Figuring Corporate Estimated Tax

RogerRossmeisl

JUNE 26, 2024

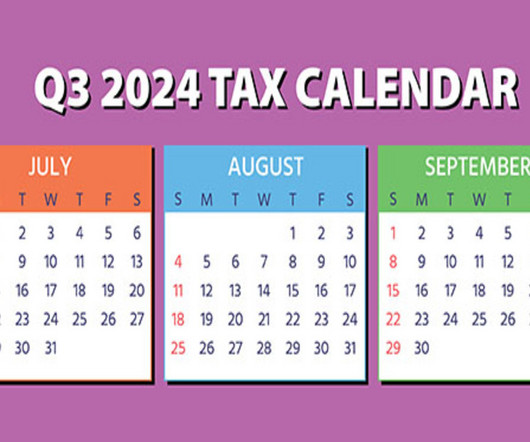

The next quarterly estimated tax payment deadline is September 16 for individuals and businesses, so it’s a good time to review the rules for computing corporate federal estimated payments. You want your business to pay the minimum amount of estimated tax without triggering the penalty for underpayment of estimated tax.

Let's personalize your content