ultimately appoints the auditor. As a refresher, these are the metrics the PCAOB wants firms to start reporting: Partner and Manager Involvement.

CPA Practice

NOVEMBER 11, 2024

DataSnipper : The Intelligence Automation Platform and Advanced Extraction Suite have provided functional automation to auditors for some time. AuditBoard : Offers robust risk management and audit automation features.

CPA Practice

NOVEMBER 11, 2024

Saah has been with the company since 1998, where he started as a recruiting manager, following a career as an internal auditor and assistant controller. He was named executive director in 2017, previously serving as director of permanent placement services.

ThomsonReuters

DECEMBER 27, 2024

Unique audit risks related to cryptocurrency What is an auditors responsibility in crypto audits? As the crypto market continues to grow, auditors must adapt their approaches to address these new challenges. Additionally, auditors need to understand the specific risks associated with cryptoassets.

Going Concern

MARCH 19, 2025

Each of them violated PCAOB Rule 3211 , Auditor Reporting of Certain Audit Participants, by “failing to accurately disclose on PCAOB Form AP the participation in firm audits of other accounting firms, including, among others, component auditors, shared service centers, and critical audit matter hub.”

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content