Is Your Accounting Firm Making These Marketing Mistakes?

Insightful Accountant

MARCH 7, 2025

Join Janel Sykora and earn CPE credit as she discusses the top 5 marketing mistakes accounting firms make (and how to fix them).

Insightful Accountant

MARCH 7, 2025

Join Janel Sykora and earn CPE credit as she discusses the top 5 marketing mistakes accounting firms make (and how to fix them).

Accounting Today

MARCH 11, 2025

Excellence in artificial intelligence is going to be a key differentiator for accounting firms in the near future.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

ThomsonReuters

MARCH 3, 2025

In a profession known for its measured approach to change, agentic AI is emerging as a transformative force for accountants, redefining the nature of daily work and opening the door to more meaningful (and profitable) relationships with clients. But what is agentic AI, and how is it transforming the accounting profession? Agentic AI leverages generative AI and large language models to autonomously plan, reason, and execute multi-step processes.

Patriot Software

MARCH 4, 2025

Choosing your accounting method is the first step in handling your companys books. If youre a small business owner, you may prefer the simplicity of cash basis as opposed to accrual or modified cash-basis accounting. But before solidifying your decision, learn the pros and cons of cash-basis accounting.

Advertisement

The office of the CFO is rapidly evolving, with more and more demands being placed upon the finance and accounting team each year. Join us in this webinar, where we share 8 things to NOT do when it comes to helping the CFO office advance in supporting the business. Learning Objectives: This course objective is to understand how best to support an organization's finance leadership.

Accounting Today

MARCH 6, 2025

Environmental, social and governance work holds tremendous potential for accounting firms.

Patriot Software

MARCH 7, 2025

Youve heard about debits and credits. You know they increase and decrease certain accounts. But, how much do you know about the accounts they affect? There are five types of accounts in accounting. If you dont know what they are, your crash course has arrived.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Ryan Lazanis

MARCH 5, 2025

Most firms take a passive approach to referrals, but a proactive strategy can bring in high-quality clients if done the right way. The post Referral Programs for Accounting Firms appeared first on Future Firm.

Basis 365

MARCH 9, 2025

As your business grows, so does the complexity of your financial operations, making it essential to have a skilled controller overseeing your financial reporting, cash flow, and internal controls. But is it better to create a position in-house or hire fractional controller services ? Each option has distinct benefits and drawbacks, depending on your companys size, budget, and financial needs.

Accounting Today

MARCH 13, 2025

We must consider alternatives to the 150-hour rule to improve the accountant talent pipeline.

VJM Global

MARCH 10, 2025

Held by Honble High Court of Kerala In the matter of Joint Commissioner (Intelligence and Enforcement) vs. M/s Lakshmi Mobile Accessories (W.A.NO.258 OF 2025) The Assessee received consolidated Show Cause Notice under Section 74 of CGST Act for FY 2017-18 to 2023-24. The Assessee challenged such SCN in the writ petitioner wherein it was held that the department is required to issue separate SCN for every assessment year.

Speaker: Dylan Secrest, Founder of Alamo Innovation and Construction Digital Transformation Consultant

Construction payment workflows are notoriously complex when you consider juggling multiple stakeholders, compliance requirements, and evolving project scopes. Delays in approvals or misaligned data between budgets, lien waivers, and pay applications can grind progress to a halt. The good news? It doesn't have to be this way! Join expert Dylan Secrest to discover how leading contractors are turning payment chaos into clarity using digital workflows, integrated systems, and automation strategies.

ThomsonReuters

MARCH 26, 2025

Businesses continue to face serious cyber threats that target payroll and tax information. As scams become more common, it is important for companies to protect sensitive data and stay compliant with regulations to better secure their payroll processes and reduce risks. Cliff Steinhauer, Director of Information Security and Engagement at The National Cybersecurity Alliance (NCA), recently highlighted the importance of recognizing common payroll-related tax scams, understanding the evolution of d

RogerRossmeisl

MARCH 3, 2025

As posted to US Department of Treasury website on 3/2/25 The Treasury Department announced on 3/2/25 that, with respect to the Corporate Transparency Act, not only will it not enforce any penalties or fines associated with the beneficial ownership information reporting rule under the existing regulatory deadlines, but it will further not enforce any penalties or fines against U.S. citizens or domestic reporting companies or their beneficial owners after the forthcoming rule changes take effect e

Withum

MARCH 7, 2025

Vacation ownership resorts operate in a unique segment of the hospitality industry, requiring solid financial management to ensure sustainability, profitability and guest and owner satisfaction. Effective budgeting and financial reporting are crucial for these entities to manage their resources efficiently, meet regulatory requirements, and provide transparency to stakeholders.

