How to Track Business Expenses Without the Stress

inDinero Tax Tips

JANUARY 13, 2025

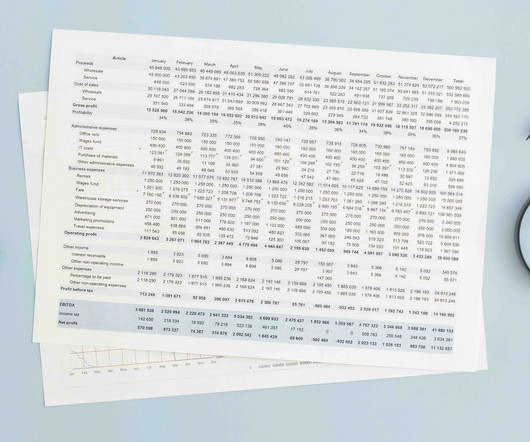

From here, tracking business expenses is easy. But with business accounts in order, and software integrations logging expenses, the administratively tedious parts are handled. Periodically Review Pointing this out may seem obvious, but youd be surprised how many startup owners dont regularly check in on their finances.

Let's personalize your content