Alaska Becomes the Latest State to Offer an Alternate CPA Pathway, With No Help From the Governor

Going Concern

JULY 29, 2025

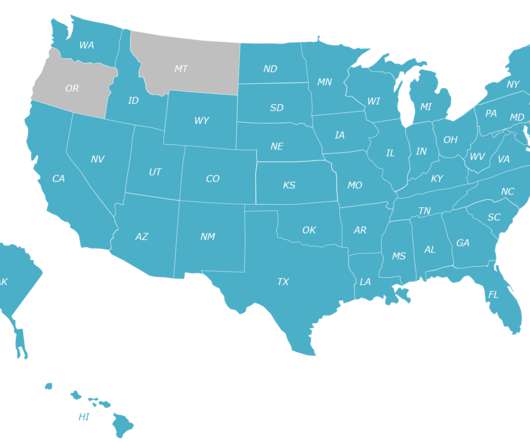

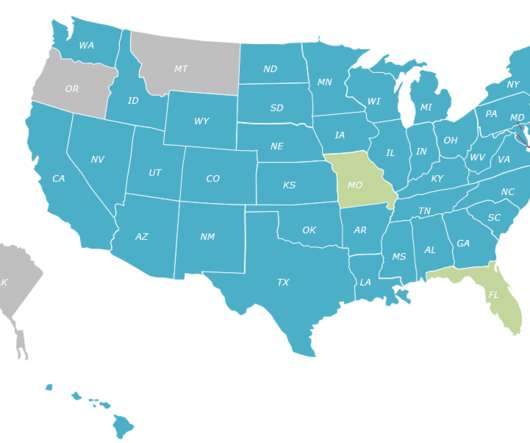

Good news for all you 150 haters out there: Aspiring CPAs in the great state of Alaska now have the option to go for 120 units of education and two years of experience for licensure. Alaska joins handfuls of other states already with this law in place or on their way to making it official. You can do the math from there.

Let's personalize your content