Basis 365

MARCH 25, 2025

The month-end close process is a critical accounting procedure that ensures the accuracy of financial statements, providing a snapshot of your business's financial health. While many business owners rely on these reports to make informed decisions, few understand the extensive effort required to produce them. This blog walks you through the steps involved in the month-end close and explains why each step is vital for reliable financial reporting.

Speaker: Gerald Ratigan

The accounts payable (AP) function is evolving and AI is leading the charge. As finance teams face rising invoice volumes and expectations for speed and accuracy, AI-powered automation has shifted from a futuristic concept to the most practical solution. But for finance leaders, success isn’t just about selecting the right tools, it’s about implementing the right strategy.

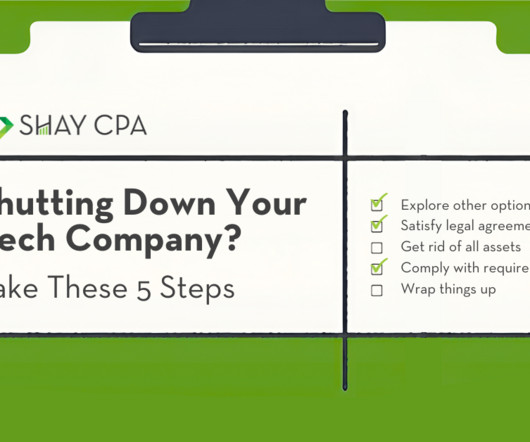

Shay CPA

MARCH 26, 2025

Deciding to close down operations at a company you founded is never easy. This venture represents a lot of time, energy, and money. Shutting it down can feel like a major loss. At the same time, though, it might come with some measure of relief. By the time youre deciding to close up shop, youve probably had some difficult months or even years. Youve felt your runway slipping away and you might be, in some ways, ready to end this chapter.

Accounting Insight

MARCH 26, 2025

The rise of cloud computing has transformed how businesses operate, offering scalability, flexibility, and innovation at an unprecedented pace. However, for finance leaders, this shift presents a challenge: how to manage unpredictable cloud costs while ensuring financial discipline and strategic investment. Enter FinOps (Financial Operations) a cloud financial management discipline that helps businesses maximise the value of their cloud investments.

ThomsonReuters

MARCH 3, 2025

Blog home As businesses continue to expand their global footprint, the importance of effective global payroll management has become increasingly crucial. In a recent discussion, Mariah Hantis, Senior Director, Global Operations, Payroll, and Benefits at Deel, provided insights into the key challenges, emerging trends, and best practices surrounding global payroll strategies.

RogerRossmeisl

MARCH 3, 2025

As higher education costs continue to rise, you may be concerned about how to save and pay for college. Fortunately, several tools and strategies offered in the U.S. tax code may help ease the financial burden. Below is an overview of some of the most beneficial tax breaks and planning options for funding your childs or grandchilds education. Qualified tuition programs or 529 plans A 529 plan allows you to buy tuition credits or contribute to an account set up to meet your childs future higher e

Speaker: Sean Yoder

Nonprofits are under more pressure than ever to demonstrate financial accountability while continuing to expand their impact. Traditional budgeting models often fall short, reinforcing silos, limiting flexibility, and stalling growth. Enter collaborative budgeting: a dynamic, team-driven process that enables smarter resource allocation and builds financial resilience at scale.

Going Concern

MARCH 19, 2025

The other day the PCAOB proudly announced that it was punishing several members of KPMG’s global network , those being: KPMG Brazil, KPMG Canada, KPMG Italy, KPMG Israel, KPMG UK, KPMG Mexico, KPMG Samjong, KPMG Switzerland, KPMG, KPMG Australia. All they had to do was nab KPMG Kenya and it would be a true world tour of audit naughtiness. Oh sorry, that’s ignorant of us just assuming there’s a KPMG Kenya.

Basis 365

MARCH 23, 2025

The way businesses handle their finances is evolving. Managing accounting in-house is expensive, time-consuming, and often inefficient. Hiring full-time staff, maintaining software, and ensuring compliance take valuable resources away from growth. Outsourced accounting services offer a smarter approach. By leveraging cloud-based technology and expert financial support, businesses can reduce costs, improve accuracy, and gain real-time financial insights.

CTP

MARCH 21, 2025

When it comes to choosing an entity type, many entrepreneurs are drawn to S corporations and may make an election without truly weighing the pros and cons of each option. Business owners may not think to ask their tax planner for advice on business structures, but offering your expertise early in the process can help your clients save significantly on their tax bill down the road.

Withum

MARCH 17, 2025

These days, nothing is more fluid in the United States than the term tariffs. While debate can be had on the macroeconomics and impacts of tariff policy on the U.S. economy, the tariff discussion appears to be ongoing for the foreseeable future. Because of this, business owners and managers will need to contemplate the impacts of tariffs on their financial reporting process.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

ThomsonReuters

MARCH 10, 2025

Blog home Ronan Le Gall , along with his colleagues Tim Carpenter , partner and principal at EY who leads the indirect tax technology practice for the Americas , and Vanessa Grazziotin Dexheimer , Senior Manager at EY in indirect tax and global VAT were discussing the power of clean data as an end-to-end solution for indirect direct tax processes at the Thomson Reuters Synergy Conference.

Menzies

MARCH 3, 2025

Menzies LLP - A leading chartered accountancy firm. Greg Huitson-Little , partner in our Forensic and Valuation Services team, muses on the recent budget amused by definitional debates, unpacking what the employer national insurance rises really look like, and wondering whether the nutty issue of pass-on in competition damages is about to get its biggest experiment to date.

Accounting Insight

MARCH 31, 2025

For finance teams, the chancellors spring statement didnt reveal much we werent already anticipating. Spending cuts and stagnant economic growth dominated the agenda. But the standout point was the OBRs revised economic growth forecasts. The chancellor revealed that the body has slashed its growth forecast for this year in half from 2% to 1%. It paints a painful picture considering the impending rises to employer National Insurance Contributions (NICs) are already seeing businesses cutting costs

Basis 365

MARCH 23, 2025

The way businesses handle their finances is evolving. Managing accounting in-house is expensive, time-consuming, and often inefficient. Hiring full-time staff, maintaining software, and ensuring compliance take valuable resources away from growth. Outsourced accounting services offer a smarter approach. By leveraging cloud-based technology and expert financial support, businesses can reduce costs, improve accuracy, and gain real-time financial insights.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

CTP

MARCH 24, 2025

The Tax Cuts and Jobs Act (TCJA) brought about far-reaching changes in the world of tax law. Though recent conversations have fixated on the soon-to-expire tax provisions, TCJA also introduced permanent changes that tax professionals can lean on to bring tax savings to their clients. One significant benefit to small business owners was the introduction of new rules surrounding the cash method of accounting.

Withum

MARCH 17, 2025

On March 12, 2025, the Securities and Exchange Commission (SEC) issued a no-action letter which provided assistance for issuers and investment funds relying on Rule 506(c) of Regulation D. While prior guidance existed on the application of minimum investment amounts as a factor in determining whether an issuer has satisfied the requirement to take reasonable steps to verify purchasers accredited investor status, further clarification has now arrived.

ThomsonReuters

MARCH 20, 2025

From an unending stream of regulatory changes to increasing client demands, the accounting profession is in a constant state of change. Just as one tax season wraps up, the next is already on the horizon, bringing with it new rules, expectations, and challenges. But more and more firms are realizing that taking a proactive approach reflecting on last year’s challenges and implementing smarter strategies can better position them to thrive in an increasingly complex landscape.

Going Concern

MARCH 13, 2025

Cornerstone Research has put out their SEC Accounting and Auditing Enforcement ActivityYear in Review: FY 2024 report [ PDF ] and then they put out a press release highlighting the important parts so we don’t have to spend all day reading it. Cheers. The U.S. Securities and Exchange Commission (SEC) drastically reduced its accounting and auditing enforcement activity in fiscal year 2024, the final year of Gary Gensler’s administration, ending two consecutive years of annual increases

Advertisement

You wouldn’t keep using a 2009 flip phone - so why settle for outdated close processes? It’s time for an upgrade. SkyStem's Guide to Month-End Close Software walks you through what today’s best tools can do (and what your team shouldn’t have to deal with anymore). Get smart, fast, and a whole lot less stressed when it’s time to close the books.

Let's personalize your